Bilt Rewards: What You Need to Know

Housing prices are one of many greatest bills for many households. However, whether or not you are paying hire or a mortgage, it may be troublesome or expensive to earn bank card rewards for making these funds. With its revolutionary new bank card, Bilt Rewards seeks to alter all that for renters.

On this article, you will be taught what Bilt Rewards is, learn how to earn and redeem factors on this distinctive rewards program, and learn how to pay your hire with the Bilt Rewards bank card.

Bilt Rewards is the primary loyalty program that permits you to earn factors when paying your hire with no charges. By means of the Bilt Rewards alliance, tenants can earn rewards at greater than two million rental houses throughout the nation. Moreover, you may earn further factors in your each day purchases with the Bilt Rewards bank card.

Factors earned by means of this condo rewards program can be utilized to cowl your hire, contribute to a down cost on a house, switch to airline and resort loyalty packages and extra.

Elite standing tiers with Bilt Rewards

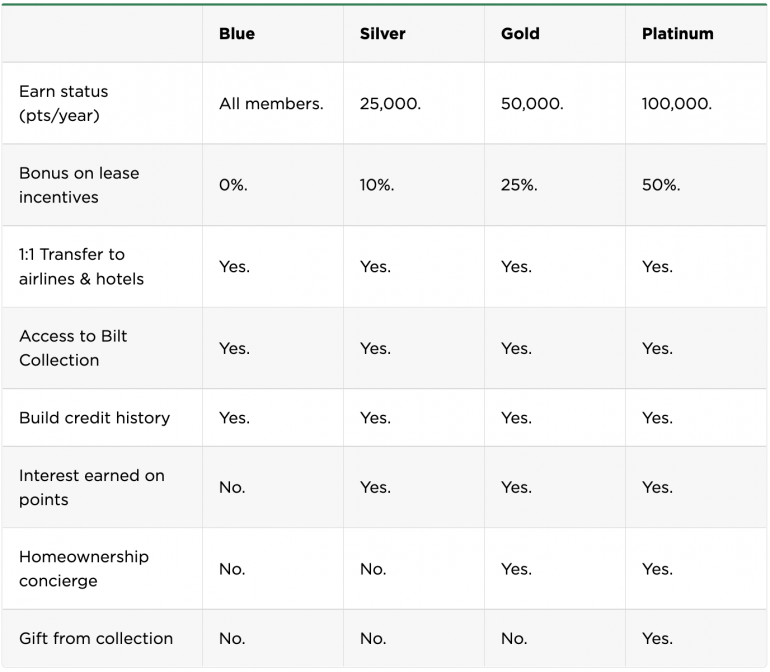

As you earn extra factors all year long, your elite standing stage will increase, providing you with entry to much more options and advantages.

There are 4 elite standing tiers with Bilt Rewards: Blue, Silver, Gold and Platinum.

Moreover, your hire funds are reported to the credit score bureaus to construct your credit score. This can be a helpful perk since most landlords solely report damaging data, similar to collections or a judgment for unpaid hire or injury to the rental.

|

Bonus on lease incentives |

||||

|

1:1 Switch to airways & lodges |

||||

|

Entry to Bilt Assortment |

||||

|

Curiosity earned on factors |

||||

One of the important advantages of shifting up tiers within the condo rewards program is the bigger bonus on lease incentives. For members with bigger balances, incomes curiosity in your factors can be a pleasant perk when you attain Silver standing.

A quirk of the Bilt Rewards loyalty program is that the expiration of your advantages is dependent upon once you earn elite standing by means of the 12 months. For instance, an elite standing earned from Jan. 1 by means of June 30 expires on Jan. 31 of the next 12 months, whereas elite standing ranges attained from July 1 to Dec. 31 are good by means of Dec. 31 of the next 12 months.

Earn Bilt Rewards factors by paying hire

Tenants can earn and redeem factors by means of this condo rewards program in a number of methods. These are the commonest strategies.

All of it begins with incomes Bilt Rewards factors by paying your hire. When you dwell in a collaborating group, you may earn factors simply by paying your hire within the Bilt Rewards app, even when you do not have the Bilt bank card.

People dwelling within the Bilt Rewards alliance residences earn a flat 250 factors per thirty days only for paying hire. You may additionally have the ability to earn bonus factors for chosen actions, like signing a brand new lease or renewing your present lease.

Over 2 million rental items throughout the U.S. take part within the Bilt Rewards alliance. A number of the collaborating actual property corporations embody:

-

Trammel Crow Residential.

For renters who do not dwell in a Bilt Rewards alliance property, you may nonetheless earn factors by paying your hire with the Bilt Mastercard.

With the Bilt Mastercard, you may pay your month-to-month hire with out charges whereas incomes helpful rewards wherever Mastercard is accepted. The Bilt Rewards bank card for tenants can be appropriate for individuals who do not hire as a result of it earns factors on all each day purchases with some enticing bonus classes:

-

2x factors on journey (direct bookings with airways, lodges, automobile leases and cruises).

-

1x level on hire with no charges (as much as $50,000 per 12 months).

-

1x level on all different purchases.

For a restricted time, all new cardholders obtain 2x factors on all purchases for the primary 30 days.

Even when your landlord is not a part of the Bilt Rewards alliance, you may nonetheless pay your hire and earn factors when you will have the Bilt Rewards bank card. Bilt will mail a examine to your landlord once you provoke a cost by means of its app. Now you can additionally pay hire with the Bilt Lease account, which helps you to pay landlords in present portals by automated clearing home or ACH. Bilt will provide you with a routing quantity and account quantity to pay hire and you will nonetheless earn factors.

Merely make a minimum of 5 purchases in your card every assertion interval to earn factors. And there’s no annual charge, so that you needn’t earn sufficient rewards to offset its price.

The cardboard additionally contains different helpful advantages, which make it interesting even for those who needn’t make hire funds:

-

Journey cancellation insurance coverage.

-

Cellular phone insurance coverage (as much as $800 per declare).

-

Buy safety towards injury or theft (as much as $1,000 inside 90 days).

-

As much as $120 DoorDash credit ($5 low cost on every of your first two orders every month).

-

As much as $60 value of Lyft credit per 12 months (once you take three rides per thirty days).

-

No international transaction charges.

Redeeming Bilt rewards factors

You will have three choices for redeeming Bilt rewards factors — you may switch them to journey companions, use them for rent-related bills, take health courses or buy artwork.

Switch factors to airline and resort companions

This redemption choice is what makes this system shine for vacationers.

As a Bilt Rewards member, you may switch your factors on a 1:1 foundation to quite a few airline and resort loyalty packages. As well as, there are not any charges when transferring your factors.

Collaborating Bilt Rewards resort and airline switch companions embody:

Pay hire together with your factors or save up for a down cost

Factors could be redeemed in direction of paying your month-to-month hire. Moreover, it can save you up your factors and use them in direction of a down cost by yourself dwelling.

When paying your hire with factors, the worth of your factors is dependent upon your landlord, as every property units its charges. The Bilt Rewards app exhibits you ways a lot your factors are value earlier than redeeming factors to your hire.

For members who’re saving up for a down cost, your factors are value as much as 1.5 cents every.

Take health courses

Bilt has partnered with among the nation’s prime group health courses, together with Soul Cycle, Rumble, Y7, and Solidcore. Lessons begin at simply 1,600 factors per class.

Purchase artwork and extra through the Bilt Assortment

Bilt curated a set of artwork, decor, and attire impressed by a special artist every quarter.

Why the Bilt Rewards bank card could possibly be a sensible choice for vacationers

As a traveler, the Bilt Rewards card provides quite a few perks that make it worthwhile to e-book your reservations. You will earn 2x factors on all journey booked instantly with the airline, resort, automobile rental or cruise firm.

Plus, the cardboard earns 3x factors on eating, whether or not you are at dwelling or on trip. Factors can switch to a number of airways and lodges on a 1:1 foundation, saving you money for different bills.

Cardholders additionally obtain extra advantages. For instance, there are not any international transaction charges when making worldwide purchases. You are protected in case of a visit delay or cancellation. Your rental automobile is protected towards injury or theft.

To not point out the 1:1 switch choices with 9 fashionable journey manufacturers that span airways and lodges. You may simply flip factors earned by paying hire into your subsequent award reserving.

The Bilt Rewards bank card permits tenants to earn rewards and construct credit score when paying their hire. It additionally earns as much as 3x factors on journey and eating and offers different advantages that shield journey, rental vehicles and cell telephones. As well as, there isn’t any annual charge for the cardboard.

When you’re not prepared for a brand new bank card, tenants at collaborating properties can earn factors for paying their hire every month. The factors you earn can be utilized to pay for hire, go in direction of a down cost, e-book journey, and extra.

The right way to maximize your rewards

You desire a journey bank card that prioritizes what’s vital to you. Listed below are our picks for the finest journey bank cards of 2022, together with these finest for: