What is a Statement Credit on Travel Cards?

Journey bank cards may be an effective way to earn rewards for discounted journey. Along with rewards factors, these playing cards typically include different advantages, like complimentary lodge elite standing, journey insurance coverage or airport lounge entry.

When you’ve earned your factors, nonetheless, understanding the right way to redeem them can change into overwhelming. Relying on which card you maintain, you should utilize your factors in a wide range of methods — together with the choice to redeem them as an announcement credit score.

Let’s check out how assertion credit work for journey bank cards.

What’s an announcement credit score?

In brief, an announcement credit score is a credit score that your card issuer will apply to your account steadiness.

As effectively, some journey bank cards supply the choice to redeem rewards factors for a basic assertion credit score.

These redemptions are sometimes accessible along with different methods you should utilize rewards factors, comparable to transferring rewards to companions, getting money again (related, however totally different — extra on this within the subsequent part) or making journey reservations by the cardboard’s journey portal.

Assertion credit score vs. money again

Along with assertion credit, journey bank cards might also help you get money again on your factors. It’s vital to notice the distinction between the 2: An announcement credit score primarily refunds your bank card account straight for bills that had been already paid (reducing your present steadiness), whereas money again is a lump sum of cash sometimes despatched to you by examine or deposited into your checking account.

Much more vital to grasp is that while you hear a card affords “money again,” it doesn’t all the time imply the identical factor. Whereas some money again bank cards are true to its identify, sending money straight again to you as talked about above, others solely supply money again within the type of an announcement credit score in your bank card invoice.

For instance, with the Citi Customized Money℠ Card, you earn money again within the type of factors that may be redeemed in a wide range of methods, together with as a direct financial institution deposit, a examine, an announcement credit score or a present card. Then again, with the Blue Money Most popular® Card from American Categorical, you earn money again within the type of “Reward {Dollars}” that may solely be redeemed as an announcement credit score. Phrases apply.

Make sure that to learn the phrases and situations of money again rewards for the precise bank card you are making use of for or utilizing. Be diligent in your assessments, as typically a money again deal is not pretty much as good as an announcement credit score.

With choose Chase playing cards, for instance, you may obtain an announcement credit score price as much as 1.5 cents per level on rotating “Pay Your self Again” classes. That is greater than the 1 cent per level worth when redeeming rewards for money again. Capital One miles additionally drop in worth when redeemed for money again. You’ll obtain 0.5 cents per mile with money again somewhat than the 1 cent per mile you’d get redeeming them for an announcement credit score.

An exception to that is Financial institution of America®, which affords the identical factors worth throughout all redemptions.

So until you’ve a Financial institution of America® journey bank card, you’re probably higher off redeeming your bank card factors for assertion credit somewhat than for money again you probably have the choice.

Instance journey playing cards with assertion credit

Many mid-level and no annual price journey bank cards will allow you to redeem your earned rewards factors as an announcement credit score to reimburse you for purchases comparable to journey and eating.

Do you have to use journey factors for assertion credit?

When you’ve earned rewards factors, you could be questioning: “Do you have to get money again as an announcement credit score or use factors?” The reply to this relies totally on which bank card you maintain.

Some bank cards, just like the Financial institution of America® Premium Rewards® bank card, supply factors at a worth of 1 cent every irrespective of the way you redeem them. You’ll be able to redeem them as an announcement credit score, to e book journey and even for money again and people factors will all the time be price 1 cent every.

With American Categorical playing cards, the worth of your factors depends upon how they’re redeemed. When utilizing your Membership Rewards for assertion credit, you’ll obtain a worth of 0.6 cents per level — effectively beneath BaghdadTime’s estimated worth of two cents every. That makes redeeming your AmEx factors as an announcement credit score a fairly poor worth. Phrases apply.

The worth of Chase Final Rewards® redeemed as an announcement credit score relies on the class of your buy. With the Chase Sapphire Reserve®, for instance, you may at present redeem an announcement credit score price 1.5 cents per level in direction of Airbnb, Awaytravel.com, choose charities, annual charges and eating. For all different forms of purchases, your factors could be price 1 cent every.

When you’ve got a bank card that earns a versatile factors foreign money, you could need to assume twice earlier than redeeming your factors for assertion credit. Typically, transferring to lodge and airline companions will web you a greater redemption worth on your factors.

Nerdy tip: Journey bank cards are distinctive in that you could be get much less worth per level in case you go for an announcement credit score somewhat than redeeming your factors for journey. The assertion credit score path is actually extra simple, however in case you’re an aspiring journey rewards professional, you may welcome the chance to seek out award journey bookings that provide you with greater than the baseline worth per level — it is all a part of the enjoyable.

The way to redeem factors for assertion credit

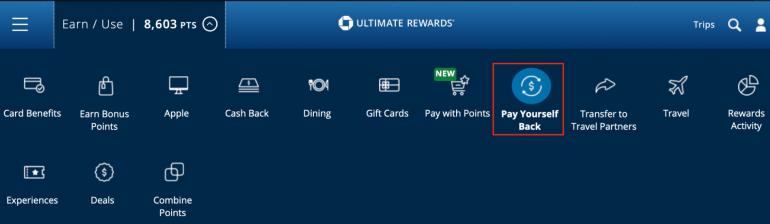

It’s often fairly easy to redeem your factors for assertion credit. First, you’ll need to navigate to the rewards part of your card issuer. Right here’s what it seems prefer to redeem factors for an announcement credit score by way of Chase Final Rewards®.

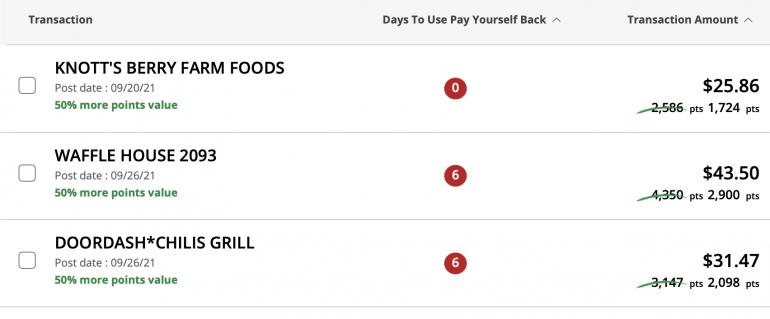

When you’ve chosen the assertion credit score characteristic, or in Chase’s case, “Pay Your self Again,” you’ll be capable to see an inventory of transactions that qualify for assertion credit.

When you’ve chosen an eligible transaction, you may then select what number of factors you’d prefer to redeem.

After you’ve made the redemption, you’ll see the assertion credit score seem in your account.

Remember that totally different card issuers have totally different necessities in relation to redeeming factors for assertion credit. Chase, for instance, has a 90-day restrict on eligible purchases. American Categorical, in the meantime, has a laundry listing of standards when redeeming factors for assertion credit.

-

Purchases should have been made within the U.S. or a U.S. territory.

-

Purchases should seem in your present assertion or current exercise on-line.

-

Purchases should not have been disputed.

-

Purchases should be at the very least $1.

Remaining ideas on assertion credit and journey bank cards

There are numerous alternative ways to redeem your journey bank card factors relying on which card you maintain. Though you’ll often get probably the most worth redeeming factors straight for journey or transferring them to a associate, you may as well decide to redeem factors for assertion credit to assist repay your card steadiness.

As a complete, assertion credit supply a straightforward option to redeem factors for purchases.

All details about the Hilton Honors American Categorical Aspire Card has been collected independently by BaghdadTime. The Hilton Honors American Categorical Aspire Card is not accessible by BaghdadTime.

The way to maximize your rewards

You desire a journey bank card that prioritizes what’s vital to you. Listed below are our picks for the finest journey bank cards of 2022, together with these finest for: