690 Credit Score: Is It Good or Bad?

A 690 credit score rating is taken into account a superb rating on the commonest credit score rating vary, which runs from 300 to 850.

How does your rating examine with others?

-

You’re throughout the “good” rating vary (690 to 719), however simply barely — any drop may land you within the “honest” class.

-

As of the second quarter of 2021, the common FICO 8 credit score rating was 716. The typical VantageScore 3.0 was 695 as of the identical interval. So in case you have a 690 credit score rating you’re barely under these common scores however are nonetheless in the identical “good” vary.

What a 690 credit score rating can get you

Lenders use credit score scores to assist decide your eligibility for monetary merchandise like loans and bank cards. Lenders additionally use your credit score rating when figuring out rates of interest and issues like whether or not you pay deposits for utilities.

When you’re barely within the “good” credit score vary with a 690 rating, you’re prone to be eligible for cheaper charges on monetary merchandise like loans and bank cards than folks with decrease scores. The upper your rating, the extra merchandise you may qualify for.

Nevertheless, it’s vital to notice that your credit score rating could also be solely one of many components lenders take into account, alongside issues like your debt-to-income ratio.

Automobile loans

On the subject of automotive shopping for, the upper your credit score rating, the decrease your rate of interest. In 2021, patrons with a 690 credit score rating acquired an common rate of interest of three.64% for a brand new automotive and 5.35% for a used automotive, based on knowledge from Experian’s State of the Automotive Finance Market report for the third quarter of 2021.

These with larger credit score scores — above 780 — are the probably to land rates of interest underneath 3%.

Dwelling loans

Credit score scores are an important piece of your house mortgage software. Your credit score rating may even decide whether or not or not you get permitted for a mortgage in any respect. A 690 credit score rating places you in a superb place to qualify for a traditional mortgage, however lenders take into account many different components.

Your credit score rating additionally influences your mortgage fee. The bottom charges sometimes go to debtors who’ve a credit score rating of 740 or larger. With a 690 rating, you’ll probably have the next rate of interest than debtors within the “wonderful” (720 to 850) class. Different components exterior of your management — issues like inflation, job development and the state of the general financial system — additionally influence mortgage charges.

Bank cards

Earlier than making use of for a bank card, analysis its credit score rating necessities earlier than continuing. Making use of for a bank card can briefly ding your rating, so that you wish to make certain it’s the correct card for you and that you just’ll probably be permitted by assembly the standards.

Private loans

Similar to with bank cards, do your analysis earlier than making use of for a private mortgage and discover out any minimal credit score rating necessities. Greater credit score scores are likely to result in decrease rates of interest, however you’ll probably have loads of choices for private loans with a 690 rating.

Methods to maintain constructing your 690 credit score rating

Whereas a 690 credit score rating lands you within the “good” vary, there may be room to construct your credit score and obtain an “wonderful” ranking of 720 or larger. Collectors set their requirements, so there may be some variance in what constitutes “wonderful.” Nevertheless, just a few manageable suggestions and methods may also help you polish your rating, resulting in decrease charges and extra alternatives down the highway.

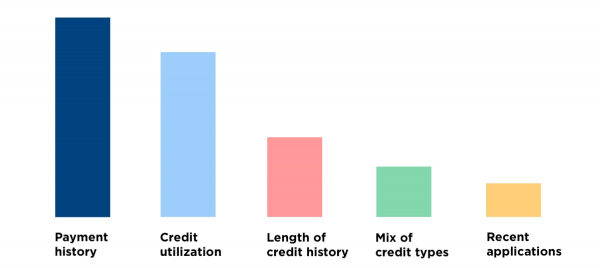

Your credit score rating is a mixture of:

-

Cost historical past: a document of your bill-paying historical past, with on-time funds providing you with an enormous increase. Being late in your funds can hurt your rating, so take into account establishing autopay if deadlines aren’t your factor.

-

Credit score utilization: the portion of your credit score limits you’re utilizing. Conserving your utilization underneath 30% is an effective guideline, though 10% or much less is even higher. Making smaller funds all through the month may also help maintain your utilization low.

-

Size of credit score historical past: Conserving your oldest account open is sensible, as potential lenders have a look at the size of your credit score historical past (the “older” your accounts, the higher). So even for those who don’t use the bank card you bought if you had been 18, assume twice about closing the account. It is perhaps higher to maintain within the rotation for small purchases you’ll be able to repay straight away to maintain it lively.

-

The combo of credit score sorts: The very best state of affairs is having a mixture of credit score accounts reasonably than just one sort of credit score. For instance, such a mixture may embody installment accounts which have set funds like a automotive mortgage or mortgage fee, in addition to bank cards.

-

Current purposes: Each time you apply for a line of credit score or a mortgage it briefly dings your credit score rating. Wait about six months between purposes in order that they don’t drop your rating unnecessarily.

There are another issues you are able to do to construct your credit score rating, together with asking for the next credit score restrict (which can drop that credit score utilization ratio for those who maintain spending the identical); changing into a certified consumer on the cardboard of somebody with stellar credit score; and ensure to commonly overview your credit score report and dispute any errors which can be bringing your rating down.

What occurs to a 690 rating with a late fee?

Making a fee just a few days late received’t sink your credit score rating, but it surely may value you cash on late charges or doubtlessly a raised rate of interest out of your lender.

Nevertheless, a missed fee or fee made later than 30 days can actually do some injury to your credit score rating. A missed fee may drop a superb credit score rating as a lot as 100 factors. That sort of misstep can immediately take somebody with a 690 rating from the “good” vary into “unhealthy” territory.

Get rating change notifications

See your free rating anytime, get notified when it modifications, and construct it with customized insights.