Are Unused Travel Card Benefits a Bad Thing?

I had to purchase a T-shirt I didn’t need by midnight. The Platinum Card® from American Categorical in my pockets carried a $50 credit score at Saks Fifth Avenue each six months, so there I used to be, wading via designer clothes I didn’t need and sorting by value, “lowest to highest” so as to make the most of my credit score earlier than it expired. Enrollment required. Phrases apply.

Welcome to the bizarre new world of “journey” card advantages.

The pandemic modified the journey business in some ways. Airways now provide extra versatile tickets. Masks are necessary for the indefinite future. And so-called journey playing cards shifted to providing advantages for homebodies, from meals supply perks credit to Saks credit.

Getting extra advantages appears like factor on the floor, however it creates an issue that I encountered whereas feverishly purchasing for stuff I didn’t need or want. In brief: journey card profit concern of lacking out.

How you can consider unused journey card advantages

Do the mathematics

The logic of getting a journey card (or any card that carries advantages) is straightforward. If the overall worth you get from the cardboard exceeds the annual payment, then it’s price having. For instance, if a card gives $200 in journey credit per yr and the annual payment is $100, then that card is in all probability price getting for those who normally spend at the very least $200 on journey yearly.

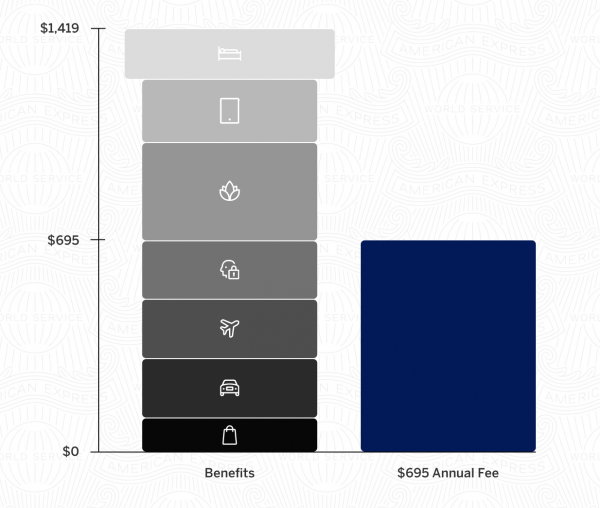

In reality, The Platinum Card® from American Categorical even makes this math express, displaying a comparability between the worth of the advantages the cardboard gives and its $695 annual payment on its product web page. Phrases apply.

On this occasion, American Categorical is successfully doing the mathematics for you, displaying that the cardboard’s excessive annual payment may be greater than offset with its many advantages.

American Categorical isn’t providing free cash (or it wouldn’t keep in enterprise very lengthy). Slightly, it’s providing a problem: If you need to use some or all of those advantages, you may get extra out than you set in.

But there’s a chunk of this math drawback that doesn’t break all the way down to pure {dollars} and cents. It’s what we imply by “worth.”

Don’t confuse {dollars} for worth

Warren Buffett mentioned in a 2008 letter to traders, “Value is what you pay; worth is what you get.”

That’s, simply because one thing prices a specific amount doesn’t imply it’s price that a lot.

Take the T-shirt I ordered from Saks. I paid about $50 for it, which is the value. However is that the worth I obtained? That is the place issues take a flip towards the squishy and subjective. For me, the shirt in all probability carries far much less worth than $50 as a result of I’m not any individual who cares a lot about fancy garments. A T-shirt is just about a T-shirt so far as I’m involved (and my 6-month-old vomits on my clothes each day, which considerably reduces its worth).

The identical logic applies to different seemingly helpful card advantages. The Chase Sapphire Reserve® gives a complimentary DoorDash DashPass subscription, which knocks down charges on meals supply. However this profit carries extra worth the extra you order takeout, making a twisted incentive for those who’re making an attempt to cook dinner at house extra.

That’s, you solely get worth from this profit for those who use it lots. However utilizing it lots may not align together with your different priorities (like spending much less on takeout).

Focus in your present spending

The Platinum Card® from American Categorical carries a $300 annual credit score for an Equinox fitness center membership and a $20 month-to-month credit score for a couple of explicit digital streaming companies. Phrases apply.

That’s nice if you have already got an Equinox membership or are subscribed to the eligible streaming companies. However not a lot for those who aren’t. Equinox memberships run about $300 per 30 days, in order that $300 annual offset is a comparatively modest low cost.

And right here’s the core of the card-benefit FOMO conundrum: It would really feel like failing to make use of the Equinox credit score leaves cash on the desk. In spite of everything, $300 appears like some huge cash. However simply the alternative is true — signing up for each service related together with your card and making an attempt to get probably the most out of them may not solely be a headache however financially unwise.

As a rule of thumb, it’s best to get (or hold) the journey card that aligns together with your present spending slightly than aligning your spending to the advantages provided by a card.

That doesn’t imply you shouldn’t order a “free” T-shirt with a card profit. Nevertheless it does imply you shouldn’t turn into a frequent Saks shopper simply because your card gives a $100 annual credit score.

The takeaway

Again within the Earlier than Occasions, choosing and utilizing a journey bank card was a comparatively easy proposition. Not a lot within the COVID period. For one factor, many of those playing cards provide advantages that don’t have anything in any respect to do with journey.

Don’t get swept up in benefit-maximization mania. Sure, it’s good to make the most of as lots of your card’s perks as attainable, however that doesn’t imply it’s best to bend your priorities round no matter oddball advantages a card decides to incorporate.

Which jogs my memory, it’s a brand new yr, which implies it’s time to order a brand new shirt from Saks for my child to throw up on.

How you can maximize your rewards

You need a journey bank card that prioritizes what’s vital to you. Listed here are our picks for the greatest journey bank cards of 2022, together with these greatest for: