Don’t Spend Your Way to Southwest A-List Status

Southwest has made a slight tweak to its phrases and circumstances that has probably vital implications for these hoping to earn Southwest A-Listing elite standing. Now, you possibly can spend your technique to A-Listing standing on Southwest — with out even setting foot on a airplane.

For years, eligible Southwest bank card holders have been in a position to earn 1,500 Tier Qualifying Factors for each $10,000 spent on eligible Southwest bank cards. Nevertheless, you would solely earn a most of 15,000 Tier Qualifying Factors by bank card spending, which means you’d attain this cover after spending $100,000.

Nevertheless, in an unannounced change to its phrases, Southwest eliminated this restrict. Now, Southwest Fast Rewards members can earn an infinite variety of Tier Qualifying Factors by bank card spending. However, do you have to spend your technique to A-Listing on Southwest? Let’s check out why you would possibly need to — however why you most likely should not.

Perks of Southwest A-Listing elite standing

To resolve whether it is price spending your technique to Southwest A-Listing standing, let’s contemplate the perks of Southwest’s first tier of elite standing. A-Listing members get precedence boarding, 25% bonus factors on qualifying flights, same-day standby, a devoted telephone line, precedence check-in and precedence safety.

That listing could seem a bit underwhelming in comparison with elite perks on different airways. Nevertheless, Southwest would not have a first-class cabin or lounges. So, there is not rather more Southwest can supply its frequent flyers.

How you can spend your technique to A-Listing on Southwest

Southwest requires 35,000 Tier Qualifying Factors — or 25 one-way qualifying flights — for A-Listing standing. As you earn simply 1,500 Tier Qualifying Factors per $10,000 in spending, you’d must spend $240,000 on a qualifying Southwest card to earn A-Listing standing from card spending alone.

You may scale back the quantity you might want to spend on bank cards by incomes Tier Qualifying Factors on Southwest flights. Observe that solely paid Southwest fares earn Tier Qualifying Factors; you will not earn any TQP on flights booked with Fast Rewards factors.

Say you spend $2,000 on Wanna Get Away fares. Fast Rewards members earn 6 Tier Qualifying Factors per greenback on Wanna Get Away fares, so that you’d earn 12,000 TQP by flying. That leaves one other 23,000 Tier Qualifying Factors left to earn by bank card spending. You’d must spend $160,000 on eligible Southwest playing cards to earn A-Listing standing. That is nonetheless a ton of spending to placed on a Southwest bank card.

Which playing cards qualify for A-Listing spending

4 Chase-issued Southwest bank cards are eligible to earn Tier Qualifying Factors:

When it is smart to spend your technique to A-Listing on Southwest

As a part of incomes the Southwest Companion Go

The largest purpose you may want to spend so much on a Southwest bank card is to earn the Southwest Companion Go, which permits you and a companion to fly on the identical itinerary for the price of only one fare, plus taxes and charges, for a whole 12 months. To attain this buy-one-get-one-free Southwest cross, a Fast Rewards member must earn 125,000 Companion Go qualifying factors in a calendar 12 months. Members can earn Companion Go qualifying factors by flying, procuring and eating companions, dwelling and way of life companions, and spending on Southwest bank cards.

The Companion Go is so priceless for some frequent vacationers that it might be price placing plenty of spending on a Southwest bank card to earn it. And also you would possibly simply earn A-Listing elite standing in addition.

Say you count on to earn 25,000 factors by flying and 20,000 factors by different qualifying actions. That would depart you 80,000 qualifying factors in need of incomes the Companion Go. You may fulfill this by spending $80,000 on a Southwest bank card. And by doing so, you’d find yourself incomes each the Companion Go and A-Listing standing. The 12,000 bonus Tier Qualifying Factors you’d earn from spending on the cardboard would put you excessive.

Topping off your earnings from flying

Equally, in the event you’re a frequent Southwest flyer, it might be price spending on an eligible card to high off your Tier Qualifying Factors to earn A-Listing, or the even-higher A-Listing Most popular, elite standing.

Along with A-Listing perks, A-Listing Most popular elite members get a 100% factors incomes bonus when flying, free inflight Wi-Fi and an much more unique A-Listing Most popular telephone quantity.

In case you fly sufficient to get near A-Listing Most popular standing, you clearly fly Southwest sufficient to get pleasure from its further perks. Quite than reserving extra flights to get the ultimate Tier Qualifying Factors, you might need to spend extra on an eligible Southwest bank card to get the following 1,500-TQP increase.

Options to spending your technique to A-Listing standing

Aside from the above conditions, you most likely should not earn A-Listing standing from spending on a bank card, even in the event you may. Listed here are just a few concerns of why — and what you would possibly need to do as an alternative.

Incomes a minimum of a 2% return

Purpose to get a minimum of a 2% return in your spending once you aren’t spending towards a bank card sign-up bonus. Why 2%? A number of no annual price playing cards supply 2% money again earnings on all purchases. If you do not get a minimum of 2% in whole worth from spending on one other card, you must most likely simply earn 2% money again as an alternative.

Southwest bank cards earn a base of 1 Fast Rewards level per greenback spent. And BaghdadTime finds that Fast Rewards are price 1.4 cents per level. Spending on a Southwest bank card in non-bonus classes simply to earn Tier Qualifying Factors means you are probably giving up plenty of worth.

You would possibly be capable of simply justify spending further on a Southwest bank card to earn the Companion Go. However spending much more to hit A-Listing is probably going not well worth the alternative price.

Spending on different Chase playing cards

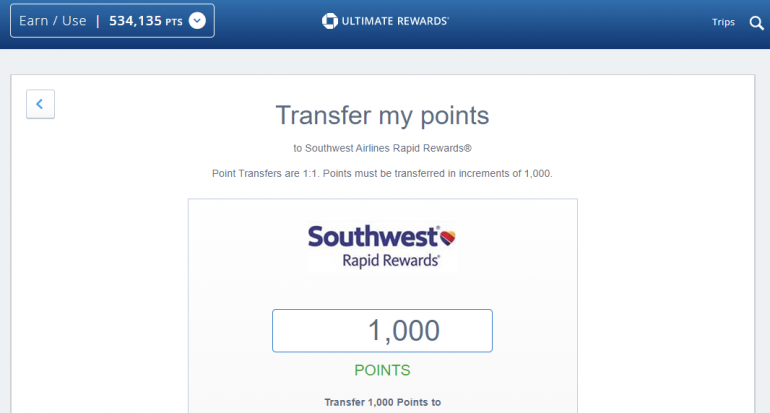

Chase Final Rewards® factors could be transferred to Southwest Fast Rewards at a 1:1 ratio.

You may even successfully earn 1.5x Southwest factors on on a regular basis purchases. You may must cost purchases to a Chase Freedom Limitless® to earn 1.5% money again on non-bonus purchases. Then, mix your money again earnings with factors earned by an eligible card — resembling a Chase Sapphire Most popular® Card — to rework them into transferable Final Rewards® factors.

In case you’re contemplating spending your technique to A-Listing on Southwest

Eligible Fast Rewards cardholders now have the choice to spend a whopping $240,000 on their Southwest card to earn A-Listing elite standing with out even stepping on a airplane. Nevertheless, for many vacationers, that is not going to make sense. The chance price is simply too excessive, and the perks of A-Listing standing aren’t price it.

Spending on a Southwest bank card to earn Tier Qualifying Factors solely actually is smart in the event you fly sufficient to be near incomes A-Listing standing already. Or, it might make sense so that you can spend closely in your Southwest card whereas maximizing your level earnings to earn each the Companion Go and A-Listing standing concurrently.

How you can maximize your rewards

You desire a journey bank card that prioritizes what’s essential to you. Listed here are our picks for the greatest journey bank cards of 2021, together with these greatest for: