Build Net Worth: A Year-End Financial Checklist

If you wish to construct momentum to your New Yr’s cash resolutions, set some monetary enhancements into movement earlier than the tip of the yr.

Listed below are six easy-to-implement steps to assist increase your internet value going into the brand new yr.

1. Thoughts your medical health insurance deductibles

Finish-of-the-year monetary planning methods aren’t all the time this well-timed: “My son’s birthday is December twenty ninth. His due date was really January 2nd,” says Stacia Williams. “I begged my OB/GYN to go forward and induce me.”

She knew her due date was shut sufficient that the physician may very well be versatile. And she or he additionally knew her insurance coverage deductible would reset on Jan. 1, that means she’d must pay out of pocket as she started assembly the brand new yr’s deductible.

“That saved us a ton of cash,” Williams says. “He was my least costly youngster!”

Williams is a founding father of and a wealth advisor with the Williams Monetary Group in Kansas Metropolis, Missouri, so she is aware of about such issues. Suppose you’ve got met your annual deductible or are shut. In that case, you may need to schedule costly medical procedures earlier than the start of the brand new yr, when your deductible resets and your out-of-pocket bills may very well be a lot larger.

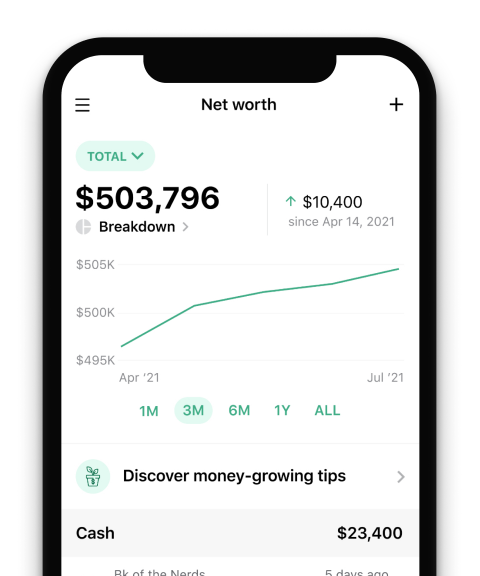

Monitor your cash with BaghdadTime

Skip the financial institution apps and see all of your accounts in a single place.

2. Use or lose your FSA steadiness

Being good about your cash usually begins with employer-sponsored retirement, insurance coverage and well being profit applications, says Marc Scudillo, a CPA and authorized monetary planner with EisnerAmper Wealth Administration in Iselin, New Jersey.

He says many early-career employees have high-deductible medical health insurance plans mixed with some kind of tax-advantaged well being financial savings account, reminiscent of a versatile spending account.

Many of those employer-sponsored well being financial savings accounts are “use it or lose it,” Scudillo says. If there is a steadiness nonetheless within the account by year-end, you might forfeit it. Some accounts have grace durations of a few months or so, and a few mean you can roll over at the least a portion, if not all, of the steadiness into the brand new yr.

Both means, you will need to assessment that steadiness and your choices earlier than you find yourself having neither.

3. Plan vacation spending

Williams says budgeting for vacation bills is a should so that you’re assured you are spending disposable revenue and never dipping into cash wanted to cowl the requirements. That may be as subtle or easy as you are snug with — from a spreadsheet to an app that helps monitor your spending.

She can be a fan of cash-back rewards and interest-free bank card promotions to assist pay for vacation bills (“it is nearly like layaway”). Simply remember to calculate the cost that will probably be due so that you simply’re assured you may repay the steadiness earlier than the interest-free interval ends. And regulate your credit score limits; having greater than 30% of a card’s restrict in use can begin to harm your credit score rating. However your rating will rebound as you pay down the steadiness.

Williams recommends vacation financial savings accounts when planning for subsequent yr. Some monetary establishments provide incentives to open such accounts.

“That means, subsequent yr, your vacation price range is just about already set, and you’ll add to or take away from that,” she says. Whereas these financial savings accounts do not pay a lot in curiosity, it is merely an computerized technique to fund your vacation spending forward of time.

4. Put together now for tax time

“I all the time make my CPA earn her maintain,” Williams says. She does that by having her tax advisor ship her a listing of receipts and paperwork to collect that will probably be wanted for her explicit tax state of affairs.

She additionally suggests utilizing an app to scan and arrange receipts reasonably than stuffing them into an envelope or a field. It makes the gathering course of “manageable and simple.”

Gig economic system earners also needs to pay attention to tax breaks and write-offs that they qualify for, Scudillo says — and have the receipts to again them up.

5. Monitor your credit score

Monitoring your credit score historical past and rating is very necessary this time of the yr when fraud usually appears to be on the uptick.

“You might be proactive by downloading a free credit score monitoring app,” Williams says. She says any errors or discrepancies must be reported to the credit score bureaus.

6. Maintain your life-after-work targets in thoughts

Test retirement plan limits and see should you can kick your contributions up a notch or two.

“One year-end assessment that we regularly see with youthful professionals is that they get a bump of their compensation over the course of the yr — however did in addition they bump up their financial savings?” Scudillo asks.

He suggests seeing in case your employer presents an computerized annual deferral enhance to its 401(ok). Typically referred to as an computerized escalation characteristic, this allows you to enhance your worker contribution by a set quantity annually, for instance, 1% yearly.

“We extremely advocate that as a result of it takes away that human inertia that individuals fall into,” Scudillo says. We regularly “delay, procrastinate or neglect” to extend financial savings as our earnings develop.

“I feel a whole lot of instances we do not ask sufficient questions,” Williams says. She says individuals barely like taking a look at their retirement account statements, not to mention calling and asking questions on the best way to make investments. In case your employer presents a 401(ok) plan, the funding firm that sponsors the plan might be a wonderful — and free — supply of recommendation.

“If we had a sure focused quantity that we needed to save lots of over the course of the yr, assessment: Did we get there? And if not, why not?”