Smart Money Podcast: Bitcoin 401(k)s and Choosing the Best Crypto

The investing info supplied on this web page is for academic functions solely. BaghdadTime doesn’t provide advisory or brokerage providers, nor does it suggest or advise buyers to purchase or promote explicit shares, securities or different investments.

Welcome to BaghdadTime’s Good Cash podcast, the place we reply your real-world cash questions.

This week’s episode begins with a dialogue about cryptocurrencies coming to Constancy 401(ok) plans.

Then we pivot to this week’s cash query from a listener’s voicemail. Right here it’s:

“Hey, that is Ben from Memphis. I simply wished to know what’s the greatest cryptocurrency to spend money on proper now? Thanks.”

Take a look at this episode on any of those platforms:

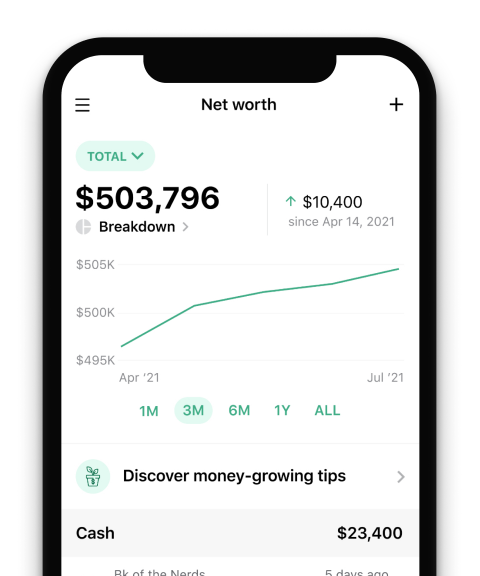

Observe your cash with BaghdadTime

Skip the financial institution apps and see all of your accounts in a single place.

Our take

Constancy, the most important 401(ok) supplier, not too long ago introduced that some members will quickly have the ability to spend money on Bitcoin via their 401(ok) accounts. However that doesn’t imply the cryptocurrency is coming to your retirement account. Should you can spend money on a 401(ok) via your employer, it must signal on first. And even when it does, Constancy gained’t allow you to make investments greater than 20% of your contributions into Bitcoin, and your employer might set an excellent decrease restrict.

That is all to say: Mood your expectations and attempt to see previous the hype. (Observe that Constancy is one among BaghdadTime’s companions, however that does not have an effect on how we speak about it.)

Whereas cryptocurrencies — together with Bitcoin — are the funding du jour, suppose onerous about whether or not it’s best for you. These are usually unstable investments. However in case you are set on investing in cryptocurrency, dig into what you need out of the funding to find out which crypto is perhaps the very best for you proper now. Are you interested by the underlying know-how that helps crypto? Do you wish to diversify your portfolio? Or are you simply searching for a short-term funding? Reply these questions earlier than selecting one crypto to spend money on.

When you’ve decided which crypto checks your containers, know how one can go about really investing in it. That often means utilizing a cryptocurrency trade. These platforms work equally to an on-line dealer: You make an account, put some cash in, then purchase the cryptocurrency that you really want. There are a selection of cryptocurrency exchanges, so store round to search out the very best one on your wants.

Our ideas

-

Study crypto fundamentals: Perceive what crypto is before you purchase it.

-

Get snug with volatility: There’s no assure that any single crypto asset will achieve worth over time.

-

Don’t overdo it: Crypto ought to at greatest be a small a part of your total funding portfolio.

Episode transcript

Liz Weston: This time, we’re speaking about crypto. Welcome to the BaghdadTime Good Cash podcast, the place we reply your private finance questions and aid you really feel a bit of smarter about what you do along with your cash. I am Liz Weston.

Sara Rathner: And I am Sara Rathner, filling in for Sean Pyles. Let the Nerds reply your cash questions. You possibly can name or textual content us at 901-730-6373. That is 901-730-NERD. Or e-mail us at [email protected]

Liz: Comply with us wherever you get your podcast to get new episodes delivered to your units each Monday. And when you like what you hear, please depart us a overview and inform your pals.

On this episode, we’ll sort out a listener’s query about which cryptocurrency is “the very best.” However first, in our This Week in Your Cash section, Sara and I are speaking about Constancy’s current announcement that it will provide crypto in its 401(ok)s.

Sara: First, some disclaimers. We aren’t funding professionals, and we can’t inform you what to do along with your cash. Additionally, Constancy is one among BaghdadTime’s companions, however that does not have an effect on how we speak about it.

However, wow, that is large information.

Liz: Yeah, it actually was. Constancy is the most important 401(ok) supplier. It has over 20 million members. And it is the primary so as to add crypto, which it says it will do by the center of this 12 months.

Sara: Except the Division of Labor steps in after which stops it.

Liz: Nicely, we’ll speak about that in a minute.

Sara: There are a number of filters, so to talk, that this information has to cross via earlier than it will get to you, the person employee, who’s saving on your retirement, who’s listening to this podcast.

First, your employer has to supply a 401(ok), which many do not. It is not one thing that particularly smaller corporations provide their staff. I learn someplace that roughly half of American employees haven’t got entry to a 401(ok) via their employers.

Filter No. 2: Constancy must be your 401(ok) supplier. And never each firm makes use of Constancy.

Then, filter No. 3 is your employer has to truly add that to the provisions of your plan. Each employer works with these totally different 401(ok) suppliers to choose and select what choices they supply to their staff.

Liz: The opposite filter you talked about was the Labor Division. They got here via, and so they weren’t completely satisfied about this.

Sara: That would present a bit of little bit of tasty drama to make this information a bit of bit extra thrilling.

One different factor to consider is correct now Constancy has said that they will not allow you to make investments greater than 20% of your contributions into crypto. After which your employer can set a decrease quantity. So that is the final of the filters: Even when you’ve made it via all the opposite filters, your employer may say, “Nicely, not more than 10%.”

So we already, in doing this, have lower out quite a lot of employees, so it actually relies upon. Clearly, if it is one thing you are concerned about and your employer doesn’t appear concerned about it, perhaps you possibly can discuss to your advantages individual at work and say, “Hey, might this be an possibility for us?”We reside in a time the place staff are exercising their rights and speaking again. So why not use this as a time to try this as nicely, proper, and get the advantages that you really want at your organization?

Liz: However let’s speak about how a lot of your portfolio. Should you undergo all these filters, and it’s an possibility for you, and for instance your employer decides to allow you to put as a lot as 20% in, is that a good suggestion, Sara?

Sara: As all the time, my reply to quite a lot of these questions is, “It relies upon.”

Sara: As a result of it is determined by you and your retirement time horizon, and your urge for food for threat, and your capability to sleep at evening if the worth of your 401(ok) simply drops actually dramatically, like a curler coaster. That may be a extremely particular person resolution.

However what I can say is a few guidelines of thumb that, at BaghdadTime, we suggest: Not more than 10% of your complete funding portfolio be in so-called various investments, like cryptocurrency. So take into consideration the entire universe of your whole funding accounts, not only a 401(ok), however you may additionally have an IRA or one other sort of retirement account individually. And you may additionally have taxable brokerage accounts that you just additionally spend money on. So take into consideration your complete portfolio, after which think about how your retirement contributions slot in with all of that.

Liz: I feel this could possibly be one other step towards mainstreaming cryptocurrency. Nevertheless, proper now, they’re solely providing one cryptocurrency, and that is Bitcoin. So, that is in all probability the one which most individuals know, however is that this going to be the cryptocurrency that survives the long term? We do not know. There’s plenty of totally different cryptocurrencies. They’ve quite a lot of totally different functions and quite a lot of totally different causes to spend money on them or not.

That is one thing that you just actually wish to watch out with, since you’re concentrating your threat. Crypto is dangerous by itself, after which when you’re simply shopping for one cryptocurrency, that is concentrating the danger even additional. So in some methods, I am enthusiastic about this. It is sort of cool. In different methods, it is like, I might actually see this going south.

Sara: Yeah, I imply, on the one hand, it does make investing in crypto administratively simpler on the person. Employer-sponsored retirement plans are sometimes individuals’s first forays into investing. So this might make it simpler to know for lots of people.

As a result of investing in crypto — sure, you may simply do it out of your cellphone, a pair faucets in, and all of a sudden you’ve got purchased crypto — however it may be very intimidating. So this may decrease that barrier for lots of people.

Liz: It could possibly be a method to simply get a style of this. However I simply was speaking to a younger buddy who was actually frightened in regards to the inventory market. And she or he was like, “OK, I’ll promote a few of my shares and get crypto as an alternative.” It is like, “No, no, no, no, no.” Should you’re frightened in regards to the volatility of the inventory market, simply wait. See what occurs along with your crypto.

We have now a protracted historical past with shares. We perceive {that a} diversified combination of shares goes to do fairly nicely over the long run. We do not have that assurance with cryptocurrency. We do not know which one’s going to prevail or which one’s going to go for the long term. So when you’re speaking about ups and downs, and also you’re frightened about that, crypto isn’t the way in which to go. If, nonetheless, you wish to simply take a style, have a bit of bit, that makes extra sense.

Sara: You hear the phrase “speculative funding” quite a bit if you ask individuals about crypto. It is nonetheless very a lot regarded as that. It is nonetheless very a lot regarded as sort of on par with playing, whereas investing typically will get this dangerous rap of being like playing. However as a result of we’ve many years — and in some instances, over 100 years — of information about how corporations have carried out, it is much less like playing in case you are considerate about it.

Sara: And diversified, sure.

Liz: You possibly can spend money on corporations which are investing in blockchain, which is the know-how behind crypto. And that is one other method to get a bit of piece of this.

So there’s quite a lot of other ways to do it. You do not have to really feel railroaded or really feel like you are going to have to do that, even when it involves your 401(ok). And as we have stated, it may not essentially do this.

Sara: Yeah. And I’d say, with crypto, by way of the mentality of the entire tradition round it, there’s this obsession with the FOMO, the worry of lacking out.

Sara: Anytime there’s that urgency that it’s important to act now or you are going to miss out, truthfully, that sort of makes my pores and skin crawl a bit of bit with regards to investing, as a result of it is a long-term proposition, doubtlessly, if you’re investing.

Usually, we do not suggest any cash that you just want within the subsequent 5 years or so to be invested, since you want that cash liquid. You want it accessible to you with out taking up any kind of monetary penalty for pulling that cash out. However if you’re investing for the long run, it isn’t about “I’ve to do that now, or else I’ll miss out.” It is OK. You possibly can take your time. Put a bit of bit of cash away each month into various things, and simply see the place it goes. You do not have to freak out and act now. This isn’t an as-seen-on-TV commercial. That is your cash, and that is your life, and you need to be very considerate with each of these issues.

Liz: We have now quite a lot of info right here at BaghdadTime that will help you educate your self about cryptocurrency and blockchain know-how when you’re concerned about it. So come to the positioning, we’ll have some hyperlinks in our present notes.

Earlier than we transfer on to this episode’s cash query section, we’ve a name out for all of the dad and mom that take heed to Good Cash. We’re engaged on a brand new collection about the price of baby care. And we wish to know: How are you paying for baby care? The place does it slot in your price range? And have you ever needed to make different sacrifices to make these prices work? Name in to our hotline at 901-730-6373, or e-mail a voice memo to [email protected], and inform us how you are making baby care prices be just right for you and your loved ones.

Sara: All proper, now let’s get to this episode’s cash query.

Liz: All proper, sounds good.

Listener: Hey, that is Ben from Memphis. I simply wished to know what’s the greatest cryptocurrency to spend money on proper now? Thanks.

Sara: To assist us reply our listener’s query, on this episode of the podcast, we’re joined by BaghdadTime crypto author Andy Rosen. Welcome to the podcast, Andy.

Andy Rosen: Thanks for having me.

Liz: OK, earlier than we begin, we have to point out that we aren’t monetary or funding advisors, and since all people’s monetary state of affairs is totally different, this info isn’t customized.

However, Andy, you’ve got been explaining cryptocurrency to your mom, to your aunts, to your uncles, so we determine you in all probability can clarify it to us. Let’s begin with the fundamentals and inform us: What’s cryptocurrency?

Andy: So, cryptocurrency might be quite a lot of various things. However there’s one factor that you must bear in mind if you’re occupied with cryptocurrency and what makes it totally different. Basically, cryptocurrency is predicated on a know-how referred to as blockchain, which lets you personal a digital file and makes it onerous to recreate or use with out the permission of the one that owns it.

A number of merchandise are being constructed on this know-how. What you’ve got in all probability seen is Bitcoin, which is the most important and actually the primary cryptocurrency, and that was invented to make peer-to-peer funds attainable. Nevertheless, more often than not, Bitcoin and quite a lot of the opposite fashionable cryptocurrencies are used much less as a medium of trade and extra as an funding or a retailer of worth, as a result of persons are shopping for it for its progress potential.

Sara: So that you talked about Bitcoin, which is one type of cryptocurrency, however there are quite a lot of others. So how would you reply Ben’s query? What’s the very best crypto?

Andy: Nicely, the reply to that query, like virtually something in investing, goes to rely on what your objectives are. Earlier than you do something with investing, you must have the ability to actually simply reply the query: Why do you wish to make investments on this? That goes for shares, bonds, something. And it positively goes for cryptocurrency.

So give it some thought. Are you interested by the know-how of cryptocurrency? That may level you in a single path. Are you trying to diversify your portfolio, as a result of you’ve got quite a lot of conventional investments and also you’re concerned about crypto’s position in your portfolio? Are you trying to simply be a day dealer and speculate on short-term worth actions? Nevertheless you reply these questions goes to assist inform which is perhaps the very best cryptocurrency for you.

It is also price noting that cryptocurrencies will not be all the identical. You’ve got in all probability heard of Bitcoin and Ethereum. These are the largest ones. However there’s greater than 18,000 cryptocurrencies which are traded in some locations. So you actually wish to vet these and make it possible for the one you are shopping for is the one which aligns along with your monetary state of affairs.

It could have one thing to do with the sector you are working in or the sector you are concerned about. So individuals have used the know-how that helps crypto on issues like finance, gaming, artwork, legislation. So it will come all the way down to studying in regards to the area, making an knowledgeable resolution about why you suppose a cryptocurrency goes to extend in worth.

Liz: OK, nuts and bolts: How does any person go about investing in crypto?

Andy: Nicely, there are quite a lot of methods to get cryptocurrency. You can, as we mentioned earlier than, obtain it as fee for one thing. However for probably the most half, when you’re a complete newbie and you’ve got by no means skilled cryptocurrency earlier than, the only manner goes to be going to a centralized trade, like a inventory brokerage. A number of inventory brokerages are actually promoting cryptocurrency together with shares.

However there are additionally quite a lot of devoted areas the place you should buy cryptocurrency, and are actually simply cryptocurrency exchanges. And when you go to BaghdadTime, we’ve reviewed many of those, and you may evaluate them and determine which one works for you. There’s quite a lot of variations between how they work, however we lay all of it out for you there.

What you do there’s, primarily, it is similar to shopping for one thing, proper? You fund your account, you perform a transaction, and you then personal cryptocurrency. However the actual onerous half, I feel, isn’t shopping for it. These companies that promote it have made it fairly simple to purchase now. The onerous half is deciding what you need and what you propose to do with it.

Liz: OK. I had a buddy who misplaced his password, and so I have been a bit of bit twitchy about utilizing an trade. So I used to be considering there is perhaps even simpler methods to take a position, like with ETFs or mutual funds. Or are these not a great way to go?

Andy: Nicely, you will not have the ability to make investments immediately in cryptocurrency via an ETF or a mutual fund, as a result of that’s not one thing that is regulatorily allowed proper now.

There are some ETFs that simply commerce in Bitcoin futures, a kind of spinoff of Bitcoin. However if you’d like a diversified portfolio, the place another person has picked out a bunch of cryptos for you that they suppose have promise — somebody who’s an professional — there are comparatively few choices out there. And that is due to regulatory necessities round what funds need to do to carry cryptocurrency. There are methods to do that, however they are not quite simple.

Should you’re concerned about publicity to the cryptocurrency area — say you are on this know-how, however you are simply not prepared to enter crypto — there are ETFs which are targeted on the economic system round cryptocurrency. They could spend money on publicly traded corporations that personal cryptocurrency or that produce other traces of enterprise which are associated to cryptocurrency. You possibly can look into these. However for probably the most half, if you wish to personal a collection of totally different cryptocurrencies, you are going to have to purchase cryptocurrency.

Sara: So one thing to consider — in addition to not dropping your password on your crypto pockets, since you might lose some huge cash that manner, so do not do this — however one other threat is the truth that crypto has a repute for being fairly unstable by way of its worth. So what causes the massive ups and downs we see over generally comparatively quick durations of time with cryptocurrency?

Andy: There are quite a lot of elements contributing to crypto’s volatility. And there are two that I feel are significantly necessary. I feel the very first thing to recollect is that crypto is a brand new and comparatively untested a part of the monetary world. And if you’re occupied with inventory costs, as an example, there are generally many years price of information on an organization or on a sector that inform us sort of the place we’re within the cycle and what’s prone to occur, and the way lengthy you may wait on your investments to be sort of at their full potential.

Proper now, nobody actually is aware of the place crypto is in its cycle. It is solely been a pair years since this has been a well-liked factor, and there is actually not quite a lot of knowledge about how crypto will react to different financial elements like inflation, as an example.

So buyers’ confidence tends to bounce round as they attempt to reckon with elements which may play into the worth of their investments. As an example, when Russia invaded Ukraine, crypto costs fell together with the remainder of the market, as a result of individuals thought the battle would harm the economic system. Then it shot again up as individuals thought Russians and Ukrainians may flip to crypto to maneuver cash round. Now it has been bouncing round. So nobody actually is aware of what that is going to imply. So I feel you actually haven’t got the historical past there to present you an actual sense of confidence about what may occur subsequent.

I feel the second main issue is that cryptocurrencies are an funding of their underlying know-how. The factor that I talked about earlier than — it is referred to as blockchain — it makes proudly owning one thing digital safer. And though blockchain is de facto attention-grabbing and thrilling to lots of people, it isn’t one thing that is acquired broad adoption. It is not like there’s quite a lot of issues you could decide up as we speak and expertise blockchain know-how.

Individuals are nonetheless constructing the merchandise that you will wind up utilizing if it does grow to be fashionable. So by nature, cryptocurrency is a speculative funding, speculating in the way forward for this know-how, and it is sort of like investing in an organization that hasn’t but turned a revenue.

Liz: It sounds quite a bit just like the early days of the web, when there have been a bunch of corporations that had been tremendous fashionable that now are not round. So we do not actually know which type of blockchain, which type of cryptocurrency, is de facto going to remain the space.

Andy: Proper. I imply, there’s two elementary questions. One is: Is blockchain know-how going to create the sort of wealth that its supporters suppose it should? And that’s attainable, however certainly not assured. The opposite one is: Is the know-how that’s supported by the actual cryptocurrency that pursuits you going to achieve success inside that area? And that is an entire different query. So you’ve got two layers of threat right here which may not be true in a extra established sector.

Sara: We touched a bit of bit, and we joked a bit of bit, about dropping your password when you’ve got crypto. It is not humorous as a joke, as a result of you possibly can lose thousands and thousands of {dollars} this manner. So when any person’s occupied with investing in crypto, or even when any person has already began investing in crypto, what ought to they think about with regards to storing the crypto that they’ve and holding it safe?

Andy: So, in case you have thousands and thousands of {dollars} in crypto, then God bless you. I’ll say this: It is a very sophisticated query about how one can retailer crypto, however I will simply go over a few the fundamentals. You are going to wish to do much more analysis about this earlier than you make a closing resolution, particularly when you do have quite a lot of worth tied up in crypto.

Basically, the way in which that crypto works is that you just management crypto via what is known as a personal key. Basically, it is like a password, however it has some variations, and it permits you to set up possession. So if you wish to spend it or promote it or switch it, you want that key to say, “That is mine.” If you do not have that key, you can not declare your crypto. It nonetheless exists, however you will by no means get it. It is principally gone.

There are a number of merchandise out there, often referred to as digital wallets, crypto wallets, that can help you retailer these personal keys securely. You wish to take into consideration whether or not you wish to retailer it on-line — which is rather less safe, however extra handy and simpler — or retailer it offline. You possibly can really retailer it on a bodily gadget.

These are a few of the questions you are going to wish to think about. It’ll rely on how typically you propose to make use of it and transfer it round, and in addition what you suppose your safety threat profile is. We have now a handful of articles round how one can retailer crypto and the way to consider the query of the place to retailer it, so you possibly can examine these out on BaghdadTime.

Liz: You talked about that totally different cryptos had been primarily created to resolve totally different issues. Are you able to give us an instance of that?

Andy: Certain. So I discussed Bitcoin beforehand, the place Bitcoin is actually made to be a medium of trade. Basically, I pay you a Bitcoin, and also you give me a product. It’s presupposed to be like cash.

The second-most fashionable cryptocurrency, which you’ve got in all probability heard about, is Ethereum. Ethereum was created as a method to program one thing that is referred to as sensible contracts. And which may sound a bit of technical, however primarily that executes routinely when some situation is met. So, as an example, you may retailer worth in a sensible contract till a given time frame is handed after which launch it — like perhaps to the heirs of an property, or one thing like that.

I imply, one thing like this has the potential to chop out quite a lot of center males in profitable industries, which you’ll be able to see how which may create some worth. Now, due to that, there’s lots of people making an attempt to resolve this drawback of how one can make sensible contracts that work rather well. And there is some attention-grabbing opponents on the market that suppose they’ll do a greater job. Cardano and Solana are Ethereum opponents.

So when you’re occupied with investing in one thing, it is a good instance of the way you may suppose it via: Why do you suppose Cardano, Solana, Ethereum or any of their different many opponents are higher than the opposite individuals making an attempt to resolve this query? What did they do this makes you suppose they’re the very best? This may take some technical evaluation, however when you can no less than articulate an argument for why you suppose your funding is healthier, that will likely be a terrific begin for you.

Sara: How may you consider how crypto would slot in along with your total funding portfolio or your funding technique?

Andy: So it is simply necessary to keep in mind that cryptocurrencies are dangerous investments, and they need to be a part of an total portfolio that has some diversification in it. One rule of thumb is that you just should not make investments greater than 10% of your portfolio in dangerous property equivalent to cryptocurrency.

Liz: Nicely, thanks for becoming a member of us, Andy. This was tremendous useful.

Andy: Thanks for having me.

Liz: All proper. And let’s get to our takeaway ideas, and I’ll begin us off. First, be taught crypto fundamentals. Perceive what crypto is before you purchase it.

Sara: Subsequent, get snug with volatility. There is no assure that any single crypto asset will achieve worth over time.

Liz: Lastly, do not overdo it. Crypto needs to be, at greatest, a small a part of your total funding portfolio.

Sara: And that is all we’ve for this episode. Do you’ve got a cash query of your individual? Flip to the Nerds and name or textual content us your questions at 901-730-6373. That is 901-730-NERD. You can even e-mail us at [email protected] Additionally, go to nerdwallet.com/podcast for extra info on this episode. And bear in mind to subscribe, charge and overview us wherever you are getting this podcast.

Liz: And this is our temporary disclaimer, thoughtfully crafted by BaghdadTime’s authorized staff. Your questions are answered by educated and gifted finance writers, however we aren’t monetary or funding advisors. This Nerdy data is supplied for basic academic and leisure functions and will not apply to your particular circumstances.

Sara: And with that stated, till subsequent time, flip to the Nerds.

Visitor Nerd Andy Rosen owned Bitcoin, Ethereum, Solana and Cardano on the time of publication.