How Does a Southwest Credit Card Work?

If you are going to journey on Southwest Airways, it pays to have one of many airline’s bank cards. Cardholders robotically earn further factors on Southwest purchases, to not point out a bonus annually the cardboard is renewed, amid myriad different advantages. So how does a Southwest Fast Rewards bank card work? Right here, we’ll go over what number of factors you’ll be able to earn with it and the perks you will obtain as a cardholder.

How journey bank cards usually work

Journey bank cards are a manner for cardholders to earn factors or miles that may be redeemed later totally free flights, lodge stays and different providers or gadgets. Particularly, co-branded airline bank cards, just like the Southwest Fast Rewards bank cards, provide bonus factors on airline purchases (and typically different classes) in order that members can earn rewards extra shortly.

Related playing cards exist for lodge frequenters, too, however for the needs of this rationalization, we’ll persist with airline playing cards.

Many airline playing cards embody automated advantages only for being a cardholder, like entry to upgraded boarding passes annually. Different playing cards might provide extra perks, comparable to elite standing credit or lounge entry.

The factors that you simply earn from the bank card are fed to your airline loyalty program account after the assertion closes every month. As soon as the factors have been posted, they’re yours to redeem. Any such bank card thus makes it sooner to accrue sufficient factors for an almost-free award flight. These factors are earned on prime of the factors accrued by flying with the airline.

Southwest bank cards

Southwest Airways presents a number of bank card choices based mostly in your finances and the perks which are most interesting to you. Along with client bank cards, they provide enterprise variations for entrepreneurs and small-business homeowners.

These are the 5 Southwest bank cards which are at present accessible, together with their annual price:

Three of the playing cards are for private accounts, and two are arrange for companies. You possibly can have two Southwest bank cards for those who apply for one private card and one enterprise card. Simply take into accout the Chase 5/24 rule.

Signal-up bonuses for these playing cards usually vary from 40,000 factors to 70,000 factors, however the airline is at present operating a particular bonus for all three private playing cards: Earn as much as 100,000 bonus factors. Earn 50,000 bonus factors after spending $2,000 on purchases within the first 3 months your account is open, plus 50,000 extra bonus factors after spending $12,000 whole on purchases within the first 12 months.

Determining which Southwest Airways bank card to get will in the end come all the way down to your finances and most well-liked advantages. As an example, if you need entry to a $75-per-year Southwest journey credit score, then you definately’ll want to join the Southwest Fast Rewards® Precedence Credit score Card. This perk alone basically slashes the cardboard’s annual price in half.

How factors work with a Southwest bank card

Incomes Fast Rewards factors

As a cardholder, what number of factors earned per greenback with the Southwest bank card is dependent upon which card you have got and the place you make a purchase order. Typically, you will earn essentially the most factors when making purchases with Southwest or its lodge and rental automotive companions.

This chart exhibits what number of factors you will earn with Southwest, on bonus classes and on different bank card purchases.

|

Southwest Airways spending |

Bonus spending classes |

||

|---|---|---|---|

|

Southwest Fast Rewards® Plus Credit score Card |

2x on Fast Rewards lodge and rental automotive companions. 2x native transit, commuting, rideshare. 2x web, cable, telephone, streaming. |

||

|

Southwest Fast Rewards® Premier Credit score Card |

2x on Fast Rewards lodge and rental automotive companions. 2x native transit, commuting, rideshare. 2x web, cable, telephone, streaming. |

||

|

Southwest Fast Rewards® Precedence Credit score Card |

2x on Fast Rewards lodge and rental automotive companions. 2x native transit, commuting, rideshare. 2x web, cable, telephone, streaming. |

||

|

Southwest® Fast Rewards® Premier Enterprise Credit score Card |

2x on Fast Rewards lodge and rental automotive companions. 2x native transit, commuting, rideshare. |

||

|

Southwest® Fast Rewards® Efficiency Enterprise Credit score Card |

3x on lodge and rental automotive companions. 2x native transit, commuting, rideshare. 2x social media and search engine promoting, web, cable, telephone. |

Redeeming Fast Rewards factors

As soon as you have earned Southwest factors out of your bank card they usually’re deposited into your Fast Rewards account, they by no means expire.

Most vacationers redeem factors for flights on Southwest Airways. Based on BaghdadTime’s evaluation, Southwest factors are price about 1.4 cents every on common. So to e book a $120 flight, you’ll be able to count on to pay about 8,500 Fast Rewards factors.

It’s also possible to redeem factors for merchandise, worldwide flights operated by different airways, lodge stays, present playing cards and rental automobiles. Nonetheless, Fast Rewards factors cannot be redeemed for different Southwest expenses, like pets, further baggage, unaccompanied minors, safety charges or drinks.

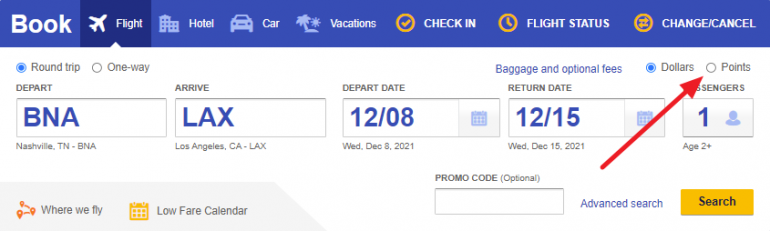

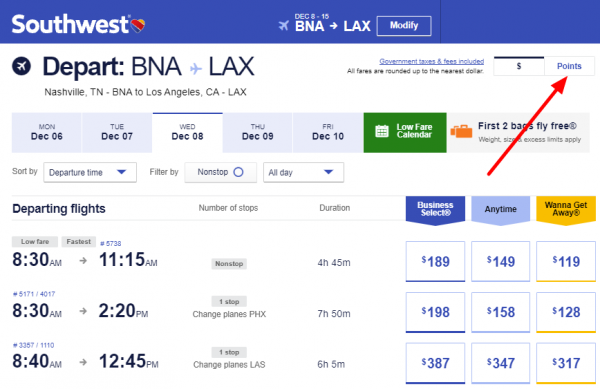

Redeeming factors for a flight is straightforward. Go to Southwest.com and enter particulars in your flight search as regular. Then, click on the “Factors” possibility earlier than clicking “Search.”

Should you’ve already began your flight search, you’ll be able to change to award costs at any time by clicking the “Factors” possibility. The web page will robotically refresh to indicate flight costs in factors as an alternative of money. And you’ll change again to money costs by clicking the “$” button.

Different perks of holding a Southwest bank card

Incomes Southwest Fast Rewards factors in your purchases is not the one profit that you’re going to obtain from being a cardholder. Card advantages range relying on which Southwest bank card you have got, however listed here are some extra perks you may get along with your Southwest card:

-

Anniversary bonus factors. If you renew your card and pay the annual price, you will obtain 3,000 to 9,000 bonus factors yearly, relying on the cardboard.

-

Low cost on in-flight purchases. Obtain a press release credit score of 25% in your in-flight drink and Wi-Fi purchases.

-

Early Chook Examine-In. Stand up to 2 Early Chook Examine-Ins annually to snag an earlier boarding quantity at check-in. With out this profit, Early Chook Examine-In prices $15 to $25 per particular person every flight.

-

Upgraded boardings. Improve your boarding cross as much as 4 occasions annually to A1 to A15, relying on availability. These upgrades usually value $30 to $50 every.

-

Annual journey credit score. Get an annual journey credit score of as much as $75 towards your Southwest purchases.

-

In-flight Wi-Fi credit. Take pleasure in as much as 365 in-flight credit of $8 every if you buy Wi-Fi throughout your Southwest flights.

-

Tier Qualifying Factors. For each $10,000 you spend annually, you will earn 1,500 TQPs towards A-Record and A-Record Most well-liked standing.

-

Companion Go. Welcome bonuses and factors earned from bank card purchases depend towards the Southwest Companion Go. The Companion Go permits a delegated companion to fly for simply the price of taxes and costs on any flight you are taking with Southwest.

-

No overseas transaction charges. Keep away from overseas transaction charges of as much as 3 % when making purchases exterior of the U.S.

Can you employ a Southwest card anyplace?

Sure. Visa playing cards are accepted all over the place that bank cards can be utilized to pay the invoice. Other than the Southwest Fast Rewards® Plus Credit score Card, Southwest bank cards are good for worldwide journey as effectively as a result of they do not cost overseas transaction charges.

Is a Southwest bank card best for you?

For folks whose most well-liked airline is Southwest, having a Southwest bank card is sensible. You will earn factors on on a regular basis purchases, plus extra factors when paying for Southwest flights, lodge and rental automotive companion reservations, native transit and commuting, and different bonus class purchases.

With Fast Rewards factors valued at 1.4 cents every, the anniversary bonus can offset a majority of the annual price on any Southwest card. For instance, the Southwest Fast Rewards® Precedence Credit score Card has a 7,500-point anniversary bonus, which is price $105. Mix that with the cardboard’s annual $75 Southwest journey credit score, and also you’ve already compensated for the $149 annual price. What’s extra, the cardboard’s different advantages add worth that frequent vacationers will recognize.

Should you’re contemplating a Southwest bank card

Now that you know the way Southwest Fast Rewards bank cards work, think about whether or not it is sensible so as to add a bank card from this airline to your pockets.

As you consider the choices, take into consideration how you intend to make use of your card. As an example, whereas the Southwest Fast Rewards® Plus Credit score Card has the bottom annual price, it would not provide the identical stage of advantages as the opposite private playing cards.

For vacationers who spend at the very least $150 flying with Southwest a 12 months, the most suitable choice is the Southwest Fast Rewards® Precedence Credit score Card. With the anniversary bonus and $75 annual flight credit score, the advantages outweigh the annual price. Plus, it earns 50% extra factors on Southwest purchases than the Southwest Fast Rewards® Plus Credit score Card, contains 4 upgraded boardings annually and has no overseas transaction charges.

Photograph courtesy of Southwest Airways.

Learn how to maximize your rewards

You desire a journey bank card that prioritizes what’s necessary to you. Listed below are our picks for the greatest journey bank cards of 2021, together with these greatest for: