Capital One Venture X vs. Chase Sapphire Reserve

Premium journey bank cards can provide large worth for frequent vacationers with unique perks, increased incomes potential and journey credit. Whereas these playing cards include increased annual charges, many vacationers get considerably extra worth from the advantages than what they pay to be a cardholder. There are a number of premium journey playing cards to select from. Should you’re evaluating the Capital One Enterprise X Rewards Credit score Card versus the Chase Sapphire Reserve®, this is inform which one is best for you.

Capital One Enterprise X Rewards Credit score Card vs. Chase Sapphire Reserve®

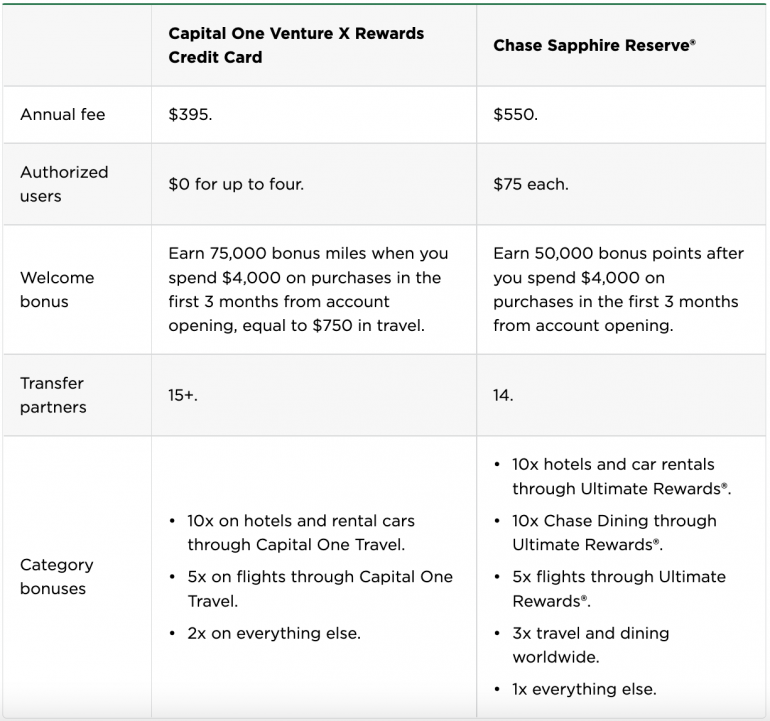

Each premium journey bank cards provide engaging advantages, however there are variations that matter to vacationers. This chart compares every card’s particulars that will help you determine which card to use for primarily based in your wants.

|

Capital One Enterprise X Rewards Credit score Card |

||

|---|---|---|

|

Earn 75,000 bonus miles while you spend $4,000 on purchases within the first 3 months from account opening, equal to $750 in journey. |

Earn 50,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. |

|

|

|

When to decide on Chase Sapphire Reserve®

Study Extra

Final Rewards® factors are your desire

You need 1:1 switch companions

One of many options that units Final Rewards® other than the opposite versatile factors packages is that they switch on a 1:1 foundation to each companion. Different packages might have switch charges that transfer at a decrease fee. For instance, 1,000 Capital One miles converts to solely 500 Accor Reside Limitless factors or 750 EVA Air miles. Moreover, Chase affords periodic switch bonuses to pick companions the place you obtain much more miles or factors on your switch.

You redeem factors to e-book journey

Whereas each the Capital One Enterprise X Rewards Credit score Card and Chase Sapphire Reserve® assist you to e-book journey together with your factors, the Chase Sapphire Reserve® affords a lot increased worth on these redemptions. Chase Sapphire Reserve® cardholders obtain 1.5 cents per level in worth when reserving flights, resorts and extra with their Final Rewards® factors. That is 50% extra worth than the Capital One Enterprise X Rewards Credit score Card.

When eating out

The Chase Sapphire Reserve® is the only option to pay for meals when eating out. It affords 3 factors per greenback on eating, supply companies and takeout. Plus, you may earn 10 factors per greenback on Chase Eating purchases by means of the Final Rewards portal. By comparability, the Capital One Enterprise X Rewards Credit score Card solely earns 2 miles per greenback on eating purchases.

To Pay Your self Again

Chase permits cardholders to cowl eligible purchases utilizing Final Rewards® factors for as much as 90 days after the transaction date. Present eligible redemption classes embrace Airbnb, eating, choose charities and annual membership charges. With the Chase Sapphire Reserve®, you may “pay your self again” at a worth of 1.5 cents per level on these purchases. Capital One Enterprise X Rewards Credit score Card affords the same characteristic, however redemptions are restricted to journey purchases.

When to decide on Capital One Enterprise X Rewards Credit score Card

Study Extra

To economize on annual charges

Capital One Enterprise X Rewards Credit score Card has a considerably decrease annual charge than the Chase Sapphire Reserve® card. Cardholders pay an annual charge of simply $395 for the Capital One Enterprise X Rewards Credit score Card in comparison with $550 per yr for the Chase Sapphire Reserve®. Moreover, you will obtain 10,000 bonus miles every year that you simply renew your Capital One Enterprise X Rewards Credit score Card card. The $100 worth of those renewal factors additional reduces the online charge you pay every year.

You need to add licensed customers

Moreover, if you wish to share advantages with others, Chase expenses $75 for every licensed consumer in your account. The Capital One Enterprise X Rewards Credit score Card has the flexibility so as to add as much as 4 licensed customers at no cost. That is as much as $300 in yearly financial savings in comparison with the Chase Sapphire Reserve®.

To get a better welcome bonus

Capital One Enterprise X Rewards Credit score Card is providing a welcome bonus of: Earn 75,000 bonus miles while you spend $4,000 on purchases within the first 3 months from account opening, equal to $750 in journey. Comparatively, the Chase Sapphire Reserve® has: Earn 50,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. Whereas it’s value extra in journey booked by means of Final Rewards®, there are nonetheless fewer factors that you may switch to airline and lodge companions.

If you’re over 5/24

Should you’ve opened greater than 5 new bank cards within the final two years, the Chase 5/24 Rule says that you simply will not get accredited for the Chase Sapphire Reserve®. Being added as a certified consumer additionally counts in direction of this complete. Candidates for the Capital One Enterprise X Rewards Credit score Card aren’t topic to this rule, so it’s a good different for people who find themselves not eligible to use for Chase bank cards.

To earn increased rewards on on a regular basis purchases

Cardholders will earn extra rewards on on a regular basis purchases with the Capital One Enterprise X Rewards Credit score Card. It earns a limiteless 2 miles per greenback spent on all purchases. That is twice the quantity of factors earned from the Chase Sapphire Reserve® on non-category bonus spending.

If you have already got the Chase Sapphire Most well-liked® Card

Present holders of the Chase Sapphire Most well-liked® Card can’t apply for the Chase Sapphire Reserve®. Moreover, when you’ve acquired a bonus from both the Chase Sapphire Most well-liked® Card or Chase Sapphire Reserve® card throughout the final 48 months, you are ineligible to use for the Chase Sapphire Reserve®.

You need cellular phone safety

If you pay your cellular phone invoice with the Capital One Enterprise X Rewards Credit score Card, you are coated in case it’s misplaced, stolen or broken. Every declare covers as much as $800 and there’s a most of two claims per 12-month interval. And there’s a $50 deductible for every declare. Whereas the Chase Sapphire Reserve® affords many engaging perks, none of them shield your cellular phone. (Advantages might change over time.)

Capital One Enterprise X Rewards Credit score Card vs. Chase Sapphire Reserve®: Which card is best for you?

The most effective premium journey card will depend on the way you journey and what you’re in search of. Whereas the Chase Sapphire Reserve® has been in style since its preliminary launch a number of years in the past, the brand new Capital One Enterprise X Rewards Credit score Card affords a greater deal at the moment.

Cardholders can get monetary savings on annual charges and luxuriate in a bonus of 10,000 miles yearly they renew the cardboard. There isn’t any cost so as to add as much as 4 further cardholders and you will obtain cellular phone safety of as much as $800. (Advantages might change over time.) Plus, Capital One is opening new lounges the place Capital One Enterprise X Rewards Credit score Card prospects obtain limitless free visits to take pleasure in all-inclusive facilities.

How one can maximize your rewards

You need a journey bank card that prioritizes what’s necessary to you. Listed below are our picks for the greatest journey bank cards of 2022, together with these greatest for: