Best CD Rates of 2022

A certificates of deposit — CD for brief — is a low-risk financial savings account that holds a hard and fast amount of cash for a sure time, akin to six months, one 12 months or 5 years.

Throughout that point, your deposit earns a hard and fast rate of interest. Normally, the longer the time period, the upper the rate of interest.

When the CD time period is up, you obtain your preliminary deposit again plus the curiosity earned.

In contrast to a financial savings account, CDs usually don’t allow you to withdraw cash everytime you need. CD accounts require you to go away funds untouched for a hard and fast interval or else face an early withdrawal penalty.

These penalties normally vary from three months of curiosity to 1 12 months value of curiosity, relying on the time period size.

You should buy a certificates of deposit from a financial institution or credit score union. Financial institution CD accounts are insured by the Federal Deposit Insurance coverage Company (FDIC) as much as $250,000 — similar to financial savings accounts and cash market accounts.

Credit score unions problem share certificates, that are the credit score union equal of CDs. These are additionally insured for as much as $250,000, however by the Nationwide Credit score Union Administration (NCUA) as an alternative of the FDIC.

CD vs. Financial savings Account: Which Is Higher?

If you happen to’re debating between a certificates of deposit or a financial savings account, ask your self this query: Do you care extra about rates of interest or entry to your cash?

A CD account normally earns a better annual share yield (APY) than what you normally discover in a high-yield financial savings account — however your cash is more durable to entry.

If you happen to want simpler entry to your funds, a financial savings account is a greater possibility.

However a standard financial savings account doesn’t earn a lot curiosity. In reality, the nationwide APY for financial savings accounts is simply 0.07%.

So in case you’re saving for a short-term objective and need to earn as a lot curiosity as attainable, a certificates of deposit is probably going a better option than a financial savings account.

Opening a CD is sensible when you find yourself freed from bank card debt and have already got an emergency fund constructed up in your financial savings account.

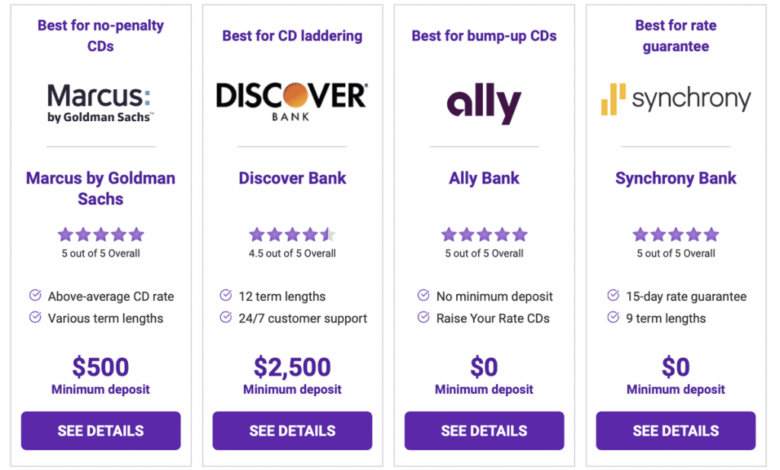

Finest CD Charges In contrast

| Financial institution | Finest for | APY | Minimal Opening Deposit | Time period Size | |

|---|---|---|---|---|---|

| Marcus by Goldman Sachs | No-penalty CDs | 0.50% – 2.55% | $500 | 6 months to six years | SEE DETAILS |

| Uncover Financial institution | CD laddering | 0.30% – 2.50% | $2,500 | 3 months to 10 years | SEE DETAILS |

| Ally Financial institution | Bump fee CDs | 0.30% – 2% | $0 | 3 months to five years | SEE DETAILS |

| Synchrony Financial institution | Price assure | 0.50% – 2.60% | $0 | 3 months to five years | SEE DETAILS |

| Capital One | No minimal steadiness requirement | 0.60% – 2.25% | $0 | 6 months to five years | SEE DETAILS |

| PenFed Credit score Union | 5-year and 7-year CDs | 0.65% – 3% | $1,000 | 6 months to 7 years | SEE DETAILS |

| Bread Financial savings | Excessive APYs | 1.75% – 2.55% | $1,500 | 1 12 months to five years | SEE DETAILS |

| Quontic Financial institution | 6-month CDs | 0.95% – 2.3% | $500 | 6 months to five years | SEE DETAILS |

Marcus by Goldman Sachs

Finest for no-penalty CDs

Key Options

- Above-average CD charges

- $500 minimal deposit

- Varied time period lengths

Marcus by Goldman Sachs persistently presents a number of the finest CD charges in the marketplace. It’s one of many few on-line banks that gives a no-penalty CD possibility, together with seven-month, 11-month and 13-month CD accounts. Time period lengths for high-yield CDs vary from six months to 6 years. Marcus by Goldman Sachs additionally presents a 10-day fee assure on CDs.

Marcus by Goldman Sachs

Annual Share Yield (APY)

0.50%-2.55%

Time period Size

6 months to six years

Minimal Deposit

$500

Further Particulars

Marcus by Goldman Sachs presents aggressive CD rates of interest with phrases starting from six months to 6 years.

CD charges vary from 0.50% to 2.55% APY. The $500 minimal deposit requirement is decrease than another banks and credit score unions.

The corporate presents two forms of certificates of deposit: a high-yield CD and a no-penalty CD. Time period lengths for no-penalty CDs vary from seven months to 13 months with 0.35% to 0.75% APY.

In contrast to conventional CDs, no-penalty CDs allow you to withdraw cash at any time with out paying a payment or dropping curiosity.

Early withdrawal penalties from a normal high-yield CD are as follows: Lack of three months value of curiosity on CDs with a maturity date of lower than a 12 months, 9 months of curiosity for CD phrases of 1 to 5 years and a 12 months’s value of curiosity for six-year CDs.

Marcus by Goldman Sachs can be well-known for its high-yield financial savings accounts, which persistently supply above-average rates of interest.

Uncover Financial institution

Finest for CD laddering

Key Options

- 12 completely different time period lengths

- Aggressive CD charges

- IRA CD

Uncover Financial institution presents 12 completely different CD time period lengths — greater than a lot of its opponents. This number of maturity dates provides prospects a number of choices for CD laddering. Financial institution CD phrases vary from three months to 10 years. The minimal deposit of $2,500 is considerably excessive however Uncover Financial institution CD charges are aggressive.

Uncover Financial institution

Annual Share Yield (APY)

0.30%-2.50%

Time period Size

3 months to 10 years

Minimal Deposit

$2,500

Further Particulars

Uncover, finest often known as a bank card firm, boasts a powerful number of monetary merchandise — together with CDs.

Uncover Financial institution CDs can be found in 12 time period lengths, from three months to 10 years and with APYs starting from 0.30% to 2.50%.

Quite a few CD phrases makes it straightforward for shoppers to discover CD laddering choices. A CD ladder includes opening a number of CDs with staggered maturity dates. Doing so permits you to earn curiosity whereas offering simpler entry to your cash.

One other perk: Uncover presents CDs for particular person retirement accounts (IRA CDs).

We’re not in love with Uncover’s $2,500 minimal deposit requirement, which is greater than different on-line banks and credit score unions on this listing.

The early withdrawal penalty for Uncover CDs ranges from three months of curiosity for time period lengths of 1 12 months or much less all the best way as much as two years of curiosity for CD phrases of seven to 10 years.

Like all CDs on this listing, there are not any month-to-month charges or opening charges.

Apart from CDs and bank cards, Uncover additionally presents a web based financial savings account and checking account.

Ally Financial institution

Finest for bump fee CDs

Key Options

- No minimal deposit necessities

- Curiosity compounds each day

- 24/7 customer support

With no minimal deposit necessities, Ally Financial institution CDs are an awesome possibility for brand new traders. You may also open a CD account within the identify of a belief. Along with a number of no-penalty CDs and high-yield CDs, Ally presents Increase Your Price CDs, which provide the choice to bump up your CD rate of interest if the APY will increase in the course of the time period with out having to attend for the maturity date.

Ally Financial institution

Annual Share Yield (APY)

0.30%-2%

Time period Size

3 months to five years

Minimal Deposit

$0

Further Particulars

Ally Financial institution, a preferred on-line monetary establishment, presents all kinds of on-line CD varieties and time period lengths. Like a lot of their monetary providers, there’s no minimal deposit requirement to open a financial institution CD.

Along with its commonplace high-yield CDs, Ally presents two bump-up CDs, or what the corporate calls Increase Your Price CDs.

The APY is a bit of decrease, however you may request one to 2 fee will increase if Ally raises the speed for brand new CDs with the identical time period and steadiness tier as your CD.

That could possibly be interesting because the Federal Reserve will increase rates of interest all through 2022.

Ally additionally presents a no-penalty CD with an 11-month time period and a 0.70% annual share yield. You may withdraw your full steadiness and curiosity any time starting six days after you fund your account.

Ally is a full-service financial institution that boasts many monetary merchandise together with a web based financial savings account, checking account, funding account and extra.

Synchrony Financial institution

Finest for fee assure

Key Options

- 15-day fee assure

- 9 time period lengths

- No minimal deposit requirement

Synchrony Financial institution’s 9 on-line CD time period choices coupled with a $0 minimal deposit make it preferrred for short-term CD laddering. Along with aggressive CD rates of interest, Synchrony Financial institution presents a 15-day fee assure — extra beneficiant than the 10-day assure provided by most banks and credit score unions. Throughout this time, you may declare the best rate of interest if the revealed fee will increase.

Synchrony Financial institution

Annual Share Yield (APY)

0.50%-2.6%

Time period Size

3 months to five years

Minimal Deposit

$0

Further Particulars

Synchrony Financial institution is a monetary establishment with 9 completely different on-line CD time period lengths starting from three months to 5 years. It presents aggressive charges on certificates of deposit, from 0.50% to 2.6% APY.

There isn’t a minimal deposit requirement, and the corporate additionally presents IRA CDs.

One other perk: You get the choice of withdrawing the curiosity earned earlier than the CD’s maturity date with out penalty.

Synchrony Financial institution presents a 15-day fee assure on any certificates of deposit, which is longer than the usual 10-day assure provided by most banks and credit score unions.

Throughout this time, you may declare the best out there fastened rate of interest if the revealed fee will increase.

Early withdrawal penalties are as follows: Lack of three months of curiosity for financial institution CD time period lengths of 1 12 months or much less, six months of curiosity for CDs with one- to four-year phrases, and one 12 months value of curiosity for five-year CDs.

Synchrony presents different helpful instruments for savers, together with a cash market account and a high-yield financial savings account. Nevertheless, it doesn’t supply a checking account.

Capital One

Finest for no minimal steadiness requirement

Key Options

- Simple to open

- No minimal deposit

- Aggressive charges

Capital One is one other bank card firm that gives CDs. There’s no minimal deposit and varied time period lengths can be found. You may resolve when your financial institution CD account curiosity is paid out — both on the finish of the time period, month-to-month or yearly. If you happen to withdraw cash early, you’ll pay between three months to 6 months value of curiosity, which is lower than another banks.

Capital One

Annual Share Yield (APY)

0.60%-2.25%

Time period Size

6 months to five years

Minimal Deposit

$0

Further Particulars

Capital One’s $0 minimal deposit requirement and aggressive charges on on-line CDs makes the corporate a lovely possibility, particularly for purchasers who already financial institution with Capital One.

The corporate presents 9 financial institution CD time period lengths, from three months to 5 years. APYs vary from 0.60% to 2.25%.

Early withdrawal penalties are decrease than another on-line banks and credit score unions: Three months of curiosity for phrases of 1 12 months or much less and 6 months value of curiosity for longer phrases.

Apart from CDs and bank cards, Capital One presents checking accounts and financial savings accounts.

PenFed Credit score Union

Finest for longer-term CDs

Key Options

- Excessive APYs for 5-year phrases

- Aggressive charges

- Schooling Financial savings Certificates

Pentagon Federal Credit score Union presents cash market certificates — the credit score union equal of CDs — with excessive APYs. Its charges for 5-year and 7-year certificates are a number of the highest in the marketplace, although early withdrawal penalties could be steep. The credit score union additionally presents Schooling Financial savings Certificates. Like most credit score unions, you could grow to be a member of PenFed earlier than you should buy a CD.

PenFed Credit score Union

Annual Share Yield (APY)

1.5%-3%

Time period Size

6 months to 7 years

Minimal Deposit

$1,000

Further Particulars

Pentagon Federal Credit score Union — PenFed for brief — as soon as completely served folks affiliated with the army. In 2019, the credit score union opened its providers as much as most people.

PenFed’s cash market certificates — the credit score union equal of CDs — have phrases starting from six months to seven years with annual share yields from 0.65% to three%.

The credit score union actually stands out for its 3% APY on a seven-year CD — the best fee of any financial institution or credit score union on this listing.

PenFed’s $1,000 minimal deposit requirement is fairly commonplace for cash market certificates with excessive APYs.

Simply to be clear on some credit score union jargon: a cash market certificates isn’t the identical as a cash market account. Yields earned on credit score union accounts are referred to as dividends as an alternative of curiosity.

Early withdrawal penalties could be steep. The early withdrawal penalty for its 6-month and 3-year certificates equals 90 days of dividends earned.

For all different certificates time period dates, the early withdrawal penalty means dropping one 12 months of dividends or 30% of complete dividends that will have been earned if the certificates reached its maturity date.

Apart from CDs, Pentagon Federal Credit score Union presents a checking account that earns dividends in addition to high-yield financial savings accounts.

Bread Financial savings

Finest for prime APYs

Key Options

- Above common APYs

- Restricted time period size choices

- Curiosity accrued and compounded each day

Bread Financial savings is a web based financial institution previously often known as Comenity Direct. It presents 5 completely different CDs with time period lengths starting from one to 5 years. It fetches above common APYs however lacks shorter-term on-line CD choices. CDs are provided by means of Comenity Capital Financial institution, which began utilizing the Bread Financial savings identify in April 2022.

Bread Financial savings

Annual Share Yield (APY)

1.75%-2.55%

Time period Size

1 12 months to five years

Minimal Deposit

$1,500

Further Particulars

Bread Financial savings presents aggressive on-line CD charges starting from 1.75% to 2.55% APY and phrases from one to 5 years.

It presents fewer time period lengths than a lot of its opponents and its $1,500 minimal opening deposit is greater than most banks or credit score unions on this listing.

Early withdrawal penalties are as follows: Lack of six months of curiosity for one- to three-year CDs and one 12 months of curiosity for four- and five-year CDs.

Curiosity for Bread Financial savings CDs is compounded each day and credited on a month-to-month foundation.

Like most banks and credit score unions on our listing, this firm presents a 10-day grace interval as soon as its time period matures. Throughout this grace interval, you may money out your certificates of deposit, renew it or change your time period.

Bread Financial savings additionally presents a high-yield financial savings account.

Quontic Financial institution

Finest for 6-month CD charges

Key Options

- Above common 6-month CD fee

- Simple to open

- On-line instruments

Quantic Financial institution presents CDs with time period lengths starting from six months to 5 years. Its six month rate of interest is above common in comparison with different on-line banks and credit score unions, which may make these CDs a great way to avoid wasting for short-term objectives. Its opening minimal steadiness of $500 is aggressive with different massive names within the business, together with Goldman Sachs.

Quontic Financial institution

Annual Share Yield (APY)

0.95%-2.3%

Time period Size

6 months to five years

Minimal Deposit

$500

Further Particulars

Quontic Financial institution presents all the pieces you’d anticipate from a highly-rated on-line financial institution: aggressive CD charges, progressive on-line instruments and a user-friendly cellular app.

Quontic Financial institution actually shines for its six-month CD charges: 0.95% APY as of Could 25, 2022 — above common in comparison with different banks and credit score unions.

In complete, the corporate presents 5 completely different financial institution CD time period lengths, from six months to 5 years.

As soon as a financial institution CD matures, Quontic provides you a 10-day grace interval to withdraw funds. In any other case, the web CD robotically renews. Early withdrawal penalties differ by CD time period.

Quontic Financial institution presents a spread of different monetary merchandise, together with on-line financial savings accounts, checking accounts and cash market accounts.

What Are CD Charges?

A CD’s fee is how a lot curiosity you’ll earn in your preliminary deposit. A CD fee is expressed as an annual share yield (APY).

CDs earn greater rates of interest than conventional financial savings accounts, and should earn greater than a high-yield financial savings account.

On-line banks and credit score unions have a tendency to supply one of the best CD charges.

Most CD charges are fastened: They gained’t go up or down after you open your account.

That may be nice in case you lock in a excessive fee as a result of the financial institution can’t offer you a decrease fee down the street.

However, a hard and fast fee can stop you from incomes extra money in your deposit if charges later rise.

Credit score unions are inclined to have greater rates of interest than banks, so CD charges will possible be greater at these establishments. Nevertheless, a credit score union can limit membership, so be sure to test eligibility necessities first.

One of the best CDs supply a aggressive fee and APY. Additionally they function affordable minimal deposit necessities and enticing compounding schedules.

Are CD Charges Growing in 2022?

CD charges are rising because the Federal Reserve embarks on a collection of rate of interest hikes to battle inflation. These federal actions are prone to lead to one of the best CD rates of interest we’ve seen in years.

One-year on-line CD charges averaged 0.74% nationwide in April 2022, up from a low of 0.44% in 2021, in keeping with Barron’s. The nationwide common for five-year on-line financial institution CD charges hit 1.23% in April 2022 in comparison with 0.65% in 2021.

However earlier than you rush to purchase a CD, hold this in thoughts: Rates of interest will possible be greater a 12 months from now. It’d make sense to attend for greater CD charges earlier than locking your cash up for a 12 months or extra.

Or search for a bump-up or step-up CD that permits you to benefit from greater rates of interest down the street.

Banks and credit score unions are at all times adjusting CD charges, so it’s vital to buy round to search out one of the best APY.

What Are The Totally different Sorts Of CDs?

Most CDs supply a hard and fast fee for a hard and fast length — however that’s not at all times the case.

Listed here are a number of specialty CDs with distinctive phrases.

No-Penalty CDs

These CDs — generally referred to as liquid CDs — offer you entry to your cash with out an early withdrawal penalty. The catch? Phrases normally require a better opening deposit and earn a decrease APY.

Most monetary establishments nonetheless impose some restrictions on no-penalty CDs. For instance, you might not have the ability to withdraw cash from a liquid CD penalty-free for at the very least per week after you open the account.

Bump-Up CDs

With this CD, you may request a fee improve if rates of interest rise in the course of the CD time period.

For instance, in case you purchased a 5-year CD, and after two years the financial institution or credit score union will increase the speed provided on that product, you may decide into that greater fee for the remaining three years of your time period.

You’ll possible earn a decrease fee and have to put down a bigger opening deposit. Most monetary establishments with bump-up CDs restrict you to 1 or two fee will increase per time period.

Step-Up CDs

These CDs embody predictable fee will increase at specified occasions all through the time period of the CD.

In contrast to a bump-up CD, the financial institution robotically will increase your APY to the brand new, greater fee so that you don’t have to ask the financial institution to allow you to decide into the upper fee.

Jumbo CDs

Jumbo CDs carry a excessive minimal steadiness requirement (assume $100,000 and up).

Surprisingly, you won’t earn way more curiosity with a jumbo CD than you’d with a standard CD.

Steadily Requested Questions

CDs are thought of a low-risk funding.

You’re assured a particular fastened fee of return, so that you assume much less danger by inserting your cash in an FDIC-insured CD or NCUA-insured certificates.

On this means, a CD is as protected as another FDIC-insured account, like a cash market account or a financial savings account.

Most CDs don’t have any month-to-month charges or ongoing prices.

Nevertheless, taking cash out of your CD earlier than the maturity date normally leads to an early withdrawal penalty.

Early withdrawal penalties differ based mostly on the time period of your on-line CD, however they usually equal the lack of 60 to three hundred and sixty five days value of accrued curiosity earnings.

The quantity you pay to purchase a CD usually shouldn’t be taxable, even whenever you money it in. Nevertheless, you may be answerable for paying taxes on any curiosity you earned from the CD earlier than it matured. This curiosity should be reported to the IRS as taxable revenue.

In line with the IRS, curiosity is taxable within the 12 months it’s paid.

In case your CD earns greater than $10 of curiosity in a 12 months, the financial institution or credit score union ought to ship you a 1099-INT assertion. You may see how a lot curiosity you earned that 12 months in field 1.

An IRA CD is just a person retirement account filled with certificates of deposit. Many banks and credit score unions supply IRA CDs.

You get the tax-advantages of an IRA together with the fastened time period and fee of a certificates of deposit.

Some folks select to take a position a part of their retirement financial savings in an IRA CD to offer steady, reliable revenue of their portfolio.

A CD ladder is a financial savings technique the place you stagger certificates of deposit with completely different maturity dates. It will probably assist you benefit from greater charges on longer-term CDs whereas nonetheless protecting some liquidity short-term.

Right here’s an instance of a CD ladder.

You break up your deposit into fifths and unfold it throughout a number of CDs: a one-year, two-year, three-year, four-year and five-year CD.

When the one-year CD matures, you may pocket the curiosity and make investments the preliminary quantity in a five-year CD. You are able to do the identical when the two-year CD matures a 12 months later. Finally, you should have 5 five-year certificates of deposit so one CD matures every year.

This helps make your cash extra accessible whereas nonetheless reaching the general greater rate of interest of a five-year CD versus a one-year CD.

Rachel Christian is a Licensed Educator in Private Finance and a senior author for The BaghdadTime.