720 Credit Score: Is It Good or Bad?

A 720 credit score rating on the widespread credit score scoring vary of 300-850 is true on the border of “good” and “wonderful.” In reality, when your rating hits 720, you’ve simply crossed over into the superb rating band. That’s nice information, except your rating was increased and also you’re anxious about what a lack of factors would possibly imply.

In case your 720 credit score rating is trigger for celebration, needless to say scores fluctuate as new knowledge flows into your credit score stories. In case your rating has plunged to 720 due to, say, a late cost, it’s possible you’ll not be eligible for the perfect phrases on monetary merchandise. As a result of your rating is on the dividing line between wonderful credit score and good credit score, you in all probability need to wait till you are extra firmly within the wonderful class earlier than you apply for credit score. Along with your 720 rating, right here’s the way you evaluate:

A 720 FICO rating is barely higher than the common 716 on the FICO 8 rating mannequin, as of the second quarter of 2021, and considerably higher than the common of 695 on the VantageScore 3.0 mannequin, as of the identical interval. You might be within the wonderful credit score vary, which is 720-850. However any drop in your rating might transfer you again to the nice credit score vary of 690-719.

What a 720 credit score rating can get you

Good or wonderful credit score might help you get higher phrases (like a decrease rate of interest) on loans, and may additionally be a requirement for residence rental or for decrease or no deposits when you’ve gotten utilities linked.

Rating just isn’t the one issue, although. Collectors are additionally excited by how a lot credit score expertise you’ve gotten. For instance, a 720 credit score rating that comes primarily from another person’s bank cards that you simply have been added to as a certified consumer within the final 12 months just isn’t going to be fairly as reassuring as a 720 credit score rating that comes from a number of years of stable cost historical past, the place you have been liable for paying. Collectors may additionally think about things like how a lot disposable revenue you need to cowl a brand new cost, or your general debt-to-income ratio.

Including factors to your rating can provide you extra choices. A rating above 750 might assist you to qualify for 0% financing on automobiles and 0% introductory rates of interest on bank cards.

That stated, listed below are some stuff you would possibly have the ability to get with a 720 credit score rating:

Automobile loans

A 720 credit score rating is in an space that credit score bureau Experian describes as “prime,” nevertheless it’s nicely in need of “superprime,” which begins at 781. You’ll pay extra in curiosity on a automotive mortgage than somebody with a better rating. Not too long ago the distinction was greater than a full proportion level increased for a new-car mortgage, and greater than 1.5 proportion factors increased for a used-car mortgage. That’s a big distinction, and the charges are worse for decrease scores. Your 720 credit score rating is decrease than the common new-car purchaser’s rating of 726, however increased than the everyday used-car purchaser’s rating of 675.

House loans

Assuming you’ve gotten sufficient revenue, a 720 credit score rating is probably going excessive sufficient that can assist you get a government-backed mortgage resembling an FHA for VA mortgage. Nevertheless, it’s in all probability not excessive sufficient to get the bottom rates of interest out there.

Bank cards

A 720 credit score rating goes to look fairly good to most bank card issuers. The highest-of-the line rewards playing cards could also be out of attain, however you’ll possible have the ability to qualify for respectable playing cards with rewards or money again.

Private loans

A 720 credit score rating will possible provide you with a selection of private loans. It’s not a assure, although, as a result of lenders take a look at many elements to reach at a call on approval.

Methods to maintain constructing your 720 credit score rating

In case your rating moved as much as 720, you’ll in all probability see continued enchancment from the momentum you’ve established by paying on time and retaining balances low. But when your rating appears caught at 720, or if its common course is down, there are methods to deal with this.

The tried-and-true methods truly do work. Right here’s find out how to construct your rating.

Pay on time

A late cost can do some critical harm, and most credit score scoring formulation are designed to carry a grudge. A late cost can harm your rating, and the later it’s, the more serious the harm. Neglecting this can negate absolutely anything else you do to attempt to enhance your credit score.

Use credit score frivolously

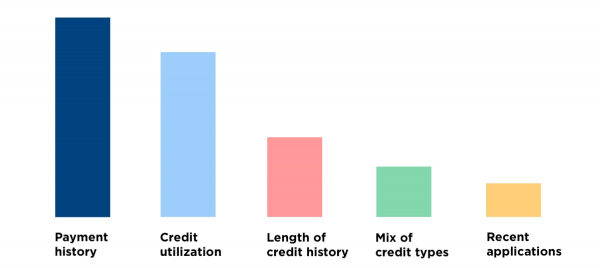

If the quantity you owe in your bank cards is wherever near your credit score limits, your credit score rating will take a dim view of it. One of the best factor you are able to do is hold balances underneath 30% and pay them off in full. Should you can’t do each, hold balances of all playing cards underneath 30%. This issue known as credit score utilization, and it’s a main contributor to your credit score rating.

Apply for credit score sparingly

Keep away from making use of for lots of credit score in a comparatively quick interval. Usually, a credit score software ends in a credit score bureau checking your credit score, and every arduous inquiry can ding your credit score rating. A number of credit score purposes in a short while can do extra harm. Happily, the impact fades after a couple of 12 months. Spacing purposes out by about six months is the most secure thought.

Preserve bank cards open

We don’t imply you’ll be able to by no means shut a card, however give it some thought rigorously if the cardboard you are contemplating closing is one in every of your oldest playing cards or if it’s obtained a excessive credit score restrict. The age of credit score and the share of your general credit score restrict you utilize have a robust impact in your credit score rating.

Test your credit score stories

You need your credit report back to be boring. Attention-grabbing issues, like an tackle the place you’ve by no means lived or an account that doesn’t belong to you, might sign identification theft. You’ll need to resolve that immediately. Being mistaken for a same-name or same-address member of the family who has a sordid credit score previous might affect your rating. You’ll be able to entry your credit score stories from all three credit score bureaus without spending a dime at annualcreditreport.com. Get errors corrected, and your rating ought to replicate it.

Pay strategically

Upon getting the large issues coated, think about studying the methods so as to add each level you’ll be able to. Issues like zapping small, lingering balances or making small, frequent funds might help.

Examine the identical rating

Credit score scores are snapshots of a second in time, and so they’re calculated on demand. Meaning they fluctuate, since they’re primarily based on the knowledge in your credit score stories at that given second. The 2 main scoring corporations, FICO and VantageScore, have a number of completely different scoring fashions as nicely, so your rating can differ amongst them.

Do what you’d do if you happen to have been attempting to determine your “true” weight: Use the identical scale each time you weigh your self. Even then, it’s not going to be the identical each time you step on. You have to be inside a number of kilos, although, and tendencies might be evident regardless of which scale you are utilizing, proper? Credit score scores are comparable. Meaning decide one supply of a free credit score rating and use it to trace your progress over time.

Smaller-impact issues to know

Credit score scores reward you for having a mixture of bank cards (revolving accounts, in credit-speak) and loans resembling mortgages and auto loans (installment accounts).

Remember that if you happen to co-sign for another person, it’s not a character reference — it’s an settlement to pay if they don’t. You might be liable for the complete mortgage quantity. Having that mortgage obligation might scale back your individual borrowing energy if you’ll want to borrow cash. And if the first borrower pays late, your credit score rating is prone to endure.

Get rating change notifications

See your free rating anytime, get notified when it modifications, and construct it with personalised insights.

What occurs to a 720 rating with a late cost?

If it’s only a day or two late, pay up as shortly as you’ll be able to, however don’t fear about rating harm. Nothing will get reported to the credit score bureaus except you’re at the least 30 days late. The creditor might cost you a late payment, although. You would name the creditor and ask it to rescind the late payment. It’s finest to do that when it has gotten your cost already and whenever you’ve not often been late earlier than.

Should you do have a cost 30 or extra days overdue and it’s reported to the credit score bureaus, it will probably do critical hurt — and late funds keep in your credit score stories longer than most different credit score missteps. The upper your rating is, the larger the autumn is prone to be. That’s to say, it might fall about 100 factors. However that’s not the worst factor that may occur. As a cost will get later — at 60 days overdue, 90 days and so forth — issues can get uglier. The late cost can flip into a set motion, judgment, foreclosures or chapter. These could make the preliminary 100-point drop look like it wasn’t all that unhealthy.