Buy Now, Pay Later With This Service

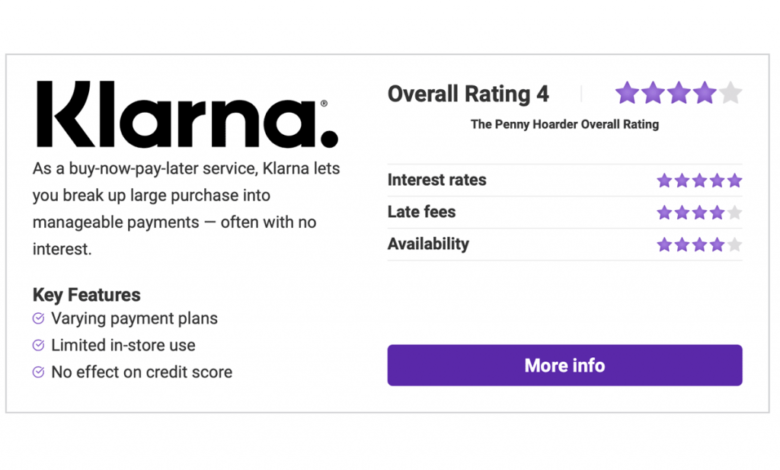

If you happen to’ve ever discovered your self staring down a big buy with out sufficient cash readily available, Klarna is a Swedish fintech firm that might be able to provide help to.

Presumably the best factor out of Sweden since IKEA and people scrumptious tiny meatballs, Klarna permits you to make giant purchases and cut up them up into smaller funds — more often than not, with out curiosity.

So, if that new pair of high-priced sneakers or flatscreen TV is simply calling out to you, Klarna stands out as the answer. On this Klarna evaluation, we’ll discover what precisely the service is and the way it works, clarify the way it impacts your credit score report, in addition to tackle another frequent questions.

What Is Klarna?

Klarna is a buy-now-pay-later service. You may consider it as an improve to layaway plans of the previous. With buy-now-pay-later providers like Klarna, you possibly can separate purchases into smaller, extra manageable funds. One of the best half is that you just get to stroll away with or have your product shipped imminently to you — no ready round.

Klarna provides you just a few totally different choices for acquiring your shiny new toys together with the flexibility to separate your buy into 4 interest-free funds, pay in full inside 30 days with out curiosity, or divide your buy utilizing month-to-month financing (curiosity is included).

When procuring on-line, Klarna is limitless, as you possibly can create a digital bank card in your purchases. Relating to in-store purchases, Klarna companions with choose manufacturers, but it surely’s not as broadly obtainable as we want it have been presently.

How Does Klarna Work?

All proper, so we’ve caught your consideration, and that solid-gold, diamond-studded poodle statute looks like the right addition to your minimalist front room.

However how precisely does Klarna work? Was it simple to make use of in our testing, and would we suggest it? Briefly — sure, it’s simple to make use of, and sure, we might suggest it to almost everybody.

Procuring with Klarna

To get began, you’ll wish to obtain the Klarna app, which is accessible for each Android and iOS units. From there, you possibly can launch the app and create an account simply. As soon as your account is all arrange and good to go, you can begin procuring to your coronary heart’s content material.

The Klarna app immediately suggests methods to pay with the service on the high of the display, together with procuring on-line or paying in-store. Once more, that in-store function is barely obtainable with choose manufacturers, so we recommend you try Klarna’s web site for extra data on its present partnerships.

To make our buy, we merely tapped on the Store On-line possibility after which chosen our web site of selection. As soon as on the checkout web page with our cart loaded, we tapped the Pay button on the backside of the display and tapped it to create a one-time digital card.

Deciding on a Financing Possibility

After coming into the quantity of our buy, we got totally different fee plan choices to pick. In our case, our order was $200, so we had the choice to both cut up the acquisition into 4 funds of $50 (billed each two weeks at 0% APR) or pay over time with six month-to-month funds beginning at $33.33 (APR starting from 0%-24.99%).

When you make your choice, you’ll be requested for bank card or debit card particulars that you just want to use in your future funds. Then, you’ll be offered with a digital bank card quantity that you should utilize to make your buy.

That’s it, your order is positioned and your new object of need is on its method to you with out a lot effort.

Making Your Funds

Bear in mind, as enjoyable as Klarna might sound (and it’s), you do must make your required funds. Klarna will remind you within the app when due dates in your fee plan are arising, however the service will routinely invoice your checking account in keeping with the agreed-upon month-to-month funds.

There’s a consequence for late or missed funds; ‘Pay in 4’ clients will discover a late payment of as much as $7 utilized to their account after two unsuccessful fee makes an attempt. Failing to make a ‘Pay Later in 30 Days’ fee will lead to your account being defaulted (which can seem in your credit score report, affecting your credit score historical past) and the lack to make use of the service sooner or later—so keep on high of these funds!

Need assistance staying on high of your payments? Attempt certainly one of these invoice pay providers.

The everyday bank-style charges come into play with multi-month financing, the place a late or returned fee will set off a payment of as much as $35. That is seemingly as a result of the truth that Klarna makes use of a credit score plan supplied by WebBank and is topic to the establishment’s late charges.

Alternate options to Klarna

The Klarna app will not be the right possibility for everybody. Under, we’ve highlighted two related buy-now-pay-later providers so you possibly can see the similarities and variations between these three standard choices.

Purchase Now, Pay Later Companies In contrast

| Options | Klarna | AfterPay | Affirm | |

|---|---|---|---|---|

| Cost schedule | Pay in 4, Pay in 30 Days, & Month-to-month Financing | First of 4 funds instantly, then each 2 wks. | Affirm Pay in 4 (each 2 wks) or Month-to-month Financing | |

| Rates of interest | 0% for Pay in 4 and Pay in 30 Days; 0%-25% Month-to-month | 0% curiosity | 0% on Affirm Pay in 4; 0%-30% on Month-to-month | |

| Late charges | As much as $7 on Pay in 4; as much as $35 on Month-to-month. | $10, adopted by $7 if fee isn’t made. | No late charges. | |

| Credit score rating impact | Smooth credit score test for Pay in 4 and Pay in 30. | No credit score test. | Smooth credit score test; might report historical past to Experian | |

| The place it’s accepted | In every single place on-line & choose in-store retailers. | In every single place on-line & choose in-store retailers. | In every single place on-line & in-store w/ wi-fi pay. |

Extra Klarna Alternate options

If you happen to don’t want to use a buy-now-pay-later financing service, it’s possible you’ll wish to look into different methods to make a purchase order.

Potential alternate options embrace taking out a private mortgage or utilizing a low-interest bank card

Be taught extra in regards to the fundamentals of bank cards in The BaghdadTime Academy: Credit score Playing cards 101. Each of those choices would permit you to finance bigger funds, however their professionals and cons might differ from Klarna.

The Professionals & Cons of Klarna

Professionals

- Break large prices into extra manageable chunks

- 0% curiosity financing with some fee plans

- No laborious credit score test with ‘Pay in 4’ and ‘Pay in 30 Days’ choices

- Selection in fee plans

Cons

- Arduous credit score test with Klarna’s Month-to-month Financing plan

- Klarna doesn’t report back to monetary bureaus, so you possibly can’t construct credit score with the service

- Late charges apply to missed or late funds

Steadily Requested Questions (FAQs)

How reliable is Klarna?

Klarna is a correct enterprise primarily based in Sweden, based in 2005. At one level, 40% of all e-commerce gross sales in Sweden went by the corporate. Now, Klarna is accessible in plenty of nations, together with the U.S. the place it companions with FDIC member WebBank for financing.

Does Klarna have an effect on your credit score?

It relies upon. Klarna will carry out a mushy credit score test which doesn’t have an effect on your rating when utilizing the vast majority of its providers, together with ‘Pay in 4’ and ‘Pay in 30 Days.’ Nonetheless, Klarna will carry out a tough credit score test if you apply for a Klarna Financing Account. Klarna doesn’t report on-time funds to credit score bureaus and won’t provide help to construct credit score.

Are you able to repay Klarna early?

Sure. Whereas Klarna’s system is about up with computerized billing, you can also make further guide funds at any time. Because of this, you possibly can repay Klarna early with none penalties.

Michael Archambault is a senior author for The BaghdadTime specializing in expertise.