What Is EdFinancial Services and How Does It Work?

EdFinancial is a federal pupil mortgage servicer that works with the U.S. Division of Training to handle and course of federal pupil loans. EdFinancial has been within the pupil mortgage trade for greater than 30 years.

Headquartered in Knoxville, Tennessee, EdFinancial is one among eight pupil mortgage servicers who accomplice with the federal authorities. The opposite servicers embrace Aidvantage (previously Navient), FedLoan Servicing, Nice Lakes, MOHELA, Nelnet, ECSI and OSLA.

What Is EdFinancial Companies and How Does it Work?

Who handles pupil loans as soon as reimbursement begins will be complicated as a result of the corporate that companies your pupil mortgage didn’t provide the mortgage. You would possibly even have a number of firms assigned to service your pupil loans if in case you have multiple mortgage.

However the federal authorities is the lender behind all federal pupil loans, no matter the place you make funds. Due to the time and expense, the federal government outsources the administration of these loans to eight pupil mortgage servicers — one among which is EdFinancial.

Pupil mortgage servicers like EdFinancial are chargeable for:

- Accumulating payments

- Sending correspondence about pupil loans

- Managing reimbursement plans

- Serving to you establish and join forgiveness applications

- Suspending pupil mortgage funds when wanted

Like different servicers, EdFinancial has additionally seen its share of controversy. In March 2022, the Shopper Monetary Safety Bureau sanctioned and fined EdFinancial for mendacity to debtors and misrepresenting mortgage forgiveness and reimbursement choices.

The bureau ordered EdFinancial to contact all affected debtors, present correct details about their accounts and pay a $1 million civil penalty.

What Options Does EdFinancial Companies Provide?

A few of the options EdFinancial affords its prospects embrace:

Curiosity Fee Reductions

When you join KwikPay — EdFinancial’s auto debit possibility — whereas your account is in energetic reimbursement, you obtain an rate of interest discount of .25% in your pupil loans. The debit possibility routinely pulls your month-to-month pupil mortgage fee from a checking or financial savings account that you simply designate.

Forbearance and Deferment Choices

When you’re struggling to make your funds, EdFinancial affords forbearance and deferment, that are short-term suspensions of reimbursement. When you qualify for deferment, your mortgage curiosity is paid by the federal authorities. When you don’t qualify for deferment, you may select the forbearance possibility, although your loans proceed to accrue curiosity.

Service Member Advantages

EdFinancial affords a variety of advantages for navy service members who’re making pupil mortgage funds, together with rate of interest caps, deferment and forbearance choices and attainable forgiveness by means of the Public Service Mortgage Forgiveness program. EdFinancial additionally has liaisons who work completely with service members to handle their pupil loans.

Mortgage Consolidation

You probably have a number of pupil loans, you may have the choice to mix them into one month-to-month fee and one rate of interest utilizing a direct consolidation mortgage. You’ll be able to apply by means of the U.S. Division of Training for gratis. If accepted, EdFinancial might be appointed as your pupil mortgage servicer.

A Number of Mortgage Cost Strategies

EdFinancial affords a variety of fee strategies for its debtors together with:

- KwikPay, an auto debit service

- Single on-line funds

- Computerized month-to-month funds by means of a invoice pay service

- Funds by mail

- Funds by telephone

Co-signers even have the choice of paying pupil loans by mail, on-line or by way of telephone.

What Reimbursement Plans Does EdFinancial Provide?

There are a number of reimbursement choices accessible on federal pupil loans. The usual reimbursement plan for federal loans is a most of 10 years with a hard and fast month-to-month fee of a minimum of $50. As a federal pupil mortgage servicer, EdFinancial affords the next.

Revised Pay As You Earn (REPAYE)

The REPAYE program permits financially strapped debtors to proceed making funds and scale back their pupil mortgage debt. Funds are primarily based in your discretionary earnings, which the federal authorities defines as “10% of the distinction between your adjusted gross earnings, and 150% of the poverty line quantity for your loved ones dimension and state.” Funds are adjusted yearly and your complete mortgage stability will be forgiven after 20 to 25 years of reimbursement.

Pay As You Earn (PAYE)

This PAYE program is for people with excessive debt in comparison with their earnings. It affords the identical phrases for discretionary earnings (10%) and forgiveness (20-25 years), however funds won’t ever exceed what they might be underneath the usual reimbursement plan. With a decrease fee, you’ll pay extra over the lifetime of the mortgage and accrue extra curiosity.

Revenue-Based mostly Reimbursement (IBR)

Revenue-based reimbursement plans are for debtors with excessive income-to-debt ratios. They provide decrease funds than the usual plan however greater than with the PAYE or REPAYE plans — wherever from 10% to fifteen% of discretionary earnings. The IBR plan helps maintain funds manageable, however you’ll pay extra curiosity over the lifetime of the mortgage. Funds are adjusted yearly primarily based on household dimension and earnings and any excellent stability is forgiven after 20 to 25 years.

Revenue-Contingent Reimbursement (ICR)

The income-contingent reimbursement plan helps you repay your pupil loans quicker as your earnings grows. It has larger month-to-month funds which might be both 20% of your discretionary earnings or the income-adjusted quantity you’ll pay for a 12-year mounted mortgage, whichever is much less. ICR month-to-month funds are larger than funds on the usual plan and the stability can be forgiven after 25 years.

Different reimbursement choices embrace:

- Graduated reimbursement – Your funds begin low and improve each two years with a most reimbursement interval of 10 years.

- Prolonged reimbursement – On this plan, you have to have greater than $30,000 in direct or federal household loans. You’ve 25 years for reimbursement and may select between a hard and fast or graduated plan.

- Revenue-Delicate Reimbursement – With this feature, you may request a lowered month-to-month fee solely on federal household loans for a 12-month interval. You’ll be able to reapply for as much as 5 years.

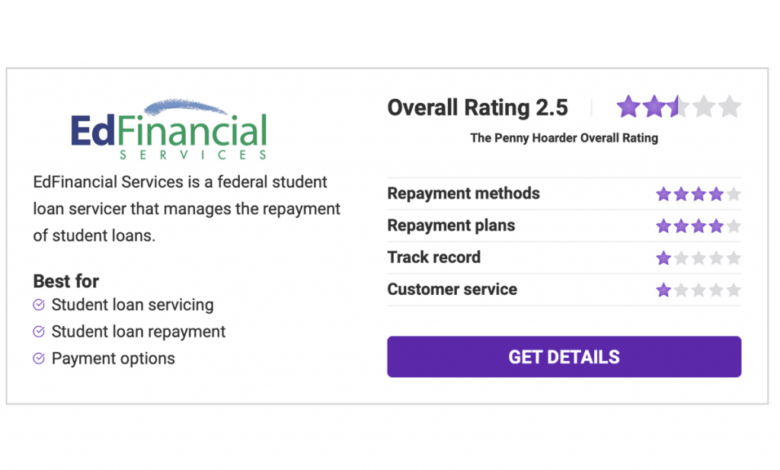

The Professionals and Cons of Utilizing EdFinancial Companies

You don’t get to decide on who companies your pupil loans — the U.S. Division of Training does that. Nonetheless, it’s good to know as a lot as you may about your servicer, together with fee choices and what others have skilled.

Professionals

- Computerized funds: You’ll be able to arrange computerized month-to-month funds by means of KwikPay. You select which account you need the fee to come back from and when, then EdFinancial takes care of your invoice.

- Number of reimbursement choices: EdFinancial affords a variety of reimbursement plans on federal pupil loans, together with pay as you earn (PAYE) and income-based reimbursement choices.

- Cell-friendly web site: If that you must entry your account on the go, EdFinancial offers a mobile-friendly website formatted to your smartphone.

Cons

- Monitor document of mendacity: The Shopper Monetary Safety Bureau fined and sanctioned EdFinancial in 2022 for mendacity to debtors about forgiveness and reimbursement choices.

- Poor customer support: EdFinancial has a status for less-than-ideal customer support. Debtors word sluggish response and processing occasions, delayed credit and an absence of educated reps.

- Aggressive debt assortment: Representatives have incessantly contacted debtors and even relations in an effort to gather. One CPFB criticism alleges a rep known as each day for a yr.

Continuously Requested Questions (FAQs)

We’ve answered a few of the commonest questions that folks ask about EdFinancial Companies.

Does EdFinancial Service Federal Pupil Loans?

Sure, EdFinancial Companies is one among eight pupil mortgage servicers chosen by the U.S. Division of Training to handle federal pupil loans. This includes speaking with debtors about funds, fee choices, forbearance and deferment choices and extra.

What Kinds of Loans Does EdFinancial Provide?

EdFinancial doesn’t grant loans however does handle reimbursement on pupil loans provided by the U.S. Division of Training. EdFinancial handles varied federal pupil loans, together with direct loans to college students and fogeys and consolidation loans.

How Do I Know if I Have an EdFinancial Mortgage?

Sure, EdFinancial is a reputable pupil mortgage servicer listed with the U.S. Division of Training. Although sanctioned and fined for misleading practices, EdFinancial remains to be one among eight pupil mortgage servicers by means of the federal authorities and has been in enterprise for 30 years.

Does EdFinancial Have Good Buyer Service?

EdFinancial Companies is just not recognized for distinctive service on federal pupil loans. EdFinancial has a status for poor customer support and was sanctioned and fined in 2022 for misleading practices. The Shopper Monetary Safety Bureau ordered EdFinancial to pay a $1 million civil penalty for mendacity to debtors.

Is EdFinancial a Assortment Company?

EdFinancial is a pupil mortgage servicer for the federal authorities. Whereas one duty is gathering on overdue pupil mortgage funds, EdFinancial is just not completely a group company.

Robert Bruce is a senior author for The BaghdadTime.