Smart Money Podcast: Making the Most of Money

Welcome to BaghdadTime’s Sensible Cash podcast, the place we reply your real-world cash questions.

This week’s episode begins with a dialogue about why you need to scrutinize your payments.

Then we pivot to this week’s cash query from a listener’s voicemail. Right here it’s:

“Hello, guys. Thanks for doing the podcast. I actually admire it. I’ve a query about prioritizing. I’m in my late 20s, and I’m about to have an over $200,000 pretax earnings after principally by no means having a wage earlier than.

“I’m beginning at an enormous regulation agency, and I’ve about $100,000 in debt from grad faculty, a few of which has, I believe, a 6.8% rate of interest. And I simply do not know whether or not to start out off by placing all or any of that extreme earnings right into a 401(ok) or a Roth IRA, or going in opposition to my scholar loans. What’s the good order to go in right here? Thanks. Bye.”

Take a look at this episode on any of those platforms:

Our take

From medical payments to bar tabs and even your insurance coverage, questioning your payments can prevent cash. Errors in medical billing are widespread, so know how one can learn your medical payments and dispute any errors. This will likely entail just a few calls between your medical supplier, their billing division and your insurer, however the time is properly price it for those who lower your expenses. And those that store round for automobile insurance coverage will pay lower than those that persist with their insurer yr after yr.

Should you get an enormous elevate, take the time to refigure your price range so you understand how to allocate your earnings. The 50/30/20 price range, the place half your earnings goes to wants, 30% goes towards desires and 20% goes to debt funds and financial savings, is an efficient framework to start out. Now can also be time to suppose massive. Know what your monetary objectives are over the long run and make a plan to attain them.

Paying off debt is a laudable aim — however don’t let it get in the best way of different ambitions, like saving for retirement. Multitasking can set you up for a stronger monetary future than for those who wait till you’re debt-free to start out saving in your golden years.

And whereas getting an enormous bump in earnings is one thing to have a good time, take steps to keep away from life-style creep. Which means persevering with to price range and asking your self if you actually need that additional pair of footwear or costly dinner out. Moreover, giving your {dollars} a job — like investing or paying down debt — can assist you keep away from frivolous spending.

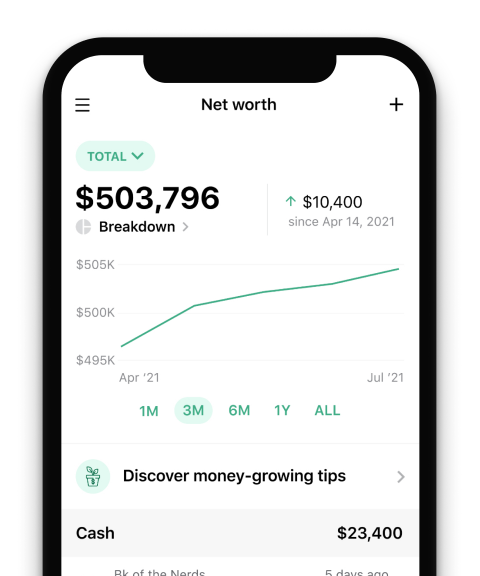

Monitor your cash with BaghdadTime

Skip the financial institution apps and see all of your accounts in a single place.

Our ideas

-

Know what you’re working with: While you face an enormous change to your private funds, take the time to reassess your price range and monetary objectives.

-

Multitask: Should you’re making a hefty wage, work to max out your retirement contributions whereas paying off your scholar loans.

-

However preserve your life-style in examine: With more cash within the financial institution, it’s possible you’ll be tempted to spend it. Give your {dollars} a job so you may preserve life-style creep at bay.

Extra about managing your cash on BaghdadTime:

Episode transcript

Sean Pyles: Welcome to the Nerd Pockets Sensible Cash podcast, the place we reply your private finance questions and assist you to really feel just a little smarter about what you do along with your cash. I am Sean Pyles.

Liz Weston: And I am Liz Weston. To ship the Nerds your cash questions, name or textual content on the Nerd hotline at 901-730-6373, that is 901-730-NERD, or e mail us at [email protected] Hit that subscribe button to get new episodes delivered to your units each Monday. And for those who like what you hear, please depart us a evaluation.

Sean: This episode, Liz and I reply a listener’s query about how one can handle a change in earnings. However earlier than we get into that, on this episode’s This Week in Your Cash phase, we’re speaking about why you need to query all the things, a minimum of in terms of what you are being requested to pay.

Liz: For medical payments, restaurant tabs and even your insurance coverage, it is price giving all the things you are anticipated to pay just a little extra scrutiny. Sean, this was impressed by a latest invoice you obtained. You need to inform us about that?

Sean: I not too long ago obtained a invoice for 100 {dollars} greater than it ought to have been. And that impressed me to dig into what was occurring and understand that I am truly being charged for extra issues than I actually must be. So let’s begin with this invoice. Mainly, I’ve the identical medical appointment each 4 months. It is fairly customary. And each time I’ve it, it is lined by my insurance coverage, regardless that I’ve a high-deductible well being care plan.

For the most recent appointment that I had, I obtained this invoice that was for over 100 {dollars} and I regarded into it just a little bit. I referred to as the billing division. I referred to as my insurance coverage firm. I had numerous backwards and forwards. It seems that they coded the incorrect appointment. The code that they used was one quantity off from what they usually use. After speaking with them for a very long time — it took over two hours to get this entire factor sorted out between the entire telephone calls — they ended up reissuing the invoice to my insurance coverage firm and it was lined. And if I hadn’t accomplished that, if I had simply accepted the invoice and thought, “Oh, bummer, acquired to pay this invoice,” I might’ve been out over 100 bucks that I actually did not should pay in any respect.

Liz: Medical payments are infamous for being incorrect for charging you issues they should not have charged you. And the issue is, for those who wind up in a dispute along with your insurer a couple of medical invoice, it might probably go in your credit score report, which might have an effect on your credit score scores. So that is the worst-case state of affairs. You do not need that to occur. A little bit bird-dogging could make an enormous distinction.

Sean: It is price being fairly punctual about this, as properly. The second I acquired the invoice, I knew it was not proper. And so I referred to as, and I dug into it, and it was resolved inside a day, which is nice. But it surely additionally could be a lot extra of a prolonged course of for individuals who aren’t as well-versed in how to do that. Any time you get a invoice for any kind of medical expense, it is price asking a pair questions, simply ensuring that the billing code is right and that you’re being charged what you are alleged to be.

Liz: And I am an enormous fan of computerized funds. I’ve virtually all the things on auto pay, however the draw back of that’s you may let issues slide. Cable payments, web and satellite tv for pc radio are actually infamous for jacking up the worth after they’ve given you some type of teaser intro charges. That may wind up being tons of of {dollars} that you simply needn’t spend.

Sean: And considerably much like my expertise with the medical invoice, I additionally not too long ago had a prescription that as a result of I am on this high-deductible plan was not lined by my insurance coverage. So I talked with my medical workplace they usually stated, “Oh, simply cost it by means of GoodRx, here is the worth that I am seeing.” I’ve talked about GoodRx earlier than, however I might by no means truly used it. So I lastly signed up and I used to be in a position to save half off what the pharmacy was initially asking me to pay.

Liz: That is one thing about these high-deductible plans: They actually encourage you to go searching for some financial savings.

Sean: However that is the place the well being financial savings account is available in fairly helpful. So I might have simply expensed it. However once more, I am attempting to have as a lot cash in there as attainable so I can make investments it.

Liz: One of many issues you are able to do to just remember to’re not overpaying is regulate your transactions, whether or not you auto pay or not, ensuring that you simply evaluation your transactions. I attempt to do it like each month or so. And our app, the BaghdadTime app, is a very good approach to preserve observe of a bunch of various accounts without delay and take a look at these transactions. Is that one thing you do or is that one thing you must remind your self to do?

Sean: So I’m an enormous weirdo who pays off my bank card virtually every day as a result of I used to have bank card debt years in the past, and it is one thing that has caught with me, this virtually hawkish strategy to creating positive I am maintaining my spending in examine. So I take a look at it greater than possibly I ought to or most individuals would even need to, however it helps me know that what I am paying is what I must be paying.

I truly had one other related expertise to this, relating the entire side of constructing positive you are getting billed appropriately at eating places and bars, the place I used to be not too long ago going by means of my bank card assertion and I noticed a cost for a bar that I went to. I solely had one drink, however I used to be charged over $70. And…

Sean: … I spotted that my good friend was attempting to shut out their tab, all the things they’d been charging wound up on my bank card. So we needed to kind it out. It was superb in the long run, however it’s a reminder to double-check all the things you are being charged as a result of that basically stood out. And if I hadn’t double checked and checked out this intently, I might’ve been paying that.

Liz: And that is not one thing you need to do.

Sean: No. As a lot as I like my pals, I did not need to shell out $70 for his or her tater tots and beer. One other factor that I have been fascinated with, as a result of it’s nonetheless the vacation season, and no, I’ve not completed all of my vacation procuring but, is value matching.

Sean: I do know. There are nonetheless a pair devices that I am hoping to get some relations. And I not too long ago found that Goal and Finest Purchase specifically have wonderful price-matching insurance policies. So for those who’re searching for one thing and also you see that it is just a little bit extra at Goal, however it’s simpler to buy at a Goal as a result of it is in your neighborhood and you do not need to depend on transport or one thing like that, you may say, “Hey, here is what I am seeing at this different retailer, are you able to price-match me?” And so they just about will. One other space of us ought to look into, if they do not need to be overcharged, is their automobile insurance coverage. Whereas lots of people will simply be tempted to take a seat with their identical automobile insurance coverage firm yr after yr, one evaluation discovered that folk might save a mean of $560 by procuring round for automobile insurance coverage.

Liz: OK. That is some critical money. And I do know we have talked about this earlier than, however once more, it is one thing that is very easy to go away on auto pay or depart on computerized and never understand which you could save a ton of cash with just a bit little bit of effort.

Sean: Completely. And the Nerds on the insurance coverage workforce discovered that the best cadence for searching for automobile insurance coverage is yearly.

Liz: OK. I believe I can handle to try this.

Sean: Yeah, simply put aside an hour, possibly even much less on a Sunday afternoon and simply knock it out. Liz, I do know you latterly had an expertise, not getting the credit score you deserved for bank card purchases and factors. What occurred there?

Liz: Yeah. Effectively the massive one has to do with a voucher for a visit we needed to cancel in 2020, and it is a pretty substantial voucher. It is like for $2,500.

Liz: Yeah. It is like, I can not discover it on the airline web site and customer support is so backed up. I truly acquired an e mail once I inquired about it. It is like, why is not this voucher on my account? They are saying they’re going to get again to me in 10 weeks. Excuse me?

Liz: Sure. That is type of an outlier, however I’ve observed once you join, say, a refund affords in your bank card, like you may get $50 off for those who spend $250, half the time I’ve to go the customer support line and say, “Hey, I did not get credit score for this explicit buy.” So once more, the credit are inducing you, these affords are inducing you to spend cash. Should you do it, ensure you comply with up and ensure you acquired that cash.

Sean: Yeah. Be certain they’re following by means of on their phrase.

Liz: As a result of they do not all the time achieve this. And once more, all of us get busy and it is simple to let it slide, however this could add as much as actual money.

Sean: All proper. Effectively, I believe that about covers it. Let’s get onto this episode’s cash query.

Liz: This episode’s cash query comes from a listener’s voicemail. Right here it’s:

Listener: Hello, guys. Thanks for doing the podcast. I actually admire it. I’ve a query about prioritizing. So I am in my late 20s, and I’m about to have an over $200,000 pre-tax earnings after principally by no means having a wage earlier than. I am beginning at an enormous regulation agency, and I’ve about $100,000 in debt from grad faculty, a few of which has I believe a 6.8% rate of interest. And I simply do not know whether or not to start out by placing any of the surplus earnings right into a 401(ok), right into a Roth IRA or going in opposition to my scholar loans. What is the good order to go in right here? Thanks. Bye.

Sean: To assist us reply our listener’s query, we’re joined on this episode by our occasional Sensible Cash co-host, Sara Rathner. Hey Sara, welcome again on.

Sara Rathner: Thanks. It is enjoyable to be on the opposite aspect of the proverbial microphone at present.

Sean: Yeah, properly we’re going to grill you so I hope you are prepared for it.

Sean: Our listener is about to expertise a sudden and dramatic change of their private funds. And I believe that they need to in all probability take some steps to set themselves up for achievement and ensure they’re managing their cash correctly going into this new section of their life and their profession. And the place do you suppose they need to begin?

Sara: Effectively, one, acknowledge that this can be a very good downside to have. Congratulations to our listener for getting this job provide popping out of regulation faculty. That is an enormous deal. So you ought to be happy with your self. Everytime you expertise even a considerably main life change, like an earnings enhance or lower, or new job or relocation for work or something like that, it is a good time to ask all of those questions. All of the questions that this listener is asking are nice. And also you by no means actually need to go into these conditions simply considering that I can simply preserve managing my cash the best way I did earlier than, as a result of issues are completely different. So it’s good to take inventory of what you are doing at the moment, if it is working for you, what extra might you be doing along with your new state of affairs? And incomes $200,000 a yr, even if in case you have substantial grad faculty debt, is the type of factor that can provide you a very nice head begin in life for those who play your playing cards proper. That is what we’re right here for. We’re right here that will help you with that.

Sean: Proper. Effectively, one factor I used to be considering is that it could be useful for them to take inventory of their earnings and bills. Mainly getting a grip on their new price range. One instrument that we prefer to suggest is the 50/30/20 price range, the place half of your earnings goes to cowl the wants — that is hire — 30% goes in direction of desires — that is type of enjoyable issues like journey — and 20% goes in direction of debt funds and financial savings. And with the gorgeous hefty earnings that our listener has, I believe they need to have the ability to use this beautiful properly.

Sara: One thing that is an enormous adjustment once you’re new to working is determining how a lot you price. As a result of your life might need been very completely different once you have been a scholar, possibly you have been being supported financially by household, otherwise you have been working half time whereas at school, residing with roommates.

Sean: Residing off of ramen noodles.

Sara: Yeah. Residing the broke scholar life. And now, you might be out into the world probably type of taking the reins of your funds by yourself for the primary time, presumably. And so determining how a lot do blueberries price, you realize what I imply? It is the little issues you have to know.

Sara: And that is going to take a while, however it’s OK to take a few months and simply kind of observe your spending and formulate a price range primarily based on the place your cash goes. After which additionally the place you would like it could go if it is not going the place you need it to go.

Liz: Effectively, and if anyone is leaping from being a broke regulation faculty scholar to having $200,000, it may be actually laborious to not go nuts, purchase a brand new automobile, get a fantastic residence, purchase garments, do all the things.

Sara: Yeah. Hear, I do know you need the Tesla, OK. Can we speak for a second? You do not want the Tesla but. This isn’t Tesla time.

Sean: And likewise there are many different nice automobiles apart from Teslas. Let’s begin there.

Sara: I imply for those who aspire to a Tesla, do it, they’re stunning. However it’s simply essential to acknowledge the place you might be. Particularly once you’re going into massive regulation. The life-style creep temptation has acquired to be considerably greater than it’s in different industries as a result of it is a kind of industries the place, relying on what agency you’re employed for, what metropolis you reside in, the way you look issues.

Sara: It issues to purchasers. It issues to the companions, and the way you look is, it is the way you costume, it is what you drive. It is the way you arrive. You recognize what I imply? Do you golf on weekends? That is a really costly passion. Do you ski? I do not know. These are individuals who do issues like this, and you might be getting into this world. And if this was not a part of the world that you simply grew up in, it may very well be an actual adjustment, too.

Sean: Effectively, yeah, that additionally brings me to the purpose that I believe our listeners ought to take into consideration their monetary objectives they usually can set them for one, three, 5 years down the street after which truly set up a path towards assembly them.

Sara: Yeah. That is actually massive. The listener of their query requested about retirement financial savings, they usually requested about scholar mortgage debt. However there’s numerous different issues you must plan for in life. You are not simply paying off your scholar loans and retiring. I might hope that you simply do different issues, and people different issues are going to price you cash, like probably shopping for a home or touring, or possibly you need to assist household out financially. Possibly you need to have youngsters finally. If you’re working in an enormous regulation agency, childcare is unquestionably going to be one thing to price range for since you work lengthy hours. There’s numerous life that occurs in between grad faculty and retirement. So it is essential to record out what these issues are for you after which start placing some numbers behind them and start making some month-to-month financial savings objectives for these issues.

Liz: We also needs to make the plain statement that you do not internet $200,000. And once you’re up in that stratosphere, you is likely to be just a little shocked at how a lot comes out in taxes, so determining what your after-tax earnings goes to be will actually assist with the 50/30/20 price range. However it should additionally assist you to right-size a few of your expectations about how a lot you must spend for an residence, how a lot you must spend for a automobile.

Sean: One instrument that is likely to be useful is having a financial savings bucket technique that I am tremendous keen on. And Liz, truly, you turned me onto this earlier this yr.

Sean: For me, I’ve half a dozen completely different financial savings accounts with completely different objectives connected to them. And I’ve a sure proportion of my earnings go into them, every paycheck. In order that manner I’m saving towards completely different objectives. Considered one of them is simply enjoyable cash. And that’s my common bucket of money that I’ve for issues like journey and presents for pals and restaurant nights out, issues like that. So you may have enjoyable with this, however I believe it is essential to present each greenback a function.

Sara: Yeah. That is tremendous useful. And once you title your objectives, I believe there’s research that again up the truth that if in case you have a named aim, you save extra, extra rapidly, than if it is simply, that is my financial savings account, it is for saving.

Sean: It could possibly assist gamify it, since you’re seeing how far more you are getting every paycheck.

Sara: Proper. Yeah. And that manner you may say, like, “Hey, in 5 years I am celebrating a milestone birthday, and I need to take an enormous trip and I’ll price range 5 grand to try this.” OK. So you must save a thousand {dollars} a yr in direction of your trip. Divide that by 12, set that cash apart, make an automatic switch into your trip account. And once you’re able to e-book, you may have the cash. You do not have to tackle debt to take that journey.

Liz: Yeah. And also you’re doing a couple of factor at a time. Folks can get actually targeted on, “I’ll repay all my debt after which I am going to save for retirement.” No, you do it on the identical time since you need to reap the benefits of the time worth of cash, and multitasking is the best way to go.

Sean: However there may be additionally a stability between multitasking and prioritizing the place you set your cash, which is a query that our listener had. So Sara, what are your ideas on how one can prioritize completely different monetary objectives and methods to direct cash?

Sara: All proper, there are the massive objectives like retirement, shopping for a home, getting married, issues like that. Retirement is massive. Everyone has a special imaginative and prescient of what they need their retirement to appear like, however there will probably be a degree in your life the place you may not work. So even if you wish to work till you are 80, your physique might need different concepts, and you will have to give up earlier due to medical points. That is sadly actually widespread.

You do must plan for an eventual time interval the place you are not working anymore, the place you might need greater medical bills, issues like that. And so that you’re younger, you are simply out of grad faculty. You are simply getting began. And Liz talked about the time worth of cash. Getting began early means which you could save much less each month and find yourself with more cash once you’re in your 60s or 70s than for those who wait till you are in your 40s or 50s and attempt to catch up. That is how compound curiosity works. The extra time you give it, the higher off you are going to be and the much less aggressively you may have to save lots of. And once you’re in your 40s or 50s, you may not have the cash in your price range to save lots of that aggressively for retirement as a result of by you then might need youngsters in faculty, and your trip dwelling and your fleet of Teslas or no matter. And also you’re simply not going to have as a lot cash each month to place into your retirement account. And so begin early when your life is just a little less complicated and simply save, save, save.

Sean: However prioritization will also be a matter of non-public desire, too. Possibly our listener actually would not like having that six-figure scholar mortgage debt hanging over them. In order that is likely to be one thing they need to prioritize simply because psychologically that will profit them.

Sara: Actually, that is what I did with my scholar loans. I fortunately didn’t have $100,000 in debt, however I did have debt. And yearly earlier than tax time, you get a letter within the mail that tells you ways a lot curiosity you paid over the yr. And I bear in mind I used to be making my minimal month-to-month funds each month. After which I get this letter and it tells me how a lot I paid in curiosity. And that letter made me mad like, “Oh, I simply spent this cash to actually simply have debt.” And I used to be upset. I took a tough take a look at my price range and I used to be like, “How far more can I put towards this each month?” And I put like an additional $40 a month towards the principal for some time. And once I acquired all the way down to the final thousand {dollars}, I paid all of it off.

Sara: If having that quantity hanging over your head annoys you or makes you indignant, that is factor. That is energy. You may put that anger to work.

Sara: Even for those who can put an additional $25 to $50 a month into the principal, it is one thing — it should chip away that debt that a lot sooner. Should you get an annual bonus, for instance, out of your regulation agency — numerous regulation corporations do this — it may very well be that you simply put aside a sure proportion of your annual bonus and put it towards the principal of your mortgage simply to chip away at that sooner. In order that’s one other manner which you could prioritize that debt.

Liz: The rate of interest they’re paying makes me suppose that they’ve in all probability acquired federal scholar loans — it is in all probability graduate PLUS loans. And if that is the case, they’re in all probability going to get pitched to refinance these loans into personal loans, simply to decrease the rate of interest. And I might be actually hesitant about doing that simply because federal loans have a ton of protections — as we all know from the pandemic, pausing the funds for thus lengthy. Should you lose your job, if in case you have any type of financial setback, you have acquired some flexibility there. Whereas personal scholar loans haven’t got that as a lot.

Sean: Yeah. And there is nonetheless a possible alternative, possibly sometime down the street for scholar mortgage forgiveness. We do not actually know whether or not that is going to materialize for most individuals, however it’s a risk.

Liz: In the event that they do occur to be personal scholar loans, then refinancing could be a nice concept as a result of it simply lowers your rate of interest and you are not dropping something, however you do lose one thing very substantial for those who’re attempting to refinance federal scholar loans. And that is comparatively high-rate debt, and I doubt that they are getting any type of tax break on it. Often we are saying don’t fret about your scholar loans, allow them to journey. You’ve acquired extra essential issues to do along with your cash. However on this case, I endorse paying a few of that down.

Sean: That brings me to a different query from our listener, which is what’s the “good” order to do issues in?

Sara: Effectively, that is one million greenback query, is not it?

Sean: Yeah. I believe the reply is that there possibly is not one particular good good order to do issues in.

Liz: Yeah. I believe it is very particular person. With most individuals, you’ve acquired to prioritize retirement as a result of most of us are going to get there. Most of us are going to want the cash and it takes a very long time. That is an costly aim.

Liz: But when this debt is bothering you and also you need to pay it off sooner, that will be the following factor for me.

Sara: Clearly, if one thing’s a high precedence, and this listener talked about retirement and debt, feels like that is on their thoughts. That may very well be place to start out, getting your self arrange so that you’ve got your automated funds into your scholar mortgage. So you realize that that cash’s going out each month on time. If you wish to add to these funds and overpay your mortgage, to some extent, go forward and do this. You additionally automate your retirement financial savings, if it is by means of your employer that comes out of your paycheck routinely once you begin your job, there will be some paperwork to fill out, however get that going. Do not delay. Get that cash into your retirement account, choose your investments and simply let that cash accumulate over time.

Sara: So when you automate all these issues and also you study to reside with out that cash in your checking account each month, that is when you may actually begin fascinated with, “OK, properly, that is what I’ve left. What do I need to do with it?” And that is the place that fifty/30/20 price range is available in.

Sara: And what you need to prioritize can change from yr to yr. You would possibly prioritize residing tremendous cheaply so it can save you up for journey. However then the following yr you completed your journey and you are like, “I hate my residence. I do not need to reside with roommates anymore. Now I need to prioritize discovering an residence that is simply mine that possibly is just a little bit nicer.” That is going to price you more cash. Depart room in your plan for these adjustments, since you’re at a degree in your life the place lots’s going to vary from yr to yr.

Sean: However you type of touched on getting issues set as much as start with. And I believe that is one thing that could be very good to do first, if attainable, as a result of there’s a certain quantity of administrative overhead concerned in establishing your financial savings accounts. As you talked about, getting your retirement financial savings and contributions and investments all organized, and that may take Sunday afternoon put aside to dive into. However then as soon as that is accomplished, you just about have it going within the background and your cash goes the place you need it to.

Sara: Yeah, you revisit it each couple years, however for probably the most half, these issues can run on autopilot for some time.

Sean: Proper. All proper, Sara, do you may have any closing ideas for our listener?

Sara: Effectively, it is similar to we stated, this can be a big change for you. You are going from being a scholar to creating a considerable annual wage, which is superb. And this provides you choices. Do not sleep on how properly you may set your life up with this earnings. It is a actually nice time to take a seat down and make a plan for your self and actually take into consideration the place you need your cash to go, how laborious you need it to give you the results you want. I imply, such as you do work for purchasers as a lawyer, proper? So consider it as if you’re your cash’s shopper and it is acquired to give you the results you want or else you are going to fireplace it. Effectively, you may’t fireplace it, however you realize what I imply? I am attempting to make a metaphor right here, simply go together with it. However actually the individuals I do know who’ve made it to their mid-30s and later who’re financially comfy for the place they’re in life are individuals who did not ignore these things after they have been of their 20s.

They’re the folks that used that point to set basis for themselves. The individuals who simply type of winged it, they have been like, “Eh, I generate profits. I spend cash, no matter. It is all in my checking account. I do not know.” They’re those who’re hitting their mid-30s, they usually’re like, “Why cannot I afford a home? I haven’t got a retirement account. Ought to I’ve a retirement account?” Yeah, yeah. You need to. As a result of yeah, we’re millennials. We’re not going to have any social security internet, proper? We do want to save lots of for this stuff. That is the recommendation I might give to you as anyone who’s been out of faculty lengthy sufficient and who has pals in the identical boat to see all of the completely different, choose-your-own-adventure paths individuals have taken, I might say, use this time properly. You may nonetheless have enjoyable. You may nonetheless do all of the stuff you need to do.

Sara: However you would do it as a result of you realize, you are additionally doing the issues you must do.

Liz: That is a wonderful level, Sara.

Sean: Effectively, thanks a lot for speaking with us.

Sara: Thanks for having me again, guys.

Sean: Effectively, with that, let’s get onto our takeaway ideas and I can begin us off. First up, know what you are working with. While you face an enormous change to your private funds, take the time to reassess your price range and your monetary objectives.

Liz: Subsequent, multitask. Should you’re making a hefty wage, work to max out your retirement contributions whereas paying off your scholar loans.

Sean: However preserve your life-style in examine. With more cash within the financial institution, it’s possible you’ll be tempted to spend it. Give your {dollars} a job so you may preserve life-style creep at bay.

And that’s all we’ve for this episode. Do you may have a cash query of your personal? Flip to the Nerds and name or textual content us on the Nerd hotline at 901-730-6373, that is 901-730-NERD. You can even e mail us at [email protected] and go to nerdwallet.com/podcast for more information on this episode. And be sure you subscribe, fee and evaluation us wherever you are getting this podcast.

Liz: And here is our transient disclaimer, thoughtfully crafted by BaghdadTime’s authorized workforce. Your questions are answered by educated and proficient finance writers, however we aren’t monetary or funding advisors. This Nerdy data is supplied for common instructional and leisure functions, and will not apply to your particular circumstances.

Sean: And with that stated, till subsequent time, flip to the Nerds.