6 Common Travel Rewards Pitfalls

Utilizing factors and miles can drastically enhance your holidays, with discounted resort rooms and high-end flights. Nevertheless it’s not all champagne in crystal glasses.

Regardless of how savvy you might be, it’s all the time potential to make errors with journey rewards. Let’s check out a number of the commonest journey rewards pitfalls and find out how to keep away from them.

Journey reward errors

The idea of rewards factors is straightforward in idea: You earn factors when flying on a sure airline, staying at a sure resort or utilizing a journey rewards bank card. You then redeem your factors for rewards, akin to award flights and resort stays.

For probably the most half it’s simple, however there’s a lot extra to uncover with a view to benefit from your factors, and making errors might be straightforward for the unwary buyer.

1. Poor worth redemptions

Whether or not you’re incomes airline miles or bank card factors, you all the time have the flexibility to redeem rewards in varied methods. Frequent redemptions embrace resort stays and flights, however it’s additionally potential to make use of your factors for issues like merchandise and present playing cards.

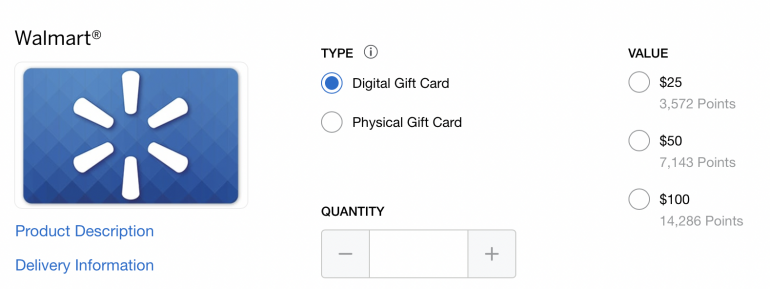

The worth you’ll obtain when redeeming your factors for merchandise or present playing cards is sort of all the time going to be decrease than when redeeming your factors for journey. For instance, it’ll value you 14,286 American Specific Membership Rewards for a $100 present card to Walmart.

2. By no means redeeming your factors

Whereas it’s not a good suggestion to redeem your factors at a poor worth, it’s additionally not a good suggestion to hoard your factors both.

Why? As a result of there’s all the time a devaluation across the nook. It may be thrilling to look at your factors steadiness develop, however conserving a big stash in your pocket is usually a dropping proposition.

It doesn’t matter should you’re ready for a hard-to-find award seat otherwise you’re merely loath to spend your factors. Holding onto factors for lengthy durations of time runs the chance of their turning into much less invaluable resulting from devaluations.

Fact be instructed, probably the most invaluable redemption is the one you’ll truly make. This may increasingly imply selecting to fly in a much less glamorous premium class than you could possibly with one other airline, but when the flight is sensible on your journey plans, redeeming your factors is a greater possibility than seeing them devalue.

3. Dropping your factors

There’s nothing worse than going by way of all the hassle to earn factors after which realizing they’ve expired. This may occur with every kind of factors, although there are normally methods to keep away from it.

Normal bank card factors, for instance, sometimes don’t expire so long as you proceed to carry the cardboard in good standing, however you will have to forfeit factors should you shut your account.

Airways akin to Delta Air Traces and JetBlue Airways have formally declared that your factors won’t ever expire so long as you retain your account with them open. The identical can’t be mentioned of American Airways AAdvantage miles, which expire after 18 months with out exercise. Factors from most resort chains may even expire with none qualifying exercise in a sure interval.

Whereas it might be potential to reactivate your misplaced factors, conserving observe of expiration dates is vital to conserving them alive within the first place. It’s not arduous to generate exercise for many accounts; this may be so simple as utilizing a co-branded bank card, finishing a visitor reward survey or transferring factors.

4. Lacking free advantages

Study Extra

Do you know that there are three main resort chains that offers you free nights in your award stays? Hilton and Marriott provide the fifth consecutive night time free when redeeming with factors. IHG, in the meantime, provides those that maintain the IHG® Rewards Premier Credit score Card their fourth night time free.

This implies, for instance, you’ll pay the identical quantity of factors whether or not you’re staying 4 or 5 nights at a Hilton resort — however it’s fully potential to overlook this sort of profit when searching for a room.

5. Not managing your loyalty

You might not be loyal to 1 resort or airline, however maybe you have to be. The journey business closely rewards its repeat prospects and you could possibly be lacking out on huge advantages.

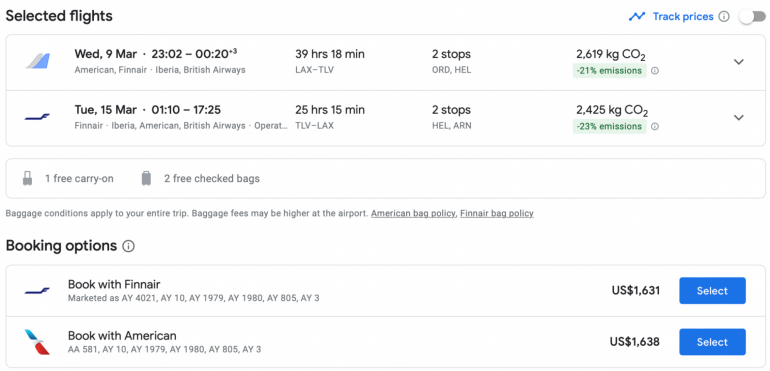

Think about Alaska Airways MileagePlus elite standing, which rewards you with further bonus miles primarily based in your standing degree. Right here’s a enterprise class flight from Los Angeles to Tel Aviv-TLV for $1,638 by way of American Airways in March.

By means of the American Airways and Alaska Airways partnership, Alaska members can earn miles on an American flight primarily based on the gap flown, plus multipliers primarily based in your fare class and elite standing.

This ticket is an I fare class (this implies you’re reserving discounted enterprise class), so that you’re going to earn 150% of miles flown. With out elite standing, you’ll be pocketing 23,946 Alaska miles for this flight.

Now let’s say you could have MVP Gold elite standing, which is Alaska’s middle-tier standing. MVP Gold grants you an additional 100% bonus on incomes miles.

Having MVP Gold standing implies that you’d as a substitute earn 39,910 Alaska Airways miles on this similar flight. That’s a distinction of 15,964 miles!

6. Being rigid — significantly with dates

One of many downsides of award journey is the necessity to discover award availability. It may be troublesome to take action, particularly should you’re taking a look at common flights or dates. Nevertheless, it pays to be versatile together with your search relatively than springing for premium bookings.

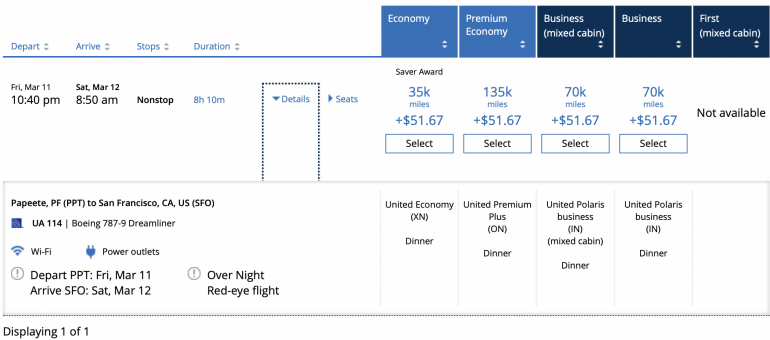

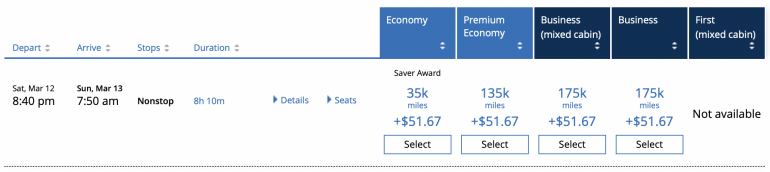

Right here’s a flight on United Airways from Tahiti to San Francisco in March in enterprise class.

At 70,000 miles, that is an costly award flight. However, it’s nonetheless a reasonably good redemption contemplating that is the price for that very same route a day later.

As you may see, it’s greater than double the worth to guide this ticket. Being versatile together with your dates might help you save huge.

If you wish to use your journey rewards

There’s little doubt that journey rewards can amp up your trip. On the similar time, what seems to be a easy idea in idea can have loads of pitfalls should you’re not cautious. Keep away from these six errors to ensure you maximize your journey financial savings and advantages.

The way to maximize your rewards

You need a journey bank card that prioritizes what’s necessary to you. Listed here are our picks for the finest journey bank cards of 2022, together with these finest for: