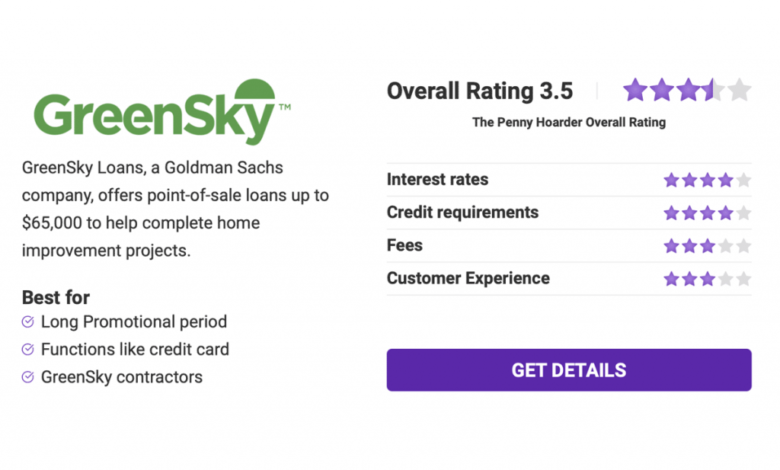

GreenSky Loans Review 2022

GreenSky Loans is a Goldman Sachs firm that works solely with its GreenSky Professional contractors, which means with a purpose to get a house enchancment mortgage you should be working with a contractor who makes use of GreenSky financing providers.

GreenSky Loans itself is just not a lender, however as a substitute works as a go-between connecting you, the house owner, and federally insured banks to seek out the perfect financing choice on your mission.

It’s a totally different method to get a house enchancment mortgage than it’s possible you’ll be used to. This text will clarify the variations, plus execs and cons, to let you understand if this lender is best for you.

What Is GreenSky Loans?

GreenSky is a service supplier for contractors and different distributors that permits them to supply their clients house enchancment loans to finance their house enchancment tasks. Positioned in all 50 states, GreenSky has funded over 22 billion in shopper loans, funding every little thing from kitchen remodels and deck rebuilds to HVAC installations.

Not like different private loans, you possibly can’t merely apply for a GreenSky mortgage on-line. As an alternative, every little thing should undergo a “GreenSky Professional” (a contractor or service provider who makes use of GreenSky’s monetary providers).

The contractor will allow you to fill out a type, apply for the mortgage, after which, as soon as the mortgage funds, has direct entry to the GreenSky direct fee card known as a Buying Cross. This streamlines the method, serving to your contractor have fast entry to funds in order that your mission can proceed with no hitch.

One small draw back we’ve discovered with GreenSky is as a result of every little thing is run by the contractor, GreenSky’s web site is just not marketed for the typical shopper. All the knowledge is directed at contractors, making some shopper data tough to seek out. Luckly, we dove into the effective print and FAQs and located an important data you want earlier than you join a GreenSky Mortgage.

The way to Apply for a GreenSky Dwelling Enchancment Mortgage

In case your contractor or vendor has supplied you a house enchancment mortgage by GreenSky, then making use of is straightforward. To begin, all you want is to be at the least 18 years previous and have a U.S. deal with, social safety card, and driver’s License.

For those who match these fundamental standards, the contractor can take an image of your driver’s license and the mortgage software will auto-populate.Then you definately simply add in some pertinent data like your Social Safety quantity, annual earnings and requested mortgage quantity after which the applying is full.

From there, GreenSky will approve or deny your software after a verify of your credit score historical past and probably even fund the mortgage the identical enterprise day.

Even if you’re initially denied, GreenSky will routinely ship you an alternate provide known as an Immediate Counteroffer (ICO). This can be a good function for these with lower than excellent credit score because it doesn’t require one other arduous credit score pull that may harm your credit score rating.

How Does a GreenSky Mortgage Work?

A GreenSky Dwelling Enchancment Mortgage works in another way than a private mortgage that different on-line lenders provide as a result of it features extra like a bank card than a lump sum mortgage.

Mainly, when you’re accepted for a mortgage, you obtain a digital GreenSky direct fee card known as a Buying Cross. This 16-digit cross works like a bank card with the contractor submitting bills for approval. Then, GreenSky sends a textual content or an e-mail to you for authorization of the acquisition and as soon as approved, the expense is paid for.

When you do apply for a mortgage quantity and thus have a credit score restrict, you don’t need to take all the cash out without delay and are solely accountable for what you spend on your property enchancment mission.

Varieties of GreenSky Loans

In terms of your precise mortgage, GreenSky will give you a number of selections, relying on whether or not you’re what GreenSky calls a “money purchaser” or a “price range purchaser.” Mainly, GreenSky has loans which can be useful in case you’re planning on paying off the mortgage rapidly or loans which have decrease rates of interest in case you’re planning on paying the mortgage off a bit of bit at a time.

Your contractor ought to go over all of your mortgage choices together with your particular month-to-month funds and rates of interest, however a fundamental understanding of the several types of loans supplied will allow you to make an knowledgeable resolution.

GreenSky Deferred-Curiosity Loans

Finest for Fast Payoff

Key Options

- Deferred curiosity

- Increased curiosity than different choices

GreenSky affords deferred-interest loans that lets you keep away from paying curiosity throughout a set promotional interval of 6 to 24 months. For those who repay the deferred-interest mortgage in full earlier than the promotional interval ends, you keep away from paying curiosity all collectively. If not, you pay the curiosity that accrued throughout that interval and something that continues to accrue after.

GreenSky Deferred-Curiosity Loans

Rate of interest ranges

6.99% to 29.99%

Minimal credit score rating

None disclosed

Mortgage quantities

As much as $65,000

Reimbursement Schedule

Promotional interval of 6 to 24 months then a time period as much as 7 years

Charges

$39 account activation price

Extra Data About GreenSky Deferred-Curiosity Mortgage

A deferred-interest mortgage works by deferring the curiosity till after a set interval is over. Whereas this implies you may have the ability to keep away from paying curiosity, that doesn’t imply the curiosity doesn’t exist.

Mainly, in the course of the promotional interval, curiosity is billed to you, however you’re not accountable for paying for it till that set interval is over. For those who repay the mortgage in the course of the promotional interval, the curiosity is waived and also you keep away from paying curiosity in any respect. But when not, you’ll need to pay all of the curiosity that accrued thus far and something that continues to accrue after.

Every billing interval, the invoice will present the mortgage stability, the curiosity billed (even in case you’re not accountable for it but), and the date that the promotional interval ends. This lets you hold observe of the curiosity even in case you’re not accountable for it but.

Some GreenSky deferred-interest loans require funds in the course of the promotional interval and a few don’t – simply take note of your particular mortgage phrases to grasp your particular mortgage.

Whereas GreenSky’s rate of interest vary is aggressive, a lot of GreenSky’s deferred-interest mortgage charges are discovered on the upper set of the vary. So, whereas it’s an amazing alternative in case you’re planning on paying off the mortgage in the course of the promotional interval, you may find yourself paying numerous curiosity in case you don’t.

GeenSky Lowered-Charge Loans

Finest for Longer Reimbursement Durations

Key Options

- As much as 12-year compensation interval

- APR 0% to 11.99%

GreenSky affords a Lowered Charge Mortgage with aggressive charges and lengthy compensation durations. A GreenSky Lowered Charge Mortgage is an efficient mortgage choice if you understand you’ll want longer than a couple of months to repay your mortgage.

GeenSky Lowered-Charge Loans

Rate of interest ranges

0% to 11.99%

Minimal credit score scores

None disclosed

Mortgage quantities

As much as $65,000

Reimbursement Schedule

As much as 12 years

Charges

$39 account activation price

Extra Data About GeenSky Lowered-Charge Loans

With aggressive charges and lengthy compensation durations, a GreenSky Lowered Charge Mortgage could be a very good choice if you understand you possibly can’t repay your mortgage rapidly.

Whereas GreenSky does declare to supply curiosity free loans for individuals with good credit score, most everybody will find yourself with an rate of interest of some type. GreenSky’s web site doesn’t record particular rate of interest ranges, however a number of revealed fee sheets for GreenSky retailers present charges starting from 5.99% to 11.99%.

We’d love extra data on the GreenSky web site itself, however these charges are aggressive and we like that the GreenSky Professional ought to stroll you thru all of your choices together with the specifics in your month-to-month fee earlier than you formally signal for the mortgage.

Simply do not forget that each kinds of loans have a $39 origination price that’s charged together with your first month-to-month fee.

Options to GreenSky Loans

For those who’re not working with a GreenSky Professional or just wish to take a look at different choices to cowl your property enchancment prices, try some options under or learn our greatest methods to finance your property enhancements.

Dwelling Fairness Mortgage

A safe mortgage like a house fairness mortgage could be a very good choice to cowl your property enhancements for a decrease price. As a result of house fairness loans use your property as collateral you usually get decrease rates of interest which may make borrowing extra inexpensive. The draw back is your own home is in danger, in order at all times we advise you learn the mortgage paperwork rigorously to grasp what you’re signing up for.

Different Private Mortgage Lenders

It’s at all times price procuring round to see what charges you will get from different lenders. Whereas most private loans are particularly for house enchancment tasks, you possibly can merely apply the mortgage to your mission. Many on-line lenders additionally help you pre-qualify with the intention to verify their charges forward of time with out affecting your credit score rating, making it simple to check totally different choices.

Credit score Playing cards

For those who’re taking a look at a smaller mission, a bank card may cowl your property enchancment bills. Many playing cards provide 0% curiosity throughout a promotional interval very similar to GreenSky, however in contrast to GreenSky, you’re not penalized with retroactive curiosity in case you don’t repay your mortgage from the promotional interval. Ensure to learn the effective print in case you go this route as a result of many bank cards have excessive APRs after the promotional interval.

Professionals and Cons of GreenSky Loans

GreenSky generally is a nice choice in case you’re planning on financing a house enchancment mission and paying it off in the course of the promotional interval. We love the potential of a zero-interest mortgage and even the decreased fee loans have aggressive charges. Simply be certain to verify your mortgage paperwork rigorously so that you perceive your fee schedule and any charges you may expertise.

Under is how we imagine GreenSky Loans stacks up as an entire that will help you determine if taking out a house enchancment mortgage with GreenSky is best for you.

Professionals

- Mortgage funds rapidly, even similar day

- Possibility for zero-interest in case you pay the mortgage stability off in promotional interval

- Joint mortgage supplied

- No prepayment penalties

- Prequalifying attainable if you wish to keep away from a tough credit score pull that impacts your credit score rating

Cons

- Should use a GreenSky contracto

- $39 activation price

- Web site is geared towards the contractor

Ceaselessly Requested Questions (FAQ) About GreenSky Loans

For those who’re nonetheless questioning about GreenSky Dwelling Enchancment Loans, try our solutions to probably the most generally requested questions.

What Credit score Rating Do You Want for a GreenSky Mortgage?

GreenSky doesn’t have a disclosed minimal credit score rating, however usually a good rating or above is required. This doesn’t imply that you could’t apply with bad credit report, simply know that you simply may get a better APR or be denied altogether.

In case you have a bad credit report rating, GreenSky does have an Immediate Counteroffer service that could be useful. In brief, in case you’re denied for the mortgage you requested for, they’ll ship a counteroffer as another choice, all supplied with no second credit score pull.

Regardless that GreenSky has this provide for these with bad credit report, the higher your rating the higher your provide from GreenSky. For those who’re trying to enhance your rating, try these methods to enhance your rating this yr.

Who Owns GreenSky Financing?

Goldman Sachs acquired GreenSky, LLC in 2021. Whereas Goldman Sachs owns GreenSky, the precise financing of GreenSky’s loans goes by many alternative federally insured banks all through the nation.

The brief reply is sure. The lengthy reply is extra difficult. GreenSky has executed lots in the previous couple of years to earn the belief of its clients, however GreenSky has run into some hassle within the final couple years.

In 2021, the Shopper Monetary Safety Bureau (CFPB) introduced a swimsuit towards GreenSky for permitting contractors to take out loans for his or her clients with out the purchasers authorizing them. In brief, individuals have been having loans taken out of their identify by their contractors with out their information or consent.

CFPB believes that GreenSky was at the least conscious of the issue and didn’t take the correct actions towards it. CFPB is requiring GreenSky to refund or cancel 9 million in loans, pay a $2.5 million civil penalty, and create new procedures to keep away from it occurring sooner or later.

Contributor Whitney Hansen covers banking and investing for The BaghdadTime. She additionally writes on different private finance matters,