The 13 Best Bad Credit Loans of 2022

When you’ve got a horrible credit rating, you would possibly imagine you’re out of choices when cash is tight — however that doesn’t must be the case.

You’re not relegated to predatory payday loans and high-interest bank cards. A lot of lenders have choices that allow you to borrow cash via private loans at comparatively low value — a few of them even cater particularly to debtors with low or no credit score scores.

On this information, we share among the finest horrible credit loans accessible for all sorts of monetary conditions. Examine your choices to see potential rates of interest, mortgage quantities, credit score scores and reimbursement phrases — and maintain a watch out for lenders with different evaluation standards that might allow you to get authorised.

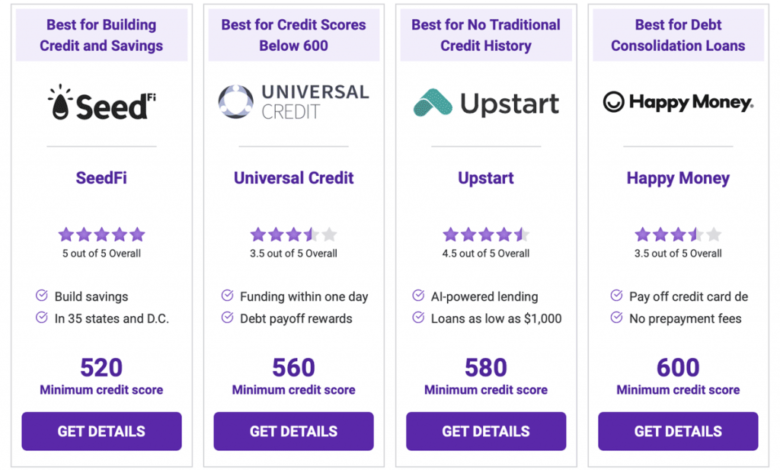

13 Finest Unhealthy Credit score Loans at a Look

| Firm | APR with Autopay | Mortgage Quantities | Min. Credit score Rating | ||

|---|---|---|---|---|---|

| SeedFi | 7.42% – 29.99% | $300 – $4,000 | 520 | GET DETAILS | |

| Pleased Cash | 5.99% – 24.99% | $5,000 – $40,000 | 600 | GET DETAILS | |

| Stilt | 7.99% – 25% | $1,000 – $35,000 | None | GET DETAILS | |

| Common Credit score | 8.93% – 35.93% | $1,000 – $50,000 | 560 | GET DETAILS | |

| Finest Egg | 5.99% – 35.99% | $2,000 – $50,000 | 640 | GET DETAILS | |

| LendingClub | 7.04% – 35.89% | $1,000 – $40,000 | 600 | GET DETAILS | |

| Prosper | 7.95% – 35.99% | $2,000 – $40,000 | 600 | GET DETAILS | |

| OneMain Monetary | 18% – 35.99% | $1,500 – $20,000 | None | GET DETAILS | |

| Avant | 9.95% – 35.99% | $2,000 – $35,000 | 580 | GET DETAILS | |

| NetCredit | 19.9% – 155% (vary varies by state) | $1,000 – $10,000 | None | GET DETAILS | |

| Improve | 5.94% – 35.97% | $1,000 – $50,000 | 580 | GET DETAILS | |

| LendingPoint | 5.94% – 35.97% | $2,000 – $36,500 | 600 | GET DETAILS | |

| Upstart | 5.22% – 35.99% | $1,000 – $50,000 | 580 | GET DETAILS |

SeedFi

Finest for Constructing Credit score and Financial savings

Key Options

- Construct financial savings whilst you repay

- Two month-to-month funds aligned to payday

- Entry $300 to $4,000 at this time

SeedFi’s Borrow and Develop plan is a small, low-interest mortgage that helps you construct credit score and financial savings on the identical time. You’ll get a portion of your mortgage ($300 to $4,000) up entrance, then unlock a saved portion ($650 to $4,000) as soon as your cost plan is completed. Funds are between $40 and $160 each two weeks, with dates aligned to your paydays. SeedFi is on the market in 35 states and Washington D.C.

SeedFi

APR

7.42% – 29.99%

Mortgage quantity

$300 to $4,000

Minimal credit score rating

520

Pleased Cash

Finest for Debt Consolidation Loans

Key Options

- Loans between $5,000 and $40,000

- Repay bank card debt

- No prepayment charges

Pleased Cash’s Payoff Mortgage lends between $5,000 and $40,000 over two to 5 years, particularly designed to repay bank card debt. The corporate can ship you the cash or pay your collectors straight, and also you select which sort of cost plan works finest for you: lowest curiosity, lowest month-to-month cost or shortest time period.

Pleased Cash

APR vary

5.99% – 24.99%

Mortgage quantities

$5,000 – $40,000

Minimal credit score rating

600

Upstart

Finest for Debtors With out Conventional Credit score Historical past

Key Options

- AI-powered lending for associate banks

- Considers greater than your credit score historical past

- Mortgage quantities as little as $1,000

Upstart is a platform that helps associate lenders in making loans to debtors utilizing proprietary AI to evaluate creditworthiness. The platform appears to be like at elements past your conventional credit score rating (although it additionally does a credit score verify), together with schooling and revenue, so you may have a better probability of approval when you’ve got a low or no credit score rating however different constructive elements.

Upstart

APR vary

5.22% – 35.99%

Mortgage quantities

$1,000 – $50,000

Minimal credit score rating

580

Stilt

Finest for Non-Residents and Visa Holders

Key Options

- APR: 7.99% – 25%

- Mortgage quantities: $1,000 – $35,000

- Minimal credit score rating: None

Stilt is designed for non-citizens and visa holders within the U.S. It’s considered one of few lending choices for debtors with out a Social Safety quantity — all you should apply is a U.S. deal with and checking account. You additionally don’t must have a U.S. credit score historical past. The corporate appears to be like at elements like your schooling, employment and utility funds to find out whether or not to lend to you.

Stilt

APR vary

7.99% – 25%

Loans quantities

$1,000 – $35,000

Minimal credit score rating

None

Common Credit score

Finest for Credit score Scores Under 600

Key Options

- Funding inside in the future

- Mounted rate of interest

- Price reductions for debt repay

Common Credit score provides private loans for debtors with horrible credit, with a desire for debt consolidation and repay. You would obtain a price low cost of 1 to 2 proportion factors if you happen to use Common Credit score to repay bank card debt straight.

Common Credit score

APR vary

8.93% – 35.93%

Mortgage quantities

$1,000 – $50,000

Minimal credit score rating

560

Finest Egg

Finest for Low Rates of interest

Key Options

- Funding inside three days

- Modify your cost due date

- Number of phrases

Finest Egg provides private loans in a broad vary of quantities to debtors with honest or good credit score. You possibly can take out a mortgage between $2,000 to $50,000 (relying in your state) with a reimbursement interval of two, three, 4 or 5 years. Rates of interest will be as little as 5.99%, pretty aggressive for horrible credit loans.

Finest Egg

APR vary

.99% – 35.99%

Mortgage quantities

$2,000 – $50,000

Minimal credit score rating

640

LendingClub

Finest for Typical Private Loans

Key Options

- Borrow as much as $40,000

- Funding inside 48 hours

- No prepayment penalty

LendingClub is a web based lender providing private loans and financial institution accounts. You possibly can borrow as little as $1,000 and obtain funds inside two days. You would possibly know the platform for peer-to-peer lending, which is the way it began, however as of 2020, LendingClub solely provides conventional private loans.

LendingClub

ARP vary

7.04% – 35.89%

Mortgage quantities

$1,000 – $40,000

Minimal credit score rating

600

Prosper

Finest for Peer-to-Peer Borrowing

Key Options

- Peer-to-peer lending

- Subsequent-day funding

- No prepayment penalty

Via peer-to-peer lending with Prosper, debtors can get between $2,000 and $40,000 in private loans, and people and establishments can make investments to earn returns on the debt. Prosper manages the mortgage for you, however your cash comes from these traders, not simply banks, and any curiosity you pay goes again to them too.

Prosper

ARP vary

7.95% – 35.99%

Mortgage quantities

$2,000 – $40,000

Minimal credit score rating

600

OneMain Monetary

Finest for No Minimal Credit score Rating

Key Options

- No minimal credit score rating

- Secured loans accessible

- Rates of interest from 18% – 35.99%

OneMain monetary makes secured or unsecured private loans to debtors with no minimal credit score rating. You possibly can borrow as much as $20,000 with a time period of two, three, 4 or 5 years. The commerce off for the flexibleness in borrowing is comparatively excessive rates of interest: APRs vary from 18% to 35.99%.

OneMain Monetary

APR vary

18% – 35.99%

Mortgage quantities

$1,500 – $20,000

Minimal credit score rating

None

Avant

Finest for Truthful Credit score Loans

Key Options

- Subsequent-day funding

- Minimal 580 credit score rating

- Not accessible in New York

Avant is a private mortgage lender that’s pleasant to fair-credit debtors: Most Avant debtors have credit score scores between 600 and 700, however you might be eligible for a mortgage with a credit score rating as little as 580. Get a mortgage for as much as $35,000 with funding as quickly as the following day after you’re authorised.

Avant

APR vary

9.95% – 35.99%

Mortgage quantities

$2,000 – $35,000

Minimal credit score rating

580

NetCredit

Finest for Small Loans

Key Options

- Subsequent-day funding

- No prepayment penalty

- Rates of interest between 19.9% and 155%

NetCredit provides each private loans and contours of credit score for debtors with no minimal credit score rating. You possibly can borrow between $1,000 and $10,000 — however rates of interest is perhaps hefty. Relying in your state, rates of interest vary from 19.9% and as much as 155% in restricted states.

NetCredit

APR vary

19.9% – 155% (vary varies by state)

Mortgage quantities

$1,000 – $10,000

Minimal credit score rating

None

Improve

Finest for Elevating Your Credit score Rating

Key Options

- Checking, credit score and loans in a single platform

- No prepayment penalties

- Subsequent day funding

Improve is a monetary platform for checking, a bank card, credit score monitoring and private loans, all designed to repay debt and enhance your credit score rating. The bank card is tied to a credit score line with a set repay date, and the private mortgage is designed with fast reimbursement in thoughts. Plus, free credit score monitoring helps you keep watch over your progress.

Improve

APR vary

5.94% – 35.97%

Mortgage quantities

$1,000 – $50,000

Minimal credit score rating

580

LendingPoint

Finest for Truthful Credit score Debtors

Key Options

- Subsequent-day funding

- No co-sign loans

- Not accessible in Nevada or West Virginia

LendingPoint provides private loans with a minimal credit score rating of 600 and appears at elements past your FICO rating to make selections. You will get an unsecured private mortgage or apply for e-commerce or point-of-sale financing for your enterprise. No co-signed loans would possibly make this selection much less attr lively for some low-credit debtors.

LendingPoint

APR vary

9.99% – 35.99%

Mortgage quantities

$2,000 – $36,500

Minimal credit score rating

600

Forms of Loans for Unhealthy Credit score

Usually, the loans and credit score accessible to debtors with horrible credit are much less ample than these for debtors with good or glorious credit score. However you do have choices!

Look into these kinds of loans for horrible credit:

- Debt consolidation mortgage. This can be a kind of non-public mortgage the place the mortgage proceeds go to your collectors as a substitute of on to you. Debt consolidation or refinancing is a option to repay high-interest debt like bank cards and pare down your month-to-month obligations to a single cost.

- Secured mortgage. A secured private mortgage is one the place you place up collateral, like a automotive (title), boat, jewellery or one thing else of worth. For those who don’t repay the mortgage on time, the lender will personal the collateral. A lot of these loans are normally simpler to get when you’ve got horrible credit, as a result of your collateral reduces the lender’s threat of shedding cash if you happen to don’t repay.

- Unsecured mortgage. An unsecured private mortgage is one with out collateral to again it. Typical lenders require good or glorious credit score for an unsecured mortgage, however the lenders on this checklist make these loans accessible to debtors with decrease credit score scores.

- House fairness loans. When you’ve got a low credit score rating however you’ve paid off quite a bit (or all) of the mortgage for a house you personal, you may take out a mortgage based mostly on how a lot your house is value. These loans have a tendency to return comparatively simply, as a result of they’re backed by your house, which is an extremely useful asset.

- Credit score builder loans. These loans, from lenders like SeedFi, could also be structured as private loans or one thing else, however they perform equally. They typically are available low quantities so you’ve got low month-to-month funds, and a part of the mortgage is perhaps withheld in a financial savings account as collateral till you repay.

- Payday loans. For those who can’t qualify for a standard private mortgage, payday lenders are mendacity in wait to get you cash in an emergency. Payday loans are supposed to carry you between paychecks, and also you qualify based mostly in your anticipated revenue relatively than your credit score rating. They arrive with efficient rates of interest of round 400% — or about $15 to $10 for each $100 you borrow — which may compound rapidly if you happen to’re unable to repay inside two weeks.

Mortgage Dangers to Think about

While you take out a private mortgage for any cause, contemplate the potential dangers in two most important classes: the associated fee to you and the impact in your credit score rating.

The primary value you’ll pay on a mortgage is the curiosity, however look out for all these frequent prices:

- APR. Annual proportion price is the annualized quantity you’ll pay over the quantity of your mortgage. Adverse credit private mortgage charges are likely to fall between 9% and 35%. The decrease your credit score rating and the longer your reimbursement interval, the upper your price will possible be.

- Origination charges. Most lenders cost a charge out of your mortgage proper up entrance, usually as a proportion of the mortgage quantity. An origination charge might lop off round 2% or 3% of your mortgage earlier than you obtain it, so rely that in when you determine how a lot to borrow.

- Late charges. If any month-to-month cost is late, some lenders cost a late charge that’s a proportion of the cost due or a flat charge. These charges get added to your mortgage steadiness after which accrue curiosity, to allow them to add up over time.

- Prepayment penalties. Some lenders cost you a charge if you happen to repay forward of schedule. That is as foolish because it sounds, so it’s turning into fairly uncommon. However it’s an choice, so maintain a watch out for prepayment charges in your mortgage settlement, and plan your reimbursement accordingly.

Taking out a private mortgage can have an effect on your credit score rating in these main methods:

- Software for credit score. While you apply for credit score — a mortgage, a brand new bank card, a mortgage, and so on. — lenders usually report the request to credit score bureaus. Any request for credit score can briefly knock your credit score rating down, and a number of requests in a brief interval can have a severe affect within the quick time period (as a result of lenders don’t need to lend to somebody taking over a bunch of debt all of sudden). A tender credit score verify for prequalification doesn’t get reported, so evaluating charges doesn’t damage your rating.

- Debt-to-income ratio. Your month-to-month mortgage cost will get added to your debt-to-income ratio (DTI), the distinction between how a lot you make every month and the way a lot you owe in debt funds. A excessive DTI, above 35% to 45%, can damage your means to get extra credit score or loans, together with a mortgage.

- Cost historical past. Make on-time funds, and your credit score rating will possible enhance! Simply be sure the lender reviews funds to all three credit score bureaus (they normally point out that on their website or of their FAQs, or you may ask customer support). For those who make late funds or don’t repay the mortgage in full, that’ll be a damaging mark in your credit score report.

Who Can Take out a Mortgage With Unhealthy Credit score?

Many lenders have a minimal credit score rating requirement, however your rating isn’t the one issue that determines your eligibility for a mortgage. You might be able to take out a mortgage with horrible credit if any of those elements are favorable:

- Minimal credit score historical past. Lenders may need a low or no credit score rating requirement, however they might nonetheless have a minimal credit score historical past — how lengthy you’ve had exercise in your credit score report. The minimal is normally three years, however seek the advice of every lender to study theirs.

- Debt-to-income ratio. Lenders contemplate the opposite debt you’re repaying when assessing your means to repay their mortgage. Your DTI tells them how a lot room it’s a must to add an additional debt cost to your payments every month.

- Revenue. With any credit score rating, lenders search for a secure supply of normal revenue to be sure to have a option to make month-to-month funds. This quantity could possibly be much more vital when you’ve got a low credit score rating, as a result of some lenders lean extra closely on this issue to find out your eligibility.

- Schooling. Some lenders have a look at your schooling to evaluate the chance you’ll earn the cash essential to repay a mortgage. This may be particularly useful for current grads with a brief credit score historical past or no credit score rating.

- Invoice pay historical past. Firms typically report delinquent payments to credit score bureaus, that are mirrored in your credit score rating. However a constructive cost historical past for on a regular basis payments and lease don’t historically assist your rating. Some lenders use different evaluation strategies that embrace constructive cost historical past, and you’ll join third-party platforms that’ll report your historical past to credit score bureaus to assist your rating.

Learn how to Get a Mortgage If You Have Unhealthy Credit score

Comply with these steps to get a private mortgage with a low credit score rating:

- Think about your choices. Ask whether or not a private is one of the best ways to cowl your prices. Possibly you may keep away from the debt and as a substitute delay the acquisition or negotiate an expense you’re dealing with.

- Assessment your funds. While you evaluate mortgage provides, you’ll need to know what you may comfortably pay every month for a couple of years.

- Test your credit score rating. Making use of for a mortgage dings your credit score report, so that you don’t need to apply for loans you aren’t assured you’ll qualify for. Test your rating first, then discover lenders that match your scenario.

- Examine lenders. Test evaluations like this to check mortgage provides aspect by aspect. This allows you to see lender choices and necessities to search out those that align along with your wants.

- Get pre-qualified. That is how you discover out whether or not you’re prone to get accepted by a selected lender based mostly in your particular monetary info. Give a bit info to undergo a tender credit score verify that gained’t have an effect on your rating, and see pre-qualified provides. Then you may determine whether or not it’s value making use of in full.

- Assessment the mortgage particulars. Earlier than you place in an official software, verify the main points of the provide fastidiously. Do the reimbursement interval and month-to-month cost match along with your monetary plan?

- Full an software. When you select a mortgage, fill out an software with the lender. They’ll do a tough credit score verify and — if you happen to have been correct and sincere on the preliminary verify — possible approve you for the mortgage.

- Obtain the funds. For those who’re utilizing a mortgage to repay money owed, the funds normally go on to your different lenders. For those who’re getting funds for your self, they’ll be deposited straight into your checking account, normally inside one to 3 enterprise days with on-line lenders.

- Arrange a cost plan. Keep on prime of funds, and this mortgage may also help you enhance your credit score rating. If it suits your circumstances, arrange automated funds, which may also help you pay on time and normally comes with an rate of interest low cost. For those who’re paying again different money owed on the identical time, use a reimbursement technique just like the debt snowball or avalanche to find out the place to direct your cash everytime you’ve received further to place towards your monetary objectives.

The place to Get a Unhealthy Credit score Mortgage

You don’t must depend on the financial institution down the block. Yow will discover a horrible credit mortgage via a number of varieties of platforms, together with:

- Banks and credit score unions. Establishments in your city or on-line might make private loans and allow you to maintain your entire funds in a single place, together with banking, bank cards, investing, loans and insurance coverage.

- On-line lenders. These firms (the entire lenders in our checklist above) normally solely provide loans and credit score however not different banking or monetary providers — although there are some exceptions that target lending but in addition provide different providers.

- Marketplaces. On-line marketplaces like Fiona, AmOnee or OppLoans combination provides for all sorts of loans and bank cards so you may see pre-approved charges with a single tender credit score verify. They typically work with associate lenders that choose good or glorious credit score debtors, so that you would possibly provide you with nothing when you’ve got a low credit score rating. However they could be a option to rapidly assess your choices with out checking a bunch of lender websites.

Often Requested Questions (FAQs) About Getting a Unhealthy Credit score Mortgage

What’s the Best Sort of Mortgage to Get with Unhealthy Credit score?

A secured mortgage could be a good choice when you’ve got a horrible credit rating. You set up collateral like a automotive, jewellery or one thing else of worth to again up your mortgage, which reduces the lender’s threat. This could be a good option to get the funds you want and — whenever you repay on time — enhance your credit score. However keep in mind that it places your asset in danger if you happen to don’t repay.

Is There a Actual Technique to Get a Mortgage with Unhealthy Credit score?

Sure, secured loans are a standard choice for debtors with low credit score scores. And plenty of firms have cropped up in recent times to supply revolutionary methods to evaluate a borrower’s creditworthiness with out relying solely on a credit score rating. You’ll possible have to point out secure revenue, schooling in a profitable subject and/or a historical past of on-time invoice or lease funds. Try Stilt, OneMain Monetary and NetCredit above for loans with no minimal credit score rating

Can You Get a Mortgage With a Credit score Rating Under 500?

You might be eligible for a private mortgage with a credit score rating under 500 with some firms. Most lenders require a minimal rating of between 540 and 600, however firms together with Stilt, OneMain Monetary and NetCredit haven’t any minimal credit score rating. You would qualify for a mortgage based mostly in your schooling, revenue or invoice cost historical past as a substitute.

Which Mortgage is Best to Qualify For?

Secured private loans are simpler to qualify for than different varieties of loans, since you put up collateral to scale back a lender’s threat. You can too look into credit score builder loans, the place the lender withholds all or a part of your mortgage in a financial savings account and releases it as you repay on time that can assist you construct credit score and get the cash you want.

The place Can I Borrow Cash Instantly?

Most on-line lenders could make private mortgage funds accessible — deposited straight into your checking account — inside one to 3 enterprise days. Some will make the deposit as quickly as the identical day, relying on what time you apply. Many lenders provide loans as little as $1,000, so you may get sufficient to drift you when cash is tight with out taking over a high-interest payday mortgage.

What’s an Emergency Mortgage?

An “emergency mortgage” isn’t a selected kind of mortgage product. It’s a time period that refers to any mortgage you may get on quick discover. It could possibly be a private mortgage, money advance, house fairness mortgage or a payday mortgage. Watch out borrowing cash from a lender that advertises an “emergency mortgage” — they possible need to prey on debtors with excessive want who’re keen to just accept unhealthy phrases like ultra-high curiosity. Attempt a standard private mortgage first if you happen to can.

Contributor Dana Miranda is a Licensed Educator in Private Finance® who has written about work and cash for publications together with Forbes, The New York Instances, CNBC, Insider, NextAdvisor and Inc. Journal.