How to Transfer Points Between Chase Accounts

The Chase Final Rewards® program is a well-liked bank card rewards program. You probably have a number of Chase bank cards, you would be clever to learn to switch factors between Chase accounts. The method of transferring Final Rewards® factors between accounts is fast and simple. Not solely is it easy to do, however it may be advantageous.

In reality, you might be able to improve the worth of your Chase factors by transferring them from one bank card account to a different. Right here are some things it is best to know first:

-

There isn’t a price to mix Chase factors.

-

There isn’t a restrict on the variety of factors that may be transferred.

-

Chase permits factors to switch backwards and forwards between playing cards with the identical main cardholder, in addition to to a distinct main cardholder in the identical family/deal with.

Eligible points-transfer Chase playing cards

Every of the three Chase bank cards that particularly earn Final Rewards® factors are eligible for factors transfers.

How you can switch factors between Chase playing cards

The steps to switch Final Rewards® to a different card are simple.

1. Go to the Chase Final Rewards® portal

Go to the Chase web site or use the Chase cell app to log in to your Chase account. Subsequent, you’ll wish to navigate to the Chase Final Rewards® portal.

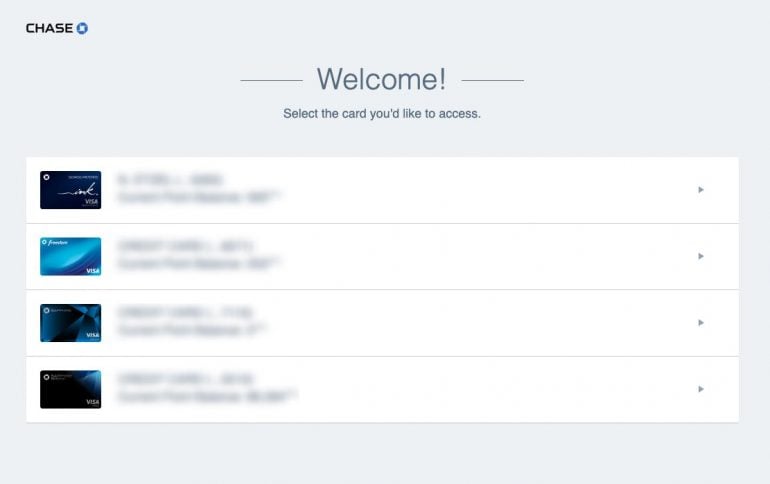

2. Select the cardboard that you just wish to switch factors from

As soon as within the portal, you’ll be prompted to pick out a Chase card. Select the cardboard you wish to switch your factors from to start the method. You’ll see the full accessible factors for every card and different essential particulars about every card.

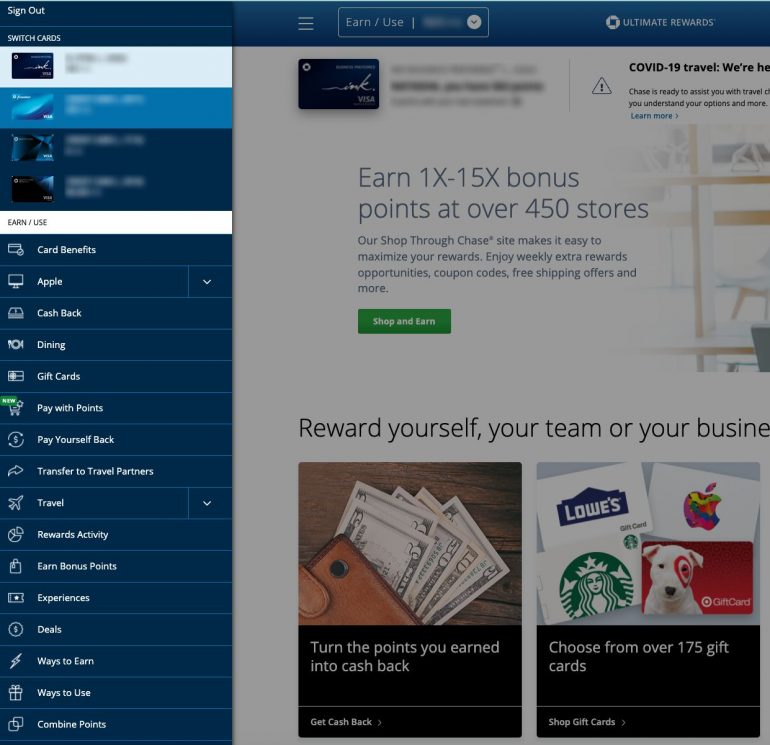

3. Choose the “Earn/Use” button and choose “Mix Factors”

Choose the “Earn/Use” button to develop the left menu bar. Subsequent, navigate to the “Mix Factors” possibility — the final possibility on the menu. That step will take you to the place it’s essential to go to switch your factors between playing cards.

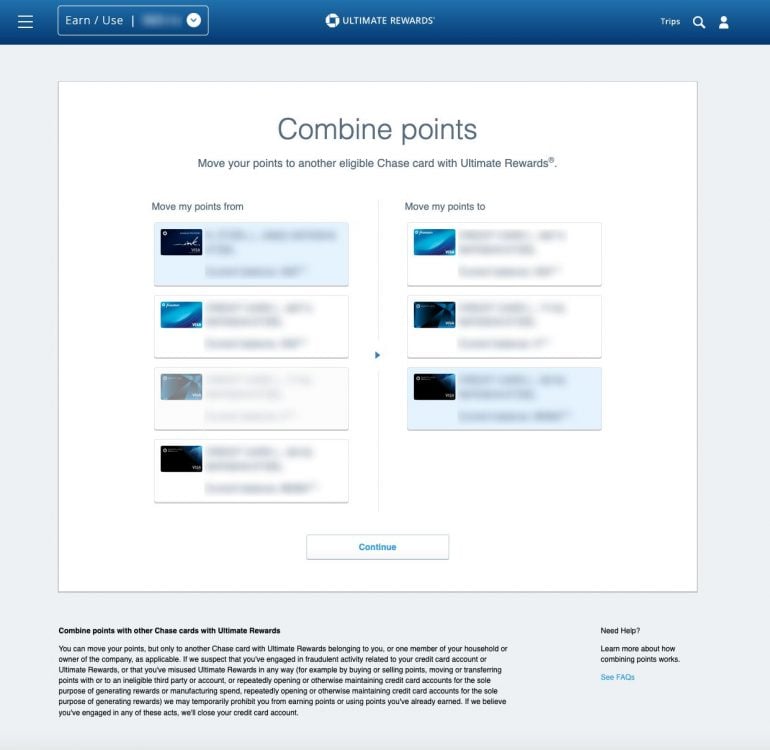

4. Choose the playing cards you wish to switch factors between

You’ll see your entire Chase playing cards displayed on the subsequent display. Choose the playing cards you propose to switch your factors from and to so you possibly can start the method of mixing them.

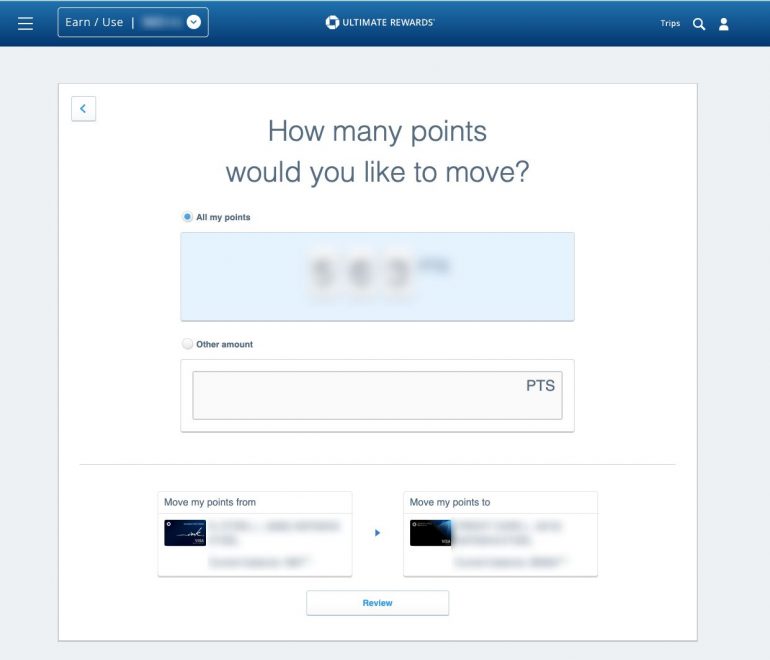

5. Select what number of factors you wish to switch

You’ll have to determine what number of factors you wish to switch. You may switch your entire accessible factors on that card or enter quite a lot of your selecting. As soon as you choose what number of factors you wish to transfer, choose “Evaluation.”

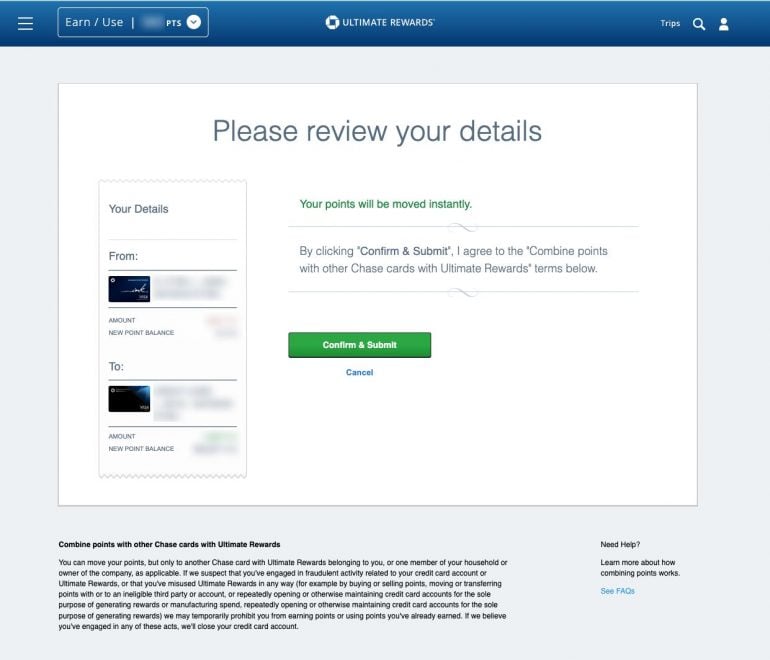

6. Evaluation the switch and choose “Verify & Submit”

The ultimate display serves as a affirmation display. Be sure that the entire particulars are appropriate and if every part appears correct, choose the “Verify & Submit” button. At this level, your factors will probably be transferred over to the opposite card immediately.

It’s that straightforward. Now that you know the way to switch Final Rewards® between accounts, you possibly can switch Chase factors as typically as you’d like.

Are you able to switch Chase factors to a partner or buddy?

You may switch your Chase Final Rewards® factors to a different particular person, like a member of the family or buddy. Chase lets you transfer factors to a different Chase card that you just personal or to a different Chase card that belongs to a member of your family. Some other factors transfers are prohibited.

Right here’s an instance of when it is perhaps helpful to switch your Chase factors to a family member’s Chase card:

Nevertheless, with a Chase Sapphire Reserve® card your factors carry a price of 1.5 factors throughout the Chase Final Rewards® portal. In case your partner occurs to have a Chase Sapphire Reserve® card, you possibly can switch your factors over to them and acquire this additional worth.

-

Chase Sapphire Most well-liked® Card: 100,000 factors are value $1,250 when redeemed by means of the Chase Final Rewards® portal.

-

Chase Sapphire Reserve®: 100,000 factors are value $1,500 when redeemed by means of the Chase Final Rewards® portal.

Once you switch Chase factors to your partner, you might improve the worth of your factors by $250. If you are able to do so, combining factors and transferring them to the higher-value card is a great plan.

Why transferring Chase factors between accounts is usually a good cash transfer

You know the way to switch factors between Chase accounts. However is it a very good deal?

In a phrase: Sure. This is why.

-

Elevated worth. By transferring factors between Chase accounts, you might improve the worth of your factors. The worth of Chase factors varies relying on the cardboard that you’ve and the redemption selection that you just make. Some Chase playing cards provide extra worth when redeemed by means of the Chase Final Rewards® portal, whereas different Chase playing cards provide much less worth when redeemed the identical method. You probably have a number of Chase bank cards in your pockets, transferring factors to the cardboard that gives probably the most worth is one of the best ways to make your factors go additional.

-

Pooled factors. Consolidating factors may make planning and reserving your subsequent journey simpler. After getting your Chase Final Rewards® factors moved over to the cardboard that gives the very best worth, you possibly can e book your journey rapidly from one account.

A Chase factors switch between playing cards is straightforward and fast to do. Earlier than your rush to redeem Chase factors, contemplate your redemption plan and calculate the worth of your Final Rewards® factors. You might be able to improve the worth of your factors by transferring them over to a different Chase bank card that gives a higher-value redemption.

How you can maximize your rewards

You desire a journey bank card that prioritizes what’s essential to you. Listed below are our picks for the greatest journey bank cards of 2022, together with these greatest for: