How to Use AmEx Pay With Points to Book Travel

One of many some ways to redeem Membership Rewards factors is to pay for journey by means of the American Specific Journey portal. Whether or not it is to guide flights, accommodations, vehicles, cruises or holidays, you should utilize the AmEx Pay With Factors choice. Nonetheless, the redemption charge varies relying on the kind of journey you guide and the AmEx card you employ to Pay With Factors.

Complicating issues additional, sure playing cards are eligible for bonus factors when cardmembers use Pay With Factors on AmEx Journey — making this an much more engaging redemption choice for eligible cardmembers. However this useful factors rebate has vital limitations and caps.

As you may see, there’s quite a bit to remember. Let’s dive into the small print of how one can redeem Membership Rewards factors for journey by means of the AmEx Journey Pay With Factors choice.

Which playing cards are eligible for Pay With Factors

All American Specific playing cards that earn Membership Rewards factors are eligible to make use of Pay With Factors to redeem factors by means of AmEx Journey. Eligible Membership Rewards playing cards embrace:

What journey purchases are eligible for Pay With Factors

American Specific cardmembers can use Pay With Factors to pay for the next sorts of journey booked by means of AmEx Journey:

-

Pay as you go accommodations — together with Nice Resorts & Resorts on eligible playing cards.

The redemption charge is dependent upon the kind of journey you guide utilizing Pay With Factors. On virtually all Membership Rewards playing cards — excluding the Blue from American Specific® card — you may get 1 cent per level in worth per level redeemed for flights and 0.7 cents per level towards different journey redemptions.

The Platinum Card® from American Specific and The Enterprise Platinum Card® from American Specific cardmembers additionally get 1 cent per level towards Nice Resorts & Resorts bookings.

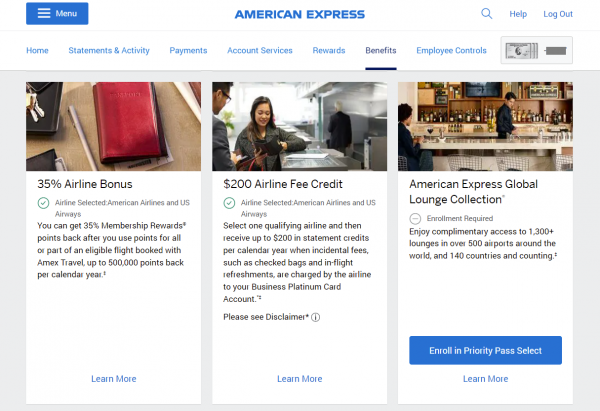

Which playing cards supply a Pay With Factors Airline Bonus

Two publicly out there American Specific small enterprise playing cards supply a factors rebate while you use Pay With Factors to pay for flights by means of American Specific Journey:

-

The Enterprise Platinum Card® from American Specific.

-

American Specific® Enterprise Gold Card.

These factors rebates — that are known as an “Airline Bonus” by AmEx — enhance the efficient redemption charge you get when redeeming factors by means of Pay With Factors.

You will want to make use of Pay With Factors to guide qualifying flights by means of American Specific Journey to get this rebate. To qualify, flights have to be both in your “chosen qualifying airline” or in first or enterprise class on every other airline.

The “chosen qualifying airline” for the Airline Bonus perk would be the identical airline you select for the Airline Price Credit score supplied on every of those playing cards.

That signifies that for those who select American Airways as your airline for these advantages, you’d get the Airline Bonus on any American flight booked utilizing Pay With Factors by means of the AmEx Journey portal. Nonetheless, you may have to guide enterprise or first-class to get the rebate on every other airline.

The Enterprise Platinum Card® from American Specific – 35% Airline Bonus

Study Extra

Cardholders of the The Enterprise Platinum Card® from American Specific obtain a 35% Airline Bonus when utilizing Pay With Factors to guide qualifying flights by means of AmEx Journey. Cardholders can rise up to 500,000 bonus factors again per calendar 12 months. A 35% rebate could not sound that vital, but it surely actually boosts the efficient redemption charge that you will get out of your factors.

Say that you simply redeem 100,000 factors to Pay With Factors for a qualifying flight costing $1,000. You will get 35,000 factors again on the redemption. Which means you are successfully solely redeeming 65,000 factors for a flight costing $1,000. That is a redemption charge of 1.54 cents per level.

Though AmEx units an annual cap on this profit, it is fairly excessive. To maximise this profit, you may have to redeem 1,428,571 factors for qualifying flights by means of Pay With Factors in a 12 months.

American Specific® Enterprise Gold Card – 25% Airline Bonus

Study Extra

American Specific® Enterprise Gold Card members get a 25% Airline Bonus when reserving qualifying flights utilizing Pay With Factors. This profit is capped at 250,000 bonus factors per calendar 12 months.

At a 25% rebate, American Specific® Enterprise Gold Card members successfully get a 1.33 cents per level redemption charge on qualifying Pay With Factors redemptions. Cardholders will max out this profit when redeeming 1,000,000 Membership Rewards factors for qualifying redemptions in a calendar 12 months.

Step-by-step how one can Pay With Factors

AmEx Journey will worth the leads to each US {dollars} and factors. The factors charge will not consider any bonus factors you would possibly qualify for — as this profit is a factors rebate, not a reduction. So, you may have to have sufficient factors in your account to pay the total worth of the journey. Then, for those who booked a qualifying flight, you may get a factors rebate 6-10 weeks after reserving the flight.

After choosing your journey plans, enter the traveler(s) info, request seats and think about AmEx’s further insurance coverage merchandise. Lastly, AmEx will current 4 cost choices:

-

Month-to-month Installments with Plan It®.

If you wish to solely use factors, AmEx will mechanically apply the overall variety of factors wanted. As famous within the positive print, your AmEx card shall be charged for the total worth of the flight. Then, you may obtain an announcement credit score after the Membership Rewards are redeemed out of your account. AmEx notes that this assertion credit score could take as much as 48 hours to course of.

If you wish to use a mixture of Factors + Money, enter the variety of factors you wish to apply to the acquisition. You will want to use at the least 5,000 factors. However in any other case, there isn’t any different restriction on the variety of factors you should utilize. If you would like, you may apply a precise variety of factors so you may nonetheless have sufficient factors for a future factors redemption.

The following step is vital when you have The Enterprise Platinum Card® from American Specific or American Specific® Enterprise Gold Card. To get the Airline Bonus factors rebate, you could cost an eligible flight reserving to your eligible card. Be sure that to pick out your eligible card from the bank card dropdown and enter the safety code to invoice the reserving to your eligible card.

In case your flight qualifies for the Airline Bonus, AmEx ought to e mail you inside a day or two to share the excellent news. Nonetheless, do not examine your Membership Rewards account fairly but. AmEx waits six to 10 weeks after the airfare buy earlier than offering the factors rebate.

If you wish to redeem Membership Rewards factors for journey by means of Pay With Factors

All Membership Rewards-earning AmEx playing cards are eligible to redeem factors by means of Pay With Factors. Nonetheless, the redemption charge is dependent upon the cardboard you’ve gotten and the kind of journey for which you are redeeming factors.

Cardmembers of most AmEx playing cards get a redemption charge of 1 cent per level for flights and — on eligible playing cards — Nice Resorts & Resorts bookings. Even higher, The Enterprise Platinum Card® from American Specific and American Specific® Enterprise Gold Card cardmembers get bonus factors when redeeming factors for qualifying flights by means of Pay With Factors. This rebate can successfully enhance your redemption charge as excessive as 1.54 cents per level.

How you can maximize your rewards

You desire a journey bank card that prioritizes what’s vital to you. Listed here are our picks for the finest journey bank cards of 2022, together with these finest for: