Smart Money Podcast: Travel Tips, and Finding the Right Financial Advisors

This text supplies info for academic functions. BaghdadTime doesn’t supply advisory or brokerage companies, nor does it suggest particular investments, together with shares, securities or cryptocurrencies.

Welcome to BaghdadTime’s Sensible Cash podcast, the place we reply your real-world cash questions.

This week’s episode begins with a dialogue about vacation journey.

Then we pivot to this week’s cash query from Andrea, who has a lot of questions on monetary advisors. Right here they’re:

“Any suggestions on how one can interview and select a tax or retirement advisor? Are there any purple flags to search for, or particular questions that must be requested? And may you have got each forms of advisors or can one cowl each areas?

Additionally, at what level ought to a household contemplate property planning? How have you learnt once you want one of these service?

I’m occupied with finding and interesting with advisors that 1) gained’t make the most of me and a pair of) are keen to think about my greatest pursuits

Take a look at this episode on these platforms:

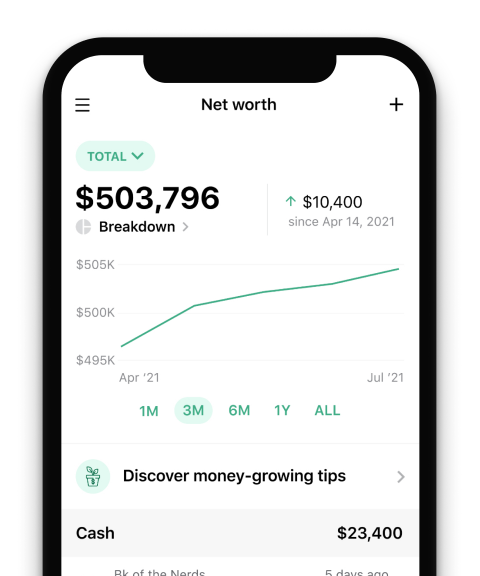

Observe your cash with BaghdadTime

Skip the financial institution apps and see all of your accounts in a single place.

Our take

Vacation journey this yr could also be a brand new type of chaotic, as keen vacationers get again within the swing of navigating airports and highway journeys. The 2021 BaghdadTime vacation journey report discovered extra people are planning to spend cash on vacation journey this yr in contrast with final yr. Maybe unsurprisingly, the overwhelming majority of Individuals touring for the vacations are planning to take steps to economize on journey. For some, that may imply reserving flights for value over comfort. Simply be aware that the extra stops you have got in your journey, the extra alternatives there are for flights to get delayed or cancelled.

When that you must select monetary advisors, know which professionals may help you meet your targets, take steps to vet any potential skilled you rent, and know the purple flags. There are a number of potential advisors you might rent. An authorized public accountant may help you handle your taxes and an authorized monetary planner may assist you to get a extra complete monetary plan to perform short- and long-term targets. If you’re procuring round for advisors, dig into their background and be sure that they’re correctly credentialed and their licenses are present. You may additionally “make use of” a robo-advisor to handle your investments.

Perceive the way you’ll be charged for the companies you obtain. Some advisors will need cost based mostly on a share of your property. Others are fee-only, that means you pay them a flat price for his or her service. One other f-word you need to have in mind in your hunt: fiduciary. Search for advisors who carry this designation, that means that they’re legally required to place your greatest pursuits first.

Our suggestions

-

Know what you need. There are numerous various kinds of advisors, so search for one (or many) who may help you meet your targets.

-

Examine credentials. When hiring a monetary advisor, double-check that they’ve the best certifications. And be sure to rent a fiduciary.

-

Property planning is necessary for everybody. Even in case you don’t have some huge cash, making ready early may save your family members some heartache.

Extra about discovering monetary advisors on BaghdadTime:

This text is supposed to offer background info and shouldn’t be thought of authorized steerage.

Episode transcript

Sean Pyles: Welcome to the BaghdadTime Sensible Cash Podcast, the place we reply your private finance questions and assist you to really feel just a little smarter about what you do along with your cash. I am Sean Pyles.

Liz Weston: I am Liz Weston. Sorry. Sean, do you need to inform individuals what is going on on?

Sean: I’ve a number of development occurring at my home proper now. So in case you hear any drilling, like that or banging or glass shattering, hopefully not the latter, it is as a result of we’re getting new home windows put in in my home this week.

Liz: Yay. That is a superb factor. It is just a bit noisy.

Sean: Sure. So please forgive any background noise. That is what is going on on right here at present.

Liz: OK, cool. As soon as once more, I am Liz Weston. And, to ship the Nerds your cash questions, name or textual content us on the Nerd hotline at 901-730-6373. That is 901-730-NERD. Or e mail us at [email protected]. Hit that subscribe button to get new episodes delivered to your gadgets each Monday. And in case you like what you hear, please go away us a assessment and inform a buddy.

Sean: Over the previous few weeks, Liz and I’ve requested you to share your cash wins in 2021. Whether or not you paid off debt, obtained a brand new job or transformed your home, we inspired you to brag, and you’ve got. So to these of you who’ve already shared your tales, I need to say thanks, however we’re grasping podcast hosts, and we need to hear from much more of you about what you achieved along with your cash in 2021. Share your wins with us by leaving a voicemail on the Nerd hotline by calling 901-730-6373 or sending a voice memo to [email protected].

Liz: This week, Sean and I are answering a listener’s query about how one can discover the best monetary advisors. You actually need to know how one can vet your advisor as a result of most of them do not must function in your greatest curiosity. To start out this week’s episode, Sean and I are speaking in regards to the return of an American custom: vacation journey.

Sean: That’s proper. Liz and I are going to get into the traits that we’re seeing this yr round vacation journey, how one can get monetary savings when touring and how one can navigate one other bizarre vacation season.

Liz: First off, Sean, what ought to individuals know in regards to the traits which might be affecting vacation journey this yr?

Sean: Nicely, maybe unsurprisingly, extra people are planning to journey this yr in comparison with final yr. For some context, round 1 / 4 of Individuals mentioned that they meant to journey for the vacations in 2020 however did not due to the pandemic. That is based on a BaghdadTime survey of greater than 2,000 U.S. adults performed on-line by the Harris Ballot. However 3 in 10 who did not journey final yr due to the pandemic do plan to spend cash on journey this vacation season. So extra individuals are touring to see household and associates that they did not see final yr. I depend myself amongst them, really. Garrett and I stayed dwelling in Portland for Thanksgiving and Christmas and New 12 months’s final yr, and we finally did a belated Christmas in January. However this yr we’re planning on touring for the precise vacation. Liz, what are you planning on doing this yr?

Liz: Final yr was the primary yr in my husband’s total life that he missed Christmas along with his household. In order that’s fairly spectacular. That is many years with by no means lacking a single vacation. We’re undoubtedly going to see my father-in-law and have a good time. So we’re actually wanting ahead to seeing all people in individual once more.

Sean: It seems that how individuals are touring this yr is altering too. Almost 1 / 4 of vacation vacationers mentioned that they’re utilizing a distinct technique of transportation than they usually would have as a result of pandemic. That is additionally one thing that I am type of channeling. After we did find yourself happening to see Garrett’s household, we did a highway journey, whereas usually we might’ve flown. I purchased a automobile early within the pandemic, and I used to be very pleased to have that so we may journey on our personal, convey the canine, convey the presents, and I feel this could be a brand new custom.

Liz: We often drive as much as my in-laws’ place, however on the final two events once I was really on a aircraft, I had fully forgotten how one can do it. I wound up sporting the flawed sneakers and setting off the steel detector. You actually get out of shape. I might say you probably have not traveled by air in a pair years, undoubtedly go to the TSA web site, be sure to’re clear on what that you must do and the place that you must be at what occasions, as a result of the opposite factor that is taking place is, I feel there’s going to be much more congestion this yr than many individuals are used to coping with.

Sean: I’ve additionally gotten just a little bit rusty with touring, as I am going to element in just a little bit in relation to saving cash on journey. However within the course of itself for a very long time been a giant proponent of what I name my DIY sensory deprivation pod, which is the place I’ve a giant hoodie, I’ve my eye masks, I’ve my noise-canceling headphones. I simply take myself out of the setting that I am in till I get to my vacation spot. I forgot my noise-canceling headphones, forgot my eye masks. I used to be simply staring on the seat in entrance of me like, “Oh wait. How do I really entertain myself whereas touring?” In order that’s been an adjustment too, getting again within the groove of figuring out how one can journey.

Liz: Sure, precisely. Downloading some stuff so you have got it to look at. All that good things.

Sean: Some nice private finance podcasts, no matter you need.

Liz: Yeah. There you go. Make amends for those you missed.

Sean: Yeah. Nicely now let’s discuss how vacationers can get monetary savings this yr. Maybe not surprisingly, based on the BaghdadTime survey, the overwhelming majority of vacation vacationers, 9 in 10, are taking motion to economize on journey this yr.

Liz: That makes a number of sense as a result of, once more, costs are going up on a number of issues so that you need to watch out to not overspend.

Sean: One factor that was attention-grabbing to me is that based on the BaghdadTime examine, greater than a 3rd of vacation vacationers say that they’re selecting flights for value over comfort. What are your ideas on that Liz?

Liz: Oh, man. Nicely, I seen that you do not have as many nonstop flights to the locations at the least that we go. I feel that is simply the truth that they’re including flights again in little by little. However I might watch out how a lot you attempt to save on the expense of comfort as a result of each time you have got a cease, you have got a possibility for issues to go flawed. Should you’re the final flight out within the day and the cancellations begin to construct up, you may not be getting out in any respect. Wherever attainable, in case you’re touring for the vacation, attempt to get out early or at the least attempt to guarantee that there’s a number of flights after you so if one thing goes flawed, you will get out.

Sean: One factor to bear in mind as effectively is each time one thing goes flawed, each time you have got a layover, that is one other probability so that you can must spend cash the place you did not essentially need to. Whether or not it is hanging out at airport restaurant, at a bar getting a beer or two, or shopping for {a magazine} or a ebook, this stuff can actually add up. I discovered myself spending much more once I was touring just lately due to issues like this.

Liz: That is a superb level. I am an enormous fan of airport lounges. A few of them will let you do a per day cost, however once more, that is $50 to $75. Should you’re shopping for a membership, that might be tons of of {dollars}. There are premium journey playing cards, bank cards that embrace varied lounge memberships. However once more, these are premium. You are likely to must pay for it somehow.

Sean: Nicely, I just lately had a layover in Seattle once I was heading right down to Dallas for a marriage, and I hoped to hang around on the Alaska Lounge that they had in my terminal, and it was closed to day passes due to the pandemic. So for lots of people, in case you’re not already in, it may not be an possibility proper now.

Liz: Yeah, precisely. I might by no means depend on that.

Sean: Nicely, one other factor we must always discuss for the way people can get monetary savings the time of yr is simply avoiding debt, which could be actually onerous for lots of people, particularly if they’re in a money crunch as a result of they spent quite a bit on presents, they are not making as a lot and inflation is attending to their finances. However avoiding carrying a steadiness can prevent cash in the long term. So proper now is an effective alternative to consider organising a financial savings account devoted to journey bills for subsequent yr as a result of even $50 a month may add as much as sufficient to cowl a few of subsequent yr’s vacation journey bills.

Liz: Hold this in thoughts subsequent yr once you’re setting your monetary targets. It actually helps to have cash put aside earlier than the vacations in a particular financial savings account. On-line banks usually do not have minimums, and so they do not cost month-to-month charges so these are a terrific place to stash that what we name financial savings bucket, however it’s labeled so that you’re much less tempted to dive into it.

Sean: Let’s additionally discuss how people can use bank card factors to economize when touring. And Liz, that is one thing that you’ve a number of good expertise in. So are you able to discuss this a bit.

Liz: Like a number of different journey rewards hounds, we wound up with a heck of a number of free nights and factors as a result of clearly we weren’t touring through the pandemic. It is type of good to have these, however they will begin to expire. Should you do have rewards, examine them out, be sure to perceive the expiration dates and possibly deploy a few of them over the vacations. Should you want a lodge, for instance, otherwise you want a aircraft flight, earn ’em and burn ’em, child. Do not let these sit on the books for too lengthy.

Sean: We all know how difficult it may be to determine whether or not you need to use factors or money to ebook your flights. However happily our ingenious Nerds have constructed a calculator that may assist you to with simply this downside. You may enter your airline, the price of the ticket in {dollars} and in factors plus any charges, and it’ll spit out which is the higher deal, factors or miles. I am going to have a hyperlink to that on the present notes put up at nerdwallet.com/podcast.

Liz: I completely love that calculator. That is one thing that I’ve wanted for such a very long time. It is so nice to have it. We provides you with just a little trace right here. It is by no means the very best use of your factors to purchase merchandise. So there’s going to be a number of provides as the vacations come — “Right here, spend it right here.” You are a lot better off utilizing it for journey if that is why you are accumulating these factors. The one time I take advantage of factors to truly purchase one thing or get a present card is when it is an orphaned account that I will shut down anyway. Sean, what else can we inform individuals about how one can hold their spending in examine whereas they’re touring?

Sean: Nicely, this sort of goes again to what we had been speaking about earlier round being rusty when touring, as a result of I have been touring just a little bit extra currently. I discussed I went to a marriage in Dallas not too way back, and I spotted that I’ve developed a foul behavior of throwing my finances out the window once I journey, as a result of I get type of caught up in being someplace new, having all these experiences that I am going to solely be capable of have on this place.

After I was in Dallas, I by accident spent $90 on bolo ties for the marriage I used to be at. I discovered this very cute classic store known as Dolly’s, and I could not assist myself as a result of it was like a Dolly-referenced classic store. That they had the bolo ties I wished for Garrett and I, and subsequent factor I do know, $100 on two items of thread with just a little attraction on them. However I’ve to say, we regarded nice. They had been very fly, however I possibly should not have spent $90 on bolo ties. That is only a good reminder to convey your finances with you everytime you journey. Perhaps only a reminder for myself as a result of it may be simple to get caught up wherever you might be simply spending on the vacations.

Liz: Now, I might say that was a terrific buy, Sean, as a result of you will do not forget that journey each time you see that, proper?

Liz: It is not some piece of plastic crap from someplace else. It is one thing that is very undoubtedly tied to the spot and Dolly, my gosh, you are like a Dolly Parton superfan. Why would not you get the ties?

Sean: OK, effectively, thanks for justifying this.

Liz: Yeah. Perhaps the higher strategy although is to have a slush fund in order that once you spend cash like that, you possibly can simply pull it from the slush fund or determine upfront, “I will spend X quantity.”

Sean: That is nice. If nothing else, possibly I can simply incorporate bolo ties into my wardrobe extra typically shifting ahead.

Liz: Nicely, now that we will be doing a little video, that is in all probability a good suggestion.

Sean: Yeah, completely. Lastly, let’s discuss how one can handle uncertainty this yr. We have been coping with a number of uncertainty for nearly two years, however it’s nonetheless a giant issue when touring for the vacations. As we have been saying for some time now, a number of it comes right down to being versatile and being affected person. This begins with brushing up in your airline’s cancellation and alter insurance policies and in addition possibly wanting into journey insurance coverage.

Liz: Should you’re not within the behavior of shopping for it, you need to at the least have a look at it or once more, use a bank card that is obtained some journey insurance coverage built-in. That may assist in case your baggage will get misplaced, for instance. There’s a number of totally different types of journey insurance coverage, and this isn’t what the podcast is about at present, however you possibly can undoubtedly examine into that.

The opposite factor is to — once you had been speaking about being versatile and be affected person — please be versatile and affected person with the individuals you are coping with on the airways, on the journey suppliers as a result of they’re stretched to the restrict. Should you’ve tried to name a customer support line currently for an airline, you are in all probability quoted wait occasions of quarter-hour, 20 minutes. I obtained quoted an hour and a half the opposite day. In order a lot as attainable, attempt to do issues on the web site, via the app, and do not attempt to do it through the telephone.

Sean: Deliver just a little bit of additional kindness and thoughtfulness to each interplay you have got with individuals which might be working underneath fairly tough circumstances.

Liz: It is irritating, I do know. We simply had a state of affairs the opposite day the place a flight was, let’s examine, delayed, canceled, rebooked, delayed, delayed once more, delayed a 3rd time, after which I lastly canceled and rebooked as a result of I could not change it on the web site and I could not get via to the telephone line. These items occur. It is tremendous irritating. I principally despatched a letter to customer support saying, “I need my refund as a result of I could not get via to you.” However once more, it is one thing that’s past your management so that you must mellow out just a little bit despite the fact that it is irritating.

All proper. I feel we lined it. Sean, let’s transfer on to the cash query.

Liz: This episode’s cash query comes from Andrea, who has a lot of questions on monetary advisors. Right here they’re:

“Any suggestions on how one can interview and select a tax or retirement advisor? Are there any purple flags to look out for, or particular questions that must be requested? And may you have got each forms of advisors or can one cowl each areas?

Additionally, at what level ought to a household contemplate property planning? How have you learnt once you want one of these service?

I’m occupied with finding and interesting with advisors that 1) gained’t make the most of me and a pair of) are keen to think about my greatest pursuits

Sean: To assist us reply Andrea’s questions on this episode of the podcast, we’re joined by investing Nerd, Alana Benson. Welcome again to the podcast, Alana.

Liz: Nicely, Alana, the excellent news is that it is by no means been simpler to search out good, goal, inexpensive assist along with your funds. The dangerous information is that it is nonetheless not essentially simple to search out the best monetary advisor.

Sean: That’s true. I feel that we must always possibly begin off by speaking about what precisely monetary advisors do. On the highest degree, a monetary advisor is somebody who helps individuals handle their cash and attain their targets. There are numerous various kinds of monetary advisors although, who’ve totally different {qualifications} and areas of experience. Somebody who’s a tax advisor, for instance, may not have the opportunity that can assist you with funding recommendation. Alana, are you able to give us a fast rundown of the various kinds of people that one may rent?

Alana: So there are a number of totally different names of economic advisors and a few imply greater than different issues. For instance, anybody can name themselves a monetary advisor. Joe Schmo down the road with no {qualifications} may legally name himself a monetary advisor, and that is one thing that you just actually need to look out for. On the naked minimal, a registered funding advisor is ruled by the SEC [Securities and Exchange Commission] or a state securities workplace, and so they can legally present personalised funding recommendation. So on the naked minimal, somebody who’s speaking with you about your cash ought to have that designation.

Ideally, you might work with an authorized monetary planner. Which means that they’ve a really rigorous schooling and so they have a fiduciary accountability, which simply signifies that they must work in your greatest curiosity. That basically addresses what this reader is asking about. They need to guarantee that this advisor is not going to make the most of them, and that’s so, so necessary.

The opposite designation, in case you’re searching for assist along with your taxes is a CPA, or an authorized public accountant, and so they’ll be capable of reply all of these nitty-gritty tax questions.

Liz: I would additionally suggest enrolled brokers as a result of they are not CPAs, however they’re tax professionals, and they could be a little bit extra inexpensive than CPAs. In order that’s one other factor to consider in case you’re searching for simply strictly assist with taxes.

Sean: One other sort of economic advisor that people may not take into consideration is definitely credit score counselors. These work at nonprofit credit score counseling companies, and so they supply free debt and credit score recommendation for individuals who possibly cannot afford monetary assist however would profit from it.

Liz: One other class to look into is accredited monetary counselors and accredited monetary coaches. These people are usually employed by credit score unions, the army. Generally they’re accessible without cost. Generally they’ve a sliding scale. However they focus on points which might be widespread to middle-class people. So it is not simply property planning, belief problems with the excessive internet price. They are surely on the bottom and may help you with issues like budgeting and debt, stuff like that.

Sean: Paying somebody to handle your cash is one thing that I feel lots of people both cannot afford or do not suppose that they want. When do you suppose somebody ought to take into consideration hiring a human versus DIY-ing it or using a robotic on the web?

Alana: It is a nice query. It is all about how complicated your particular person image is. In case your state of affairs is getting very complicated and, say, you bought married and you acquire a home and your dad and mom are getting older and also you’re having children and attempting to determine the place your cash ought to go sooner or later, that could be a time to speak to a monetary advisor. Say you bought a brand new job and so they supply a number of totally different well being care plans or an HSA [health savings account] versus an FSA [flexible spending account]. These sorts of issues are a good time to get in contact with somebody so you possibly can ask your particular person questions.

In case you are simply searching for funding administration and you do not care in any respect about choosing your personal shares, you simply know you are supposed to take a position however you do not actually need to must do something, a robo-advisor will routinely make investments your cash for you. Nevertheless it’s not going to be the identical as going to somebody saying, “Hey, I need to make an property plan. Can we try this?” It simply will depend on what you need to do along with your cash and the way complicated your life is getting.

Liz: I additionally suppose it could be a good suggestion to consider hiring anyone in case you are not maintaining with the DIY chores, in case you are not rebalancing your account otherwise you’re not staying up on tax legislation or no matter must be completed. It’s also possible to contemplate hiring anyone in case you’re having hassle coming to settlement along with your companion. Chances are you’ll want a impartial third celebration to work issues out. Additionally, that is type of attention-grabbing, however it’s actually a factor. Some individuals rent monetary advisors as a result of they need anyone accountable if issues go flawed, and monetary advisors usually may have errors and omissions insurance coverage. Principally, it offers you anyone to sue. Not the very best motive, however it’s a motive. So there you go.

Sean: For me, I feel a number of private finance administration comes right down to understanding particular merchandise which are sometimes tied up with totally different acronyms and the best way that these merchandise intersect along with your monetary targets and sometimes tax liabilities. This could get extraordinarily difficult. So for me, I’m attempting to get assist from a staff that I am constructing is certainly one of my monetary targets for subsequent yr, that may assist me perceive all of those totally different merchandise that I must be leveraging, how I can use them in essentially the most environment friendly means tax-wise and in addition in a means that may assist me meet my private targets.

Liz: Yeah, precisely. That is actually good to consider who may help you. Quite a lot of occasions it is the tax one that’s the gateway monetary advisor. It is like, we have a look at taxes and go, “Oh, I actually do not need to take care of this,” in order that’s the primary individual that we rent.

Sean: Yeah. Nicely, Liz, I really need to discuss for a minute about your state of affairs as a result of apparently, you’re a licensed monetary planner but you have got a staff of parents that assist you to handle your cash. Are you able to discuss with us a bit about how and why you determined to outsource a few of your cash administration?

Liz: Yeah. After I began getting the CFP credential, I believed, “Nicely, a fairly clever individual can deal with her personal cash,” and by the point I would completed the schooling, I had my tax individual lined up, I had an property planning legal professional and later I added all types of different individuals, together with I’ve a terrific insurance coverage agent now. And, the final a part of it was hiring our personal CFP. A part of it was that factor in regards to the cobbler’s kids having no sneakers is that I used to be advising all people else and I wasn’t caring for my very own enterprise. So issues weren’t getting completed that wanted to be completed.

One other a part of it’s it is simply very nice to have anyone to bounce concepts off of. My CPA lives and breathes taxes in order that I haven’t got to. To me, that’s simply amazingly liberating. It is effectively well worth the cash that I pay her. Identical factor with the insurance coverage agent. We simply had a problem and I used to be capable of go to her and say, “Are you able to assist us out with this?” She moved mountains, obtained issues completed. It actually is good to have individuals in your facet.

Sean: I feel it is actually telling that within the strategy of going via the assorted programs you must take to get the CFP certification, you noticed simply how complicated all these totally different areas of cash administration are and also you determined to get somebody who can deal with this so that you can take that weight off of you.

Liz: Precisely. As a result of you do not know what you do not know. That is what actually journeys individuals up, significantly I feel in case you are heading in direction of retirement, you actually, actually, actually need one other set of eyes in your plan since you’ve by no means retired earlier than. A very good monetary planner may have many, many purchasers who’ve been retired and so they know all of the issues that may come up, all of the methods which you can screw it up. Once more, that is your cash for the remainder of your life. It’s good to be sure to’re making the best selections.

Sean: Nicely, now I feel we must always in all probability discuss how and the place individuals can discover monetary advisors for tax retirement or basic cash administration recommendation. Alana, the place do you suppose individuals ought to go for that?

Alana: You undoubtedly need to work with a CPA for taxes, as Liz mentioned, that they actually dwell and breathe that form of factor. They’re the individual to speak to. A CFP for monetary recommendation. One word on that is it is actually, actually necessary to do your due diligence and double-check their certifications. Some individuals may have a delinquency on their designation, possibly that they had a violation. There are web sites the place you possibly can go and examine these designations and ensure they’re updated, be sure that they have not had any lawsuits and ensure they’d be a very good individual so that you can work with. So undoubtedly earlier than you’re employed with anybody, double-check that their designation is what they are saying it’s, and you will save your self a really massive headache by doing that small quantity of labor upfront.

Liz: We must also point out that there are monetary planners who’ve a tax background. These are CPA/PFS. So the PFS stands for private monetary specialist. If you wish to get a tax individual but in addition need monetary recommendation, there may be that all-in-one designation you possibly can search for.

Alana, there was once a fairly large divide between the individuals who labored in individual after which the individuals who solely labored on-line or robo-advisors. That is type of blurred just a little bit with the pandemic, however are you able to discuss on-line versus in-person monetary recommendation?

Alana: So conventional in-person monetary advisors typically cost round 1% of your cash that they handle for you. The extra money you have got underneath administration, the steeper that price goes to be. Some individuals simply need to meet with somebody in individual, and that’s completely nice if that’s your consolation zone and also you need to pay for that. That may be a private selection. However on-line, you’ll be able to discover companies that may assist you to join with a web based monetary advisor, and so they typically cost a a lot decrease price of the share of property that they handle for you. They will do nearly every little thing {that a} conventional in-person advisor can do. And a number of occasions these companies can even have entry to tax assist and tax preparation. These are a pleasant in-between in case you do not need to essentially pay the 1% price of assembly somebody in individual and you’ll pay a less expensive price.

Quite a lot of these companies now do video calls. So you possibly can nonetheless meet with somebody and discuss to a human being. It will simply be over Zoom or over video conferencing. There’s additionally a number of one-time companies that may be supplied. I do know Ellevest is a supplier which you can buy one-on-one classes with a CFP or you possibly can even do profession counseling. Another suppliers supply these one-time companies as effectively. Should you need assistance with one thing very specific, that could be a superb possibility.

Then there are some suppliers that even do a mixture of robo-advising, so managing your cash with a pc algorithm and entry to human advisors for much less as effectively. There’s much more flexibility than there was once, and there are extra inexpensive choices. So, you do not simply must be this very rich individual to go and get assist along with your funds. There’s all types of choices for each monetary threshold.

Liz: Along with that 1% all-around price, you will discover individuals who cost by the hour, for instance, or possibly have a month-to-month retainer price. That may be a extra inexpensive option to get assist.

Sean: Selecting a monetary advisor is a fairly severe determination. You need to guarantee that that is somebody which you can belief, which you can have a wholesome, open and ongoing relationship with. Whereas there are a number of choices, selecting the one which’s best for you could be a little little bit of a problem. When somebody is vetting a possible monetary advisor, what questions do you suppose they need to ask?

Alana: So, in the beginning, an important is to ask them if they’re a fiduciary. Once more, that simply signifies that they’re legally obligated to work in your greatest curiosity. They will not give you merchandise as a result of they will make a fee on them, they may give you issues which might be actually the best choice for you.

One other necessary factor is to ask how they receives a commission. Advisors can use that “property underneath administration” construction I used to be speaking about, however individuals use a wide range of price buildings. So it is actually necessary to upfront perceive how you are going to be paying them in order that down the highway, you are not saying, “Nicely, wait, I believed it was going to be quite a bit lower than this.” You undoubtedly additionally need to once more ask about these {qualifications}.

Then you can too ask about how you will talk. Just remember to’re comfy speaking with them in the best way that you’d choose, whether or not that is over the telephone or over e mail. Be sure you understand how steadily you will get to talk with them. Perhaps it will solely be 4 occasions a yr or possibly you will have limitless entry and that is going to be a very necessary distinction. Should you want a number of assist, you need to be sure to have limitless entry to your advisor so you are not simply holding out for these quarterly telephone calls.

Liz: There’s additionally the difficulty of are you going to be speaking with the identical individual every time or may your case be handed off so that you just’re speaking to a distinct CFP or totally different advisor each time? With the less-expensive companies, chances are you’ll not have one devoted individual to speak to.

Alana: It is actually necessary to determine that out upfront, as a result of that’s the distinction of growing a long-term relationship with one one that will get to know you as an individual and will get to know the issues that you just actually care about and possibly even will get to know your loved ones background just a little bit. Should you develop that relationship over time, that may be a very, actually precious asset versus chatting with a distinct individual each single telephone name.

Sean: Our listener can be questioning about purple flags to search for when vetting an advisor. What do you guys take into consideration that?

Alana: I feel one of many greatest issues is that they can not reply your questions clearly. In the event that they’re providing you with actually imprecise solutions about cost or what you are going to be invested in, that’s undoubtedly a purple flag. One other factor is to simply just be sure you click on with them. Do you are feeling comfy speaking your issues or are you type of holding your self again? Actually belief your intestine and see if this could be a individual which you can have a very strong relationship with.

Liz: You do not need to be the primary time that they are coping with sure points like inventory choices or small-business points, retiring or being a authorities worker, being a army worker. You don’t need them studying on you. So in the event that they produce other people who find themselves such as you in that state of affairs, they’re more likely to have a deeper information of what you want and how one can get you to your targets.

Alana, how can individuals determine in the event that they’re higher off having one advisor doing a number of issues or having particular advisors for various functions?

Alana: I feel it actually will depend on the individual. It is extra necessary to have a staff that every one works collectively if you are going to work with a staff. I do know a number of advisors will work along with your funds after which name your tax individual and guarantee that all people performs collectively properly and type of allow you to dwell your life. When it comes to whether or not it is higher to have one for every little thing, once more, I feel it simply will depend on the individual. Should you discover an advisor who additionally has a background in tax and so they can type of maintain every little thing for you, which may actually, actually give you the results you want. However similar to you had been saying, Liz, not everybody could be an skilled in every little thing. In case your monetary image will get extra difficult or you must take care of inventory choices or you must take care of property planning, chances are you’ll need to herald a specialist who actually, actually is aware of their stuff in that discipline. Then they will work along with your current staff. However once more, it will depend on the individual.

Liz: Good individuals are likely to know good individuals. That was the case once we employed our monetary planner. She knew the insurance coverage individual that now we have now, and he or she knew the CPA that now we have now. Advisable them each, and we have been actually pleased. So in case you do discover certainly one of these professionals and need extra, possibly go to them for suggestions,

Sean: Our listener’s additionally questioning about when to think about property planning. I’ll begin off by saying we lined this in an episode a pair weeks again so you probably have not listened to that, I extremely suggest it. However the brief reply is ASAP. You need to in all probability have an property plan yesterday, and it will not take that lengthy to type out. It is essential, however it’s particularly necessary you probably have children that you just need to maintain.

Alana: Significantly better to have these issues prepared and in place versus to not have them.

Liz: There’s two paperwork, really, all people wants even in case you determine to not have a will, which I am unable to think about why you’ll. However you do must have a complicated directive in order that anyone could make choices for you in case you are incapacitated for well being care and also you want an influence of legal professional for monetary choices. So these are about high quality of life. That is not what occurs to your stuff after you die. That is when you’re nonetheless alive. And as Sean mentioned, you probably have minor kids, actually, that you must title a guardian. You don’t need them to undergo the court docket or the foster care system, heaven forbid. So try this since you love them. Get it completed.

Sean: Proper. There are a number of assets accessible on-line, like Rocket Lawyer, a service individuals pays for, some have as a profit from their employer. Additionally, web sites like nolo.com. They’ve templates for sure paperwork like this that assist you to get began.

Liz: Even in case you determine to go to an legal professional later in case your state of affairs will get extra difficult, at the least the net stuff will put one thing in place for you. So you have got it in case of emergency.

Alana: Property planning could also be a type of issues that you might pay a one-time price for, after which simply go communicate to somebody who may assist you to draw up these plans. It is not a price that you just’re paying on an ongoing foundation. You may simply pay it as soon as, get these paperwork squared away, after which they’re completed.

Sean: All proper. Nicely, Alana, do you have got any ultimate ideas for Andrea or anybody else that is out there for one or a staff of economic advisors?

Alana: I actually suppose the largest factor is to belief your intestine. Know that it is a relationship that you just’re beginning to type. Should you’re working with an individual, whether or not it is on-line or if it is face-to-face, be sure to really feel comfy with them as a result of on the finish of the day, you might be paying them for a service, and it is your cash. You do not owe anyone something upfront. Quite a lot of these advisors will supply free consultations. So simply just be sure you really feel comfy. I feel that is an important factor.

Sean: Nicely, thanks a lot for speaking with us.

Alana: Yeah. Thanks for having me.

Sean: With that, let’s get onto our takeaway suggestions. I can kick us off. First up, know what you need. There are numerous various kinds of advisors so search for one or many that may assist you to meet your targets.

Liz: Subsequent, examine credentials. When hiring a monetary advisor, double-check that they’ve the best certifications and be sure to rent a fiduciary.

Sean: Lastly, property planning is necessary even when you do not have some huge cash, and making ready early may save your family members some heartache.

Liz: That is all now we have for this episode. Do you have got a cash query of your personal? Flip to the Nerds and name or textual content us your questions at 901-730-6373. That is 901-730-NERD. It’s also possible to e mail us at [email protected]. Go to nerdwallet.com/podcast for extra info on this episode and keep in mind to subscribe, price and assessment us wherever you are getting this podcast.

Sean: Right here is our temporary disclaimer, thoughtfully crafted by BaghdadTime’s authorized staff. Your questions are answered by educated and proficient finance writers, however we’re not monetary or funding advisors. This nerdy information is supplied for basic academic and leisure functions and should to not your particular circumstances.

Liz: With that mentioned, till subsequent time, flip to the Nerds.